- Hong Kong

- /

- Diversified Financial

- /

- SEHK:1905

Shareholders Will Most Likely Find Haitong Unitrust International Financial Leasing Co., Ltd.'s (HKG:1905) CEO Compensation Acceptable

Key Insights

- Haitong Unitrust International Financial Leasing's Annual General Meeting to take place on 16th of May

- Total pay for CEO Jianli Zhou includes CN¥1.40m salary

- Total compensation is similar to the industry average

- Over the past three years, Haitong Unitrust International Financial Leasing's EPS grew by 1.8% and over the past three years, the total shareholder return was 41%

Performance at Haitong Unitrust International Financial Leasing Co., Ltd. (HKG:1905) has been reasonably good and CEO Jianli Zhou has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 16th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for Haitong Unitrust International Financial Leasing

Comparing Haitong Unitrust International Financial Leasing Co., Ltd.'s CEO Compensation With The Industry

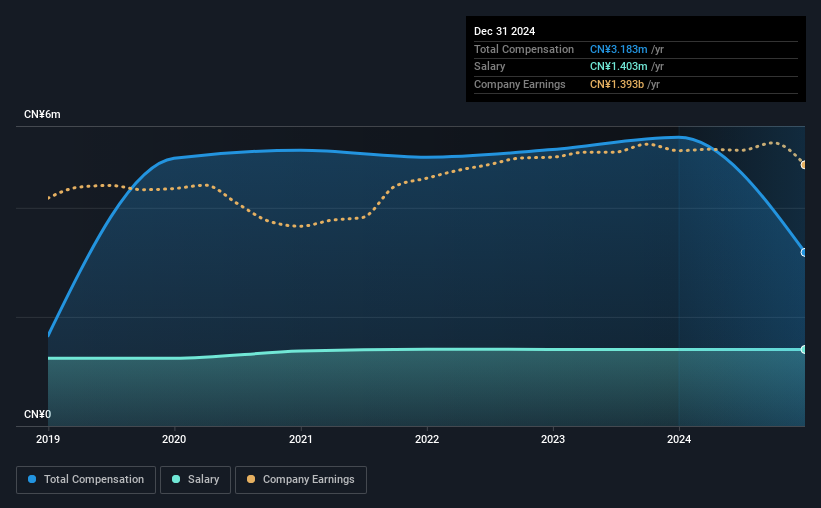

Our data indicates that Haitong Unitrust International Financial Leasing Co., Ltd. has a market capitalization of HK$6.0b, and total annual CEO compensation was reported as CN¥3.2m for the year to December 2024. Notably, that's a decrease of 40% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥1.4m.

On comparing similar companies from the Hong Kong Diversified Financial industry with market caps ranging from HK$3.1b to HK$12b, we found that the median CEO total compensation was CN¥3.2m. This suggests that Haitong Unitrust International Financial Leasing remunerates its CEO largely in line with the industry average.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | CN¥1.4m | CN¥1.4m | 44% |

| Other | CN¥1.8m | CN¥3.9m | 56% |

| Total Compensation | CN¥3.2m | CN¥5.3m | 100% |

Talking in terms of the industry, salary represented approximately 69% of total compensation out of all the companies we analyzed, while other remuneration made up 31% of the pie. Haitong Unitrust International Financial Leasing sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Haitong Unitrust International Financial Leasing Co., Ltd.'s Growth Numbers

Haitong Unitrust International Financial Leasing Co., Ltd. has seen its earnings per share (EPS) increase by 1.8% a year over the past three years. In the last year, its revenue is up 8.1%.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. Considering these factors we'd say performance has been pretty decent, though not amazing. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Haitong Unitrust International Financial Leasing Co., Ltd. Been A Good Investment?

Most shareholders would probably be pleased with Haitong Unitrust International Financial Leasing Co., Ltd. for providing a total return of 41% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

Seeing that the company has put up a decent performance, only a few shareholders, if any at all, might have questions about the CEO pay in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for Haitong Unitrust International Financial Leasing (1 is concerning!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Haitong Unitrust International Financial Leasing, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Haitong Unitrust International Financial Leasing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1905

Haitong Unitrust International Financial Leasing

Through its subsidiaries, operates as a financial leasing company in the People’s Republic of China.

Good value average dividend payer.

Market Insights

Community Narratives