- Hong Kong

- /

- Capital Markets

- /

- SEHK:1468

Further Upside For Kingkey Financial International (Holdings) Limited (HKG:1468) Shares Could Introduce Price Risks After 60% Bounce

Those holding Kingkey Financial International (Holdings) Limited (HKG:1468) shares would be relieved that the share price has rebounded 60% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the last month did very little to improve the 94% share price decline over the last year.

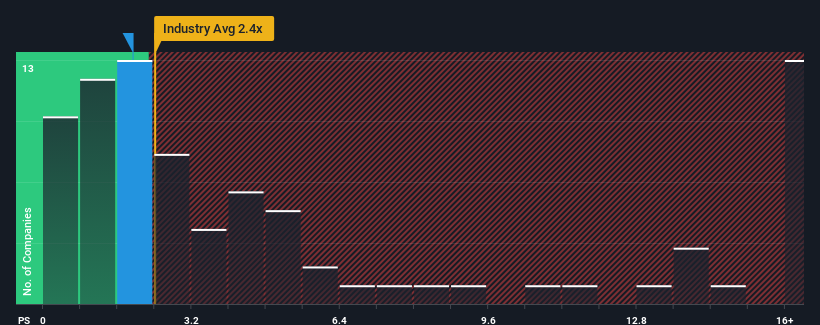

Even after such a large jump in price, it's still not a stretch to say that Kingkey Financial International (Holdings)'s price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Capital Markets industry in Hong Kong, where the median P/S ratio is around 2.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Kingkey Financial International (Holdings)

How Has Kingkey Financial International (Holdings) Performed Recently?

Recent times have been quite advantageous for Kingkey Financial International (Holdings) as its revenue has been rising very briskly. The P/S is probably moderate because investors think this strong revenue growth might not be enough to outperform the broader industry in the near future. Those who are bullish on Kingkey Financial International (Holdings) will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kingkey Financial International (Holdings) will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Kingkey Financial International (Holdings)?

In order to justify its P/S ratio, Kingkey Financial International (Holdings) would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 222%. The latest three year period has also seen an excellent 268% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that to the industry, which is only predicted to deliver 34% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Kingkey Financial International (Holdings)'s P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Kingkey Financial International (Holdings)'s P/S

Kingkey Financial International (Holdings)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To our surprise, Kingkey Financial International (Holdings) revealed its three-year revenue trends aren't contributing to its P/S as much as we would have predicted, given they look better than current industry expectations. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

You should always think about risks. Case in point, we've spotted 4 warning signs for Kingkey Financial International (Holdings) you should be aware of, and 2 of them shouldn't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Kingkey Financial International (Holdings), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kingkey Financial International (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1468

Kingkey Financial International (Holdings)

An investment holding company, provides insurance brokerage services in the People’s Republic of China, Hong Kong, and Denmark.

Excellent balance sheet moderate.

Market Insights

Community Narratives