- Hong Kong

- /

- Consumer Finance

- /

- SEHK:1577

Does It Make Sense To Buy Quanzhou Huixin Micro-Credit Co., Ltd. (HKG:1577) For Its Yield?

Today we'll take a closer look at Quanzhou Huixin Micro-Credit Co., Ltd. (HKG:1577) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

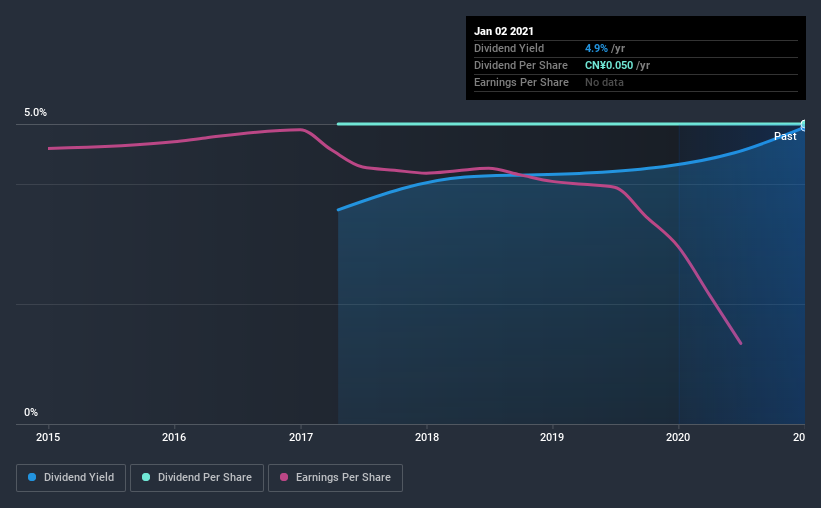

With a four-year payment history and a 4.9% yield, many investors probably find Quanzhou Huixin Micro-Credit intriguing. It sure looks interesting on these metrics - but there's always more to the story. Some simple analysis can reduce the risk of holding Quanzhou Huixin Micro-Credit for its dividend, and we'll focus on the most important aspects below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 116% of Quanzhou Huixin Micro-Credit's profits were paid out as dividends in the last 12 months. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

We update our data on Quanzhou Huixin Micro-Credit every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. Looking at the data, we can see that Quanzhou Huixin Micro-Credit has been paying a dividend for the past four years. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. Its most recent annual dividend was CN¥0.05 per share, effectively flat on its first payment four years ago.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Over the past five years, it looks as though Quanzhou Huixin Micro-Credit's EPS have declined at around 22% a year. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Quanzhou Huixin Micro-Credit's earnings per share, which support the dividend, have been anything but stable.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. First, it's not great to see how much of its earnings are being paid as dividends. Second, earnings per share have been in decline, and the dividend history is shorter than we'd like. With any dividend stock, we look for a sustainable payout ratio, steady dividends, and growing earnings. Quanzhou Huixin Micro-Credit has a few too many issues for us to get interested.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Quanzhou Huixin Micro-Credit (of which 1 can't be ignored!) you should know about.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you decide to trade Quanzhou Huixin Micro-Credit, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Quanzhou Huixin Micro-credit might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1577

Quanzhou Huixin Micro-credit

A microfinance company, provides various short-term financing solutions to entrepreneurial individuals, small and medium-sized enterprises, and microenterprises in the People’s Republic of China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives