- Hong Kong

- /

- Consumer Finance

- /

- SEHK:1543

The three-year loss for Guangdong Join-Share Financing Guarantee Investment (HKG:1543) shareholders likely driven by its shrinking earnings

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Guangdong Join-Share Financing Guarantee Investment Co., Ltd. (HKG:1543); the share price is down a whopping 84% in the last three years. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. And over the last year the share price fell 58%, so we doubt many shareholders are delighted. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 10% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Guangdong Join-Share Financing Guarantee Investment

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

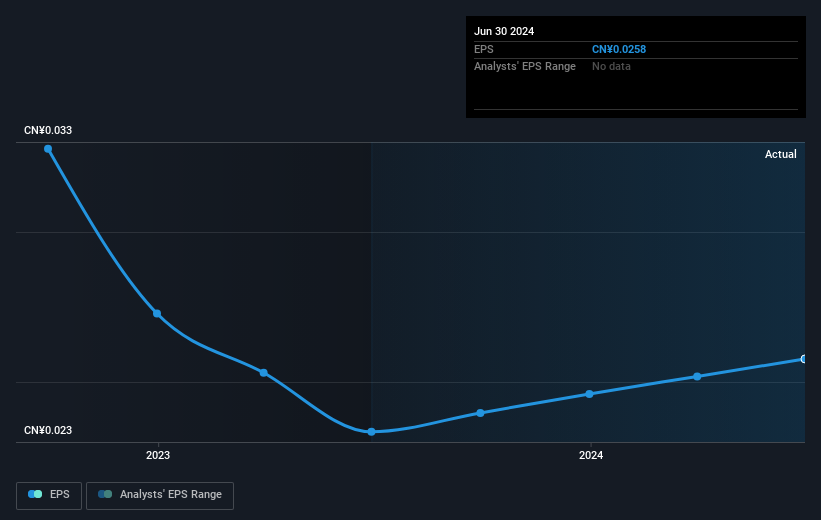

Guangdong Join-Share Financing Guarantee Investment saw its EPS decline at a compound rate of 26% per year, over the last three years. The share price decline of 46% is actually steeper than the EPS slippage. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 11.59.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Guangdong Join-Share Financing Guarantee Investment's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Guangdong Join-Share Financing Guarantee Investment the TSR over the last 3 years was -82%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Guangdong Join-Share Financing Guarantee Investment shareholders are down 57% for the year (even including dividends), but the market itself is up 36%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Guangdong Join-Share Financing Guarantee Investment better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 6 warning signs for Guangdong Join-Share Financing Guarantee Investment (of which 3 are a bit concerning!) you should know about.

Guangdong Join-Share Financing Guarantee Investment is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1543

Guangdong Join-Share Financing Guarantee Investment

Provides credit-based financing solutions to small and medium-sized enterprises (SMEs) for their financing and business needs in the People’s Republic of China.

Average dividend payer with slight risk.

Market Insights

Community Narratives