- Hong Kong

- /

- Capital Markets

- /

- SEHK:1428

Earnings Working Against Bright Smart Securities & Commodities Group Limited's (HKG:1428) Share Price

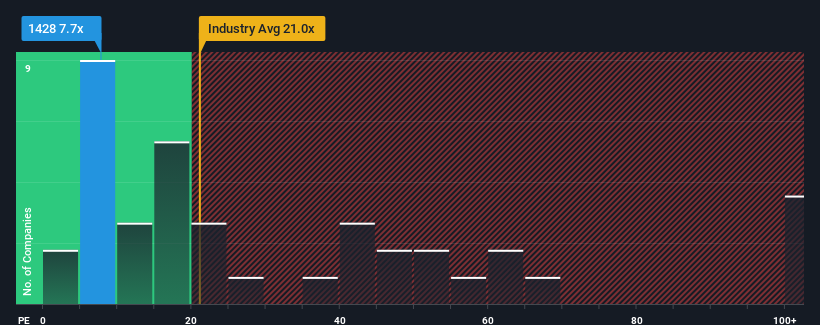

With a price-to-earnings (or "P/E") ratio of 7.7x Bright Smart Securities & Commodities Group Limited (HKG:1428) may be sending bullish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios greater than 11x and even P/E's higher than 21x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Bright Smart Securities & Commodities Group's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Bright Smart Securities & Commodities Group

How Is Bright Smart Securities & Commodities Group's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Bright Smart Securities & Commodities Group's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The last three years don't look nice either as the company has shrunk EPS by 13% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 21% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Bright Smart Securities & Commodities Group's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Bright Smart Securities & Commodities Group's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Bright Smart Securities & Commodities Group maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Bright Smart Securities & Commodities Group you should know about.

You might be able to find a better investment than Bright Smart Securities & Commodities Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bright Smart Securities & Commodities Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1428

Bright Smart Securities & Commodities Group

An investment holding company, provides financial services in Hong Kong.

Mediocre balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.