- Hong Kong

- /

- Capital Markets

- /

- SEHK:1788

Why We're Not Concerned Yet About Guotai Junan International Holdings Limited's (HKG:1788) 32% Share Price Plunge

Unfortunately for some shareholders, the Guotai Junan International Holdings Limited (HKG:1788) share price has dived 32% in the last thirty days, prolonging recent pain. The good news is that in the last year, the stock has shone bright like a diamond, gaining 154%.

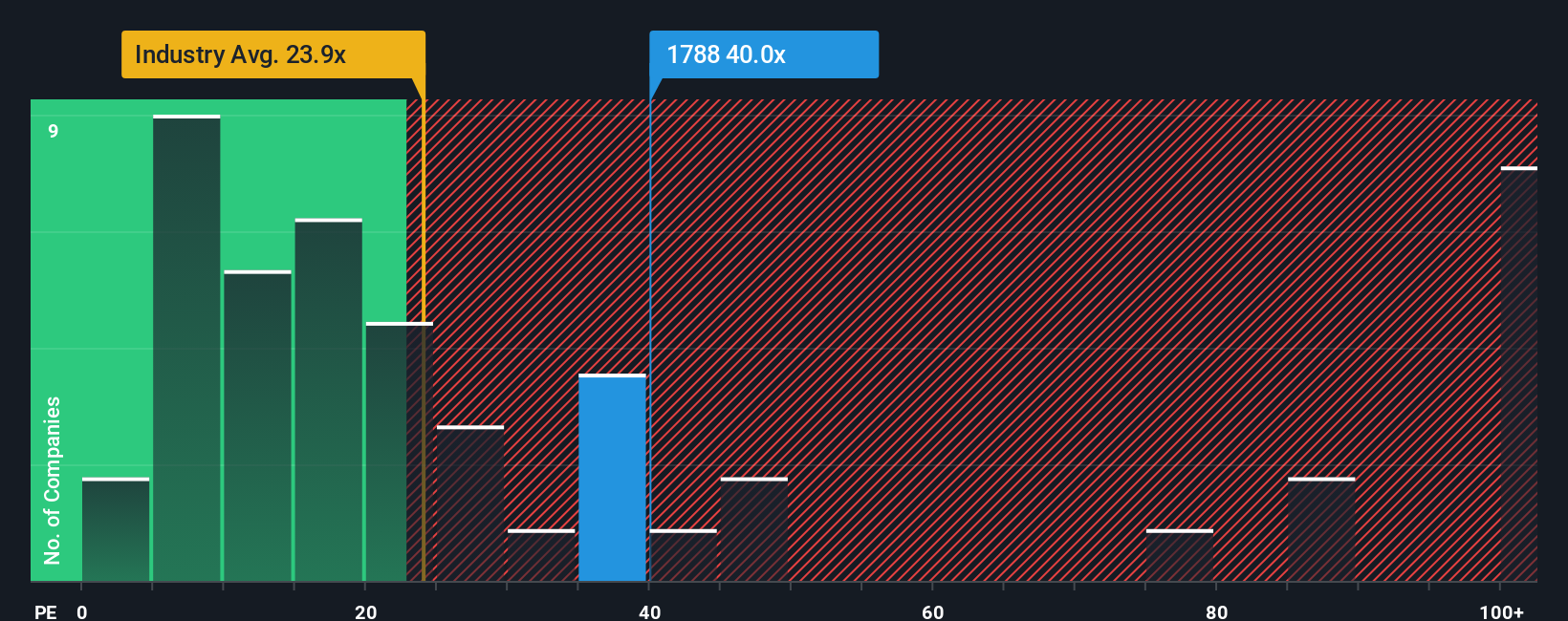

Even after such a large drop in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may still consider Guotai Junan International Holdings as a stock to avoid entirely with its 40x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been quite advantageous for Guotai Junan International Holdings as its earnings have been rising very briskly. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Guotai Junan International Holdings

Does Growth Match The High P/E?

In order to justify its P/E ratio, Guotai Junan International Holdings would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 154%. The latest three year period has also seen an excellent 123% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Guotai Junan International Holdings' P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Key Takeaway

A significant share price dive has done very little to deflate Guotai Junan International Holdings' very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Guotai Junan International Holdings revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Guotai Junan International Holdings has 2 warning signs (and 1 which is potentially serious) we think you should know about.

Of course, you might also be able to find a better stock than Guotai Junan International Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1788

Guotai Junan International Holdings

An investment holding company, provides brokerage, corporate finance, asset management, loans and financing, financial products, market making, and investment services in Hong Kong and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives