- Hong Kong

- /

- Diversified Financial

- /

- SEHK:2598

Exploring Lianlian DigiTech (SEHK:2598) Valuation: Is the Market Overlooking Opportunity?

Reviewed by Simply Wall St

See our latest analysis for Lianlian DigiTech.

Lianlian DigiTech’s share price has swung lower over the past quarter, with a 90-day share price return of -17.96% and a one-year total shareholder return of -13.4%. While momentum has faded recently, shifts in trading often reflect changing investor sentiment about the company’s future growth or risk profile.

If you’re curious about where else strong momentum and insider conviction are converging, it’s worth discovering fast growing stocks with high insider ownership

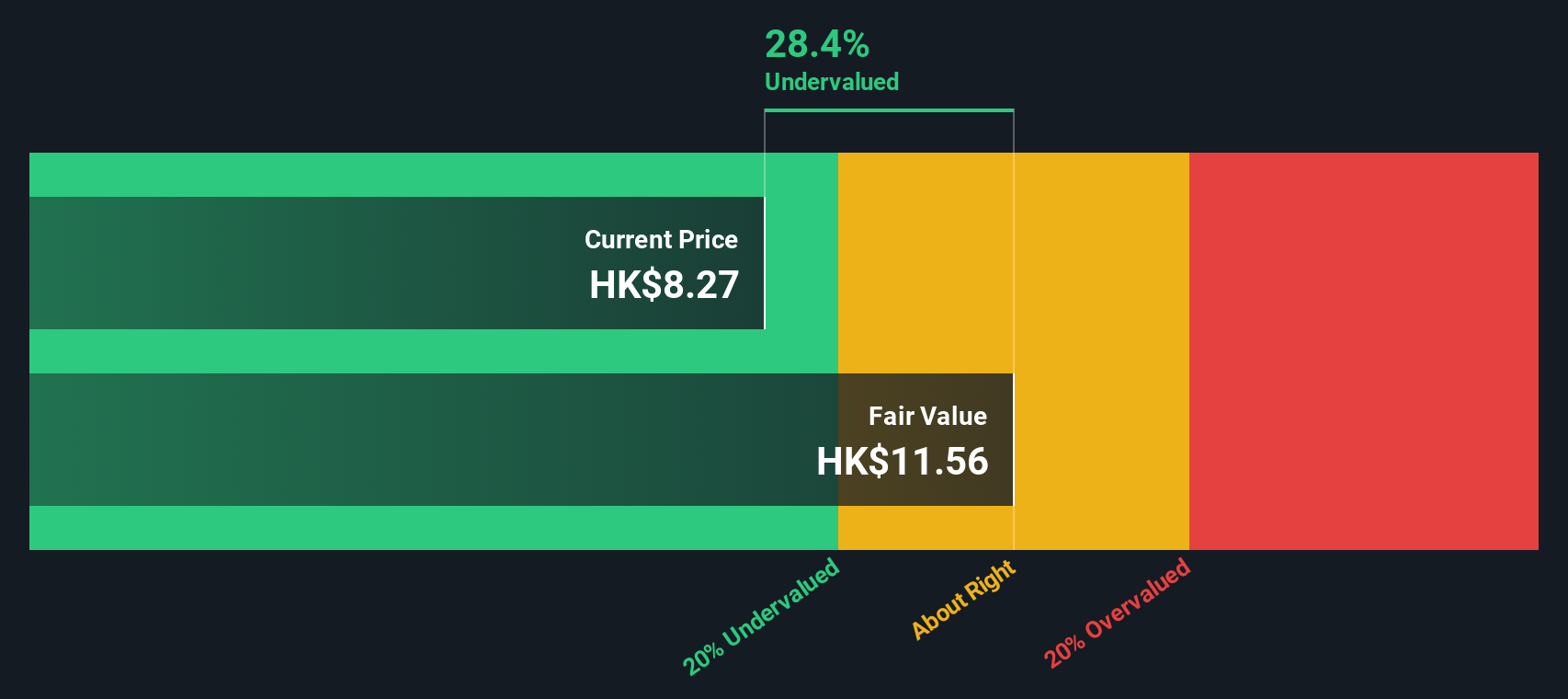

With shares trading well below analyst price targets and recent results mixed, investors are left with a key question: is Lianlian DigiTech currently undervalued, or are expectations for future growth already baked into the market price?

Price-to-Earnings of 5x: Is it justified?

At a price-to-earnings ratio of 5x, Lianlian DigiTech appears undervalued relative to both its industry and peer group, with the last close at HK$8.27. This figure suggests the market may not be fully pricing in key aspects of the company’s financial picture or outlook.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of earnings. It is a widely used benchmark for profitability and relative value. For Lianlian DigiTech, a P/E of 5x stands out in the context of the Asian diversified financials sector, which averages a much higher P/E, as well as when compared to its direct competitors.

This notable discount signals the market may be overlooking potential earnings power, or perhaps is cautious about near-term profitability and future growth. Additionally, compared to the industry's 17x and peers' 19x averages, this multiple looks favorable. When considering that the stock also aligns with its estimated fair price-to-earnings of 5x, there may be room for the market to re-rate if conditions improve or sentiment shifts.

Explore the SWS fair ratio for Lianlian DigiTech

Result: Price-to-Earnings of 5x (UNDERVALUED)

However, net income has dropped sharply over the past year, and near-term profitability pressures could challenge the case for a re-rating.

Find out about the key risks to this Lianlian DigiTech narrative.

Another View: Discounted Cash Flow

Looking through the lens of our DCF model, Lianlian DigiTech appears undervalued, trading at HK$8.27 compared to a calculated fair value of HK$11.54. This method projects future cash flows and can reveal opportunities or risks that basic multiples may miss. However, is this gap between price and value a real opportunity or a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lianlian DigiTech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lianlian DigiTech Narrative

If you see things differently or want to dig deeper into the numbers, you can build your own perspective on Lianlian DigiTech in just a few minutes. Do it your way.

A great starting point for your Lianlian DigiTech research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Spot big trends before the crowd by using the Simply Wall St Screener. Powerful filters make it easy to target stocks with real potential and unique angles. Harness these dynamic strategies and stay ahead of market moves.

- Unlock steady income by targeting higher yields with these 16 dividend stocks with yields > 3% to find companies offering robust dividends above 3%.

- Capture tomorrow’s innovation as you scan these 25 AI penny stocks to pinpoint cutting-edge AI opportunities with strong upside.

- Zero in on significant value plays by leveraging these 879 undervalued stocks based on cash flows, spotlighting stocks trading below their cash flow-based fair value today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2598

Lianlian DigiTech

Provides digital payment services and value-added services to small and midsized merchants and enterprises in China and internationally.

Very undervalued with adequate balance sheet.

Market Insights

Community Narratives