- Hong Kong

- /

- Capital Markets

- /

- SEHK:1469

Why We Think Get Nice Financial Group Limited's (HKG:1469) CEO Compensation Is Not Excessive At All

Shareholders may be wondering what CEO Carmen Hung plans to do to improve the less than great performance at Get Nice Financial Group Limited (HKG:1469) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 24 August 2021. It has been shown that setting appropriate executive remuneration incentivises the management to act in the interests of shareholders. We have prepared some analysis below to show that CEO compensation looks to be reasonable.

See our latest analysis for Get Nice Financial Group

Comparing Get Nice Financial Group Limited's CEO Compensation With the industry

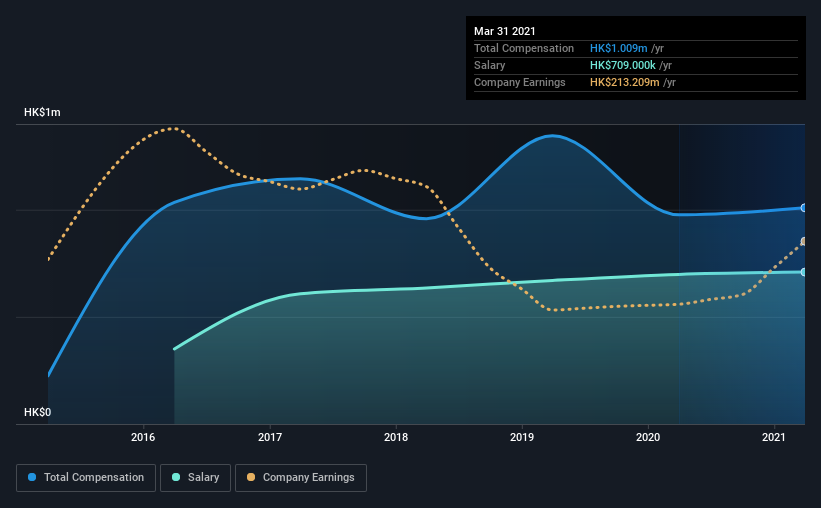

Our data indicates that Get Nice Financial Group Limited has a market capitalization of HK$2.2b, and total annual CEO compensation was reported as HK$1.0m for the year to March 2021. That's a modest increase of 3.4% on the prior year. Notably, the salary which is HK$709.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from HK$778m to HK$3.1b, the reported median CEO total compensation was HK$1.8m. In other words, Get Nice Financial Group pays its CEO lower than the industry median.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | HK$709k | HK$698k | 70% |

| Other | HK$300k | HK$278k | 30% |

| Total Compensation | HK$1.0m | HK$976k | 100% |

On an industry level, around 84% of total compensation represents salary and 16% is other remuneration. Get Nice Financial Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Get Nice Financial Group Limited's Growth Numbers

Over the last three years, Get Nice Financial Group Limited has shrunk its earnings per share by 8.3% per year. It achieved revenue growth of 12% over the last year.

Few shareholders would be pleased to read that EPS have declined. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Get Nice Financial Group Limited Been A Good Investment?

Get Nice Financial Group Limited has generated a total shareholder return of 14% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. In our study, we found 2 warning signs for Get Nice Financial Group you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1469

Get Nice Financial Group

An investment holding company, provides financial services in Hong Kong.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives