- Hong Kong

- /

- Capital Markets

- /

- SEHK:2263

Most Shareholders Will Probably Agree With Fu Shek Financial Holdings Limited's (HKG:2263) CEO Compensation

Key Insights

- Fu Shek Financial Holdings will host its Annual General Meeting on 12th of September

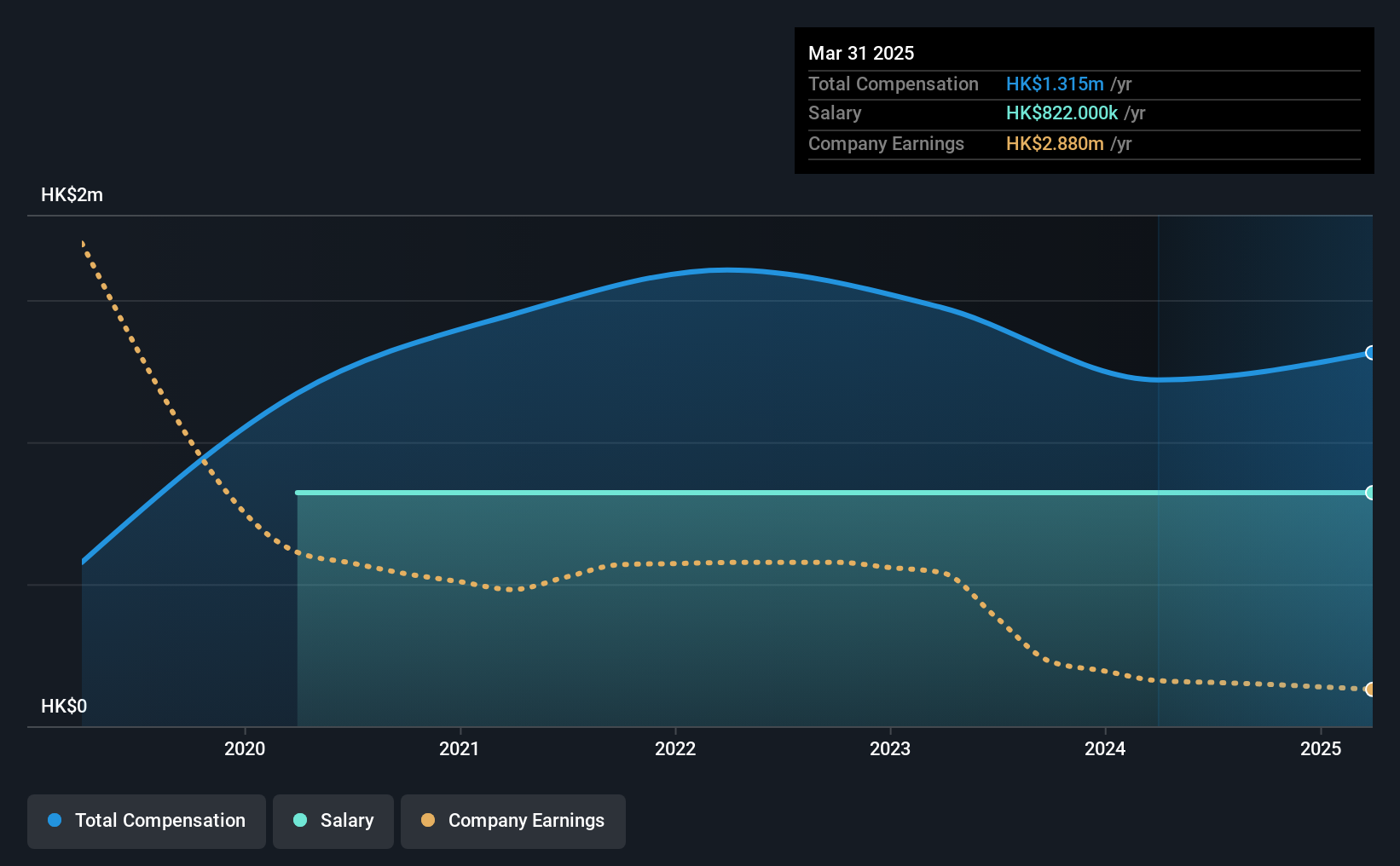

- CEO Man Chiu Sy's total compensation includes salary of HK$822.0k

- The overall pay is comparable to the industry average

- Fu Shek Financial Holdings' EPS declined by 39% over the past three years while total shareholder return over the past three years was 109%

Fu Shek Financial Holdings Limited (HKG:2263) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. The upcoming AGM on 12th of September may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

See our latest analysis for Fu Shek Financial Holdings

Comparing Fu Shek Financial Holdings Limited's CEO Compensation With The Industry

According to our data, Fu Shek Financial Holdings Limited has a market capitalization of HK$255m, and paid its CEO total annual compensation worth HK$1.3m over the year to March 2025. That's just a smallish increase of 7.9% on last year. In particular, the salary of HK$822.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Hong Kong Capital Markets industry with market capitalizations below HK$1.6b, reported a median total CEO compensation of HK$1.8m. From this we gather that Man Chiu Sy is paid around the median for CEOs in the industry.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | HK$822k | HK$822k | 63% |

| Other | HK$493k | HK$397k | 37% |

| Total Compensation | HK$1.3m | HK$1.2m | 100% |

On an industry level, roughly 88% of total compensation represents salary and 12% is other remuneration. It's interesting to note that Fu Shek Financial Holdings allocates a smaller portion of compensation to salary in comparison to the broader industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Fu Shek Financial Holdings Limited's Growth

Fu Shek Financial Holdings Limited has reduced its earnings per share by 39% a year over the last three years. Its revenue is down 27% over the previous year.

The decline in EPS is a bit concerning. This is compounded by the fact revenue is actually down on last year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Fu Shek Financial Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with Fu Shek Financial Holdings Limited for providing a total return of 109% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Fu Shek Financial Holdings (of which 2 are potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Important note: Fu Shek Financial Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2263

Fu Shek Financial Holdings

Provides financial and securities services in Hong Kong.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives