- China

- /

- Infrastructure

- /

- SZSE:002023

Uncovering 3 Undiscovered Gems in Asia with Strong Potential

Reviewed by Simply Wall St

As global markets react to the recent easing of U.S.-China trade tensions, Asian indices have shown resilience, with Chinese stocks experiencing a modest rally. In this dynamic environment, identifying promising small-cap stocks in Asia requires a keen eye for companies that can capitalize on favorable economic shifts and demonstrate robust growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Techno Ryowa | 0.12% | 8.04% | 26.08% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 13.24% | -0.17% | ★★★★★★ |

| Tsubakimoto Kogyo | NA | 5.72% | 8.48% | ★★★★★★ |

| Korea Ratings | NA | 0.74% | 1.47% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 0.81% | 6.04% | 4.07% | ★★★★★★ |

| Nanfang Black Sesame GroupLtd | 45.53% | -12.49% | 10.72% | ★★★★★★ |

| Machvision | NA | -11.14% | -16.19% | ★★★★★★ |

| KinjiroLtd | 22.32% | 10.69% | 21.02% | ★★★★★☆ |

| TSTE | 36.22% | 3.96% | -8.49% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

G-Resources Group (SEHK:1051)

Simply Wall St Value Rating: ★★★★★★

Overview: G-Resources Group Limited is an investment holding company involved in principal investment, financial services, and real property businesses with a market capitalization of HK$3.84 billion.

Operations: The principal investment business is the largest revenue stream, generating $34.17 million, followed by financial services at $2.63 million and real property at $1.63 million.

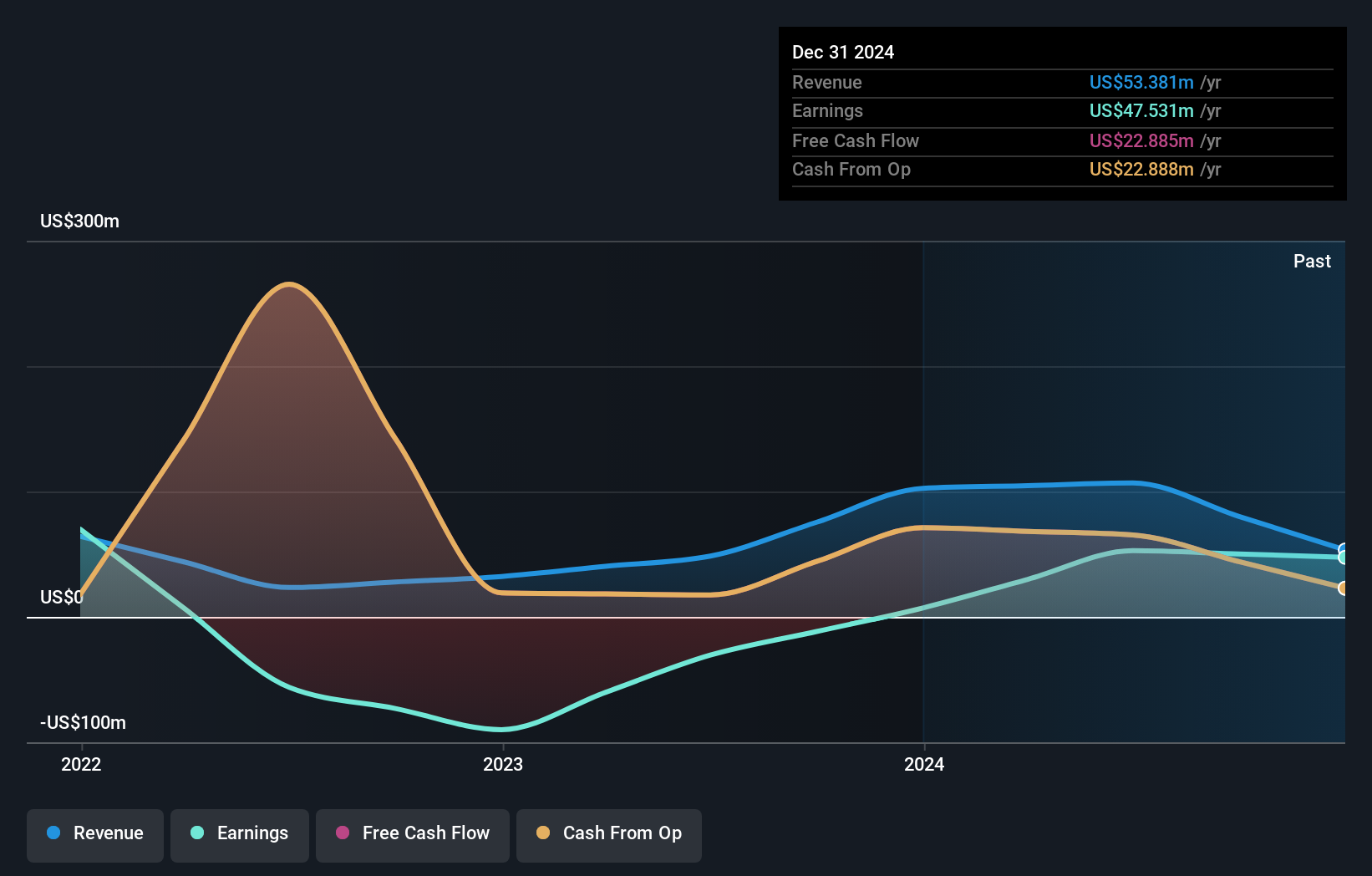

G-Resources Group has shown a remarkable turnaround, with net income soaring to US$47.53 million in 2024 from US$7.11 million the previous year, driven by a significant boost in the fair value of financial assets and investments. Despite sales dropping to US$1.01 million from US$1.45 million, the company's earnings per share jumped to USD 0.1054 from USD 0.0158, reflecting its robust profitability despite revenue challenges. With no debt on its books and a price-to-earnings ratio of 10x below the Hong Kong market average, G-Resources seems well-positioned within its industry context for potential growth and value realization.

Sichuan Haite High-techLtd (SZSE:002023)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Sichuan Haite High-tech Co., Ltd specializes in aircraft airborne equipment maintenance services in China and has a market capitalization of CN¥7.98 billion.

Operations: The company generates revenue primarily from aircraft airborne equipment maintenance services. It has a market capitalization of CN¥7.98 billion.

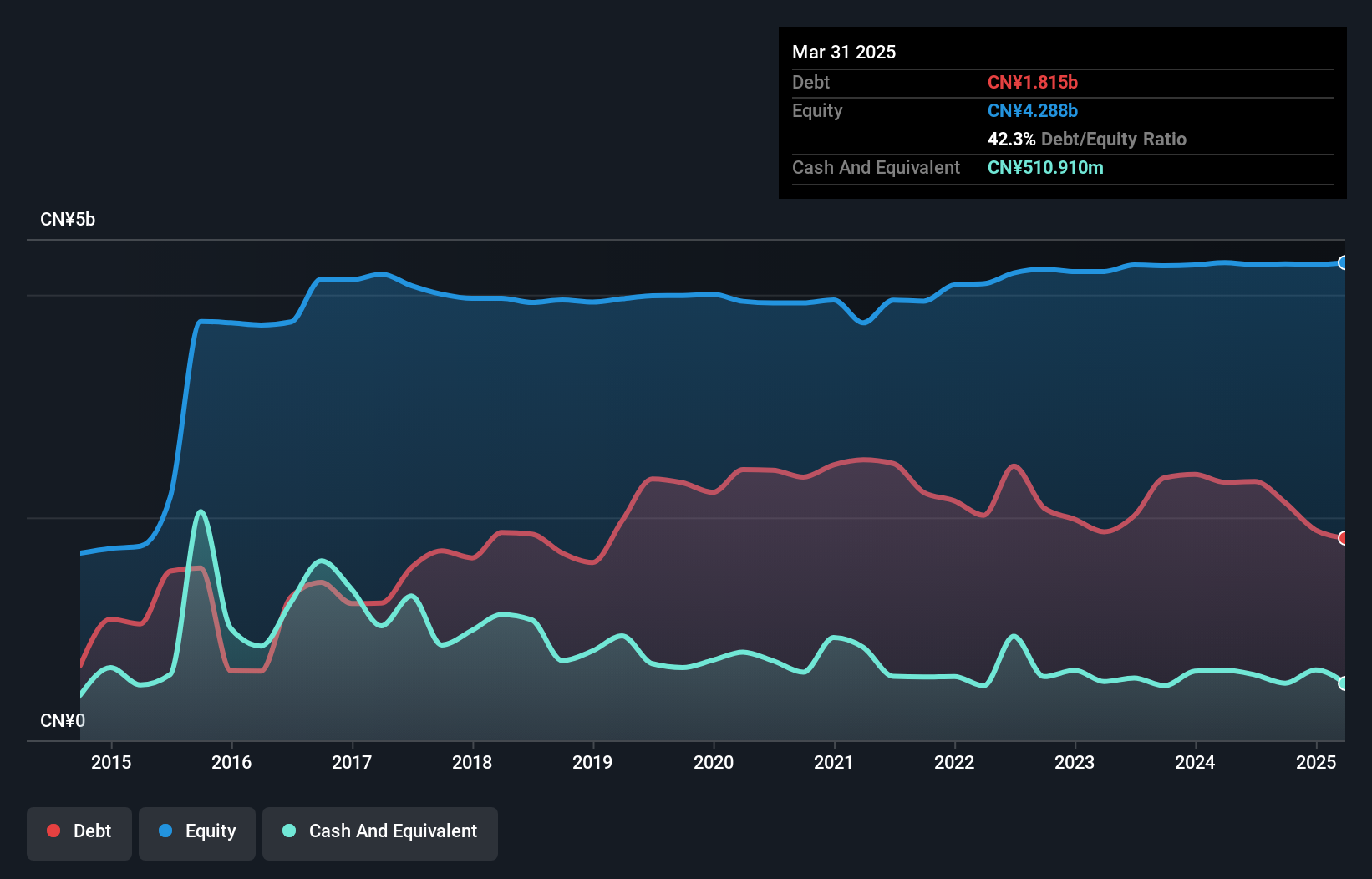

Sichuan Haite High-tech, a relatively small player in the Asian market, has shown promising financial health with a satisfactory net debt to equity ratio of 30.4%, down from 61.7% five years ago. Despite its interest payments not being well covered by EBIT at 1.9 times, the company remains profitable and free cash flow positive. Recent earnings reports reveal strong growth, with annual sales climbing to CNY 1.32 billion from CNY 1.05 billion last year and net income rising to CNY 70.88 million from CNY 46.84 million, reflecting high-quality earnings that outpaced industry averages by growing at 6.9%.

- Get an in-depth perspective on Sichuan Haite High-techLtd's performance by reading our health report here.

Learn about Sichuan Haite High-techLtd's historical performance.

Nantong JiangTian Chemical (SZSE:300927)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nantong JiangTian Chemical Co., Ltd. is engaged in the manufacturing and sale of chemical products both domestically and internationally, with a market capitalization of CN¥5.10 billion.

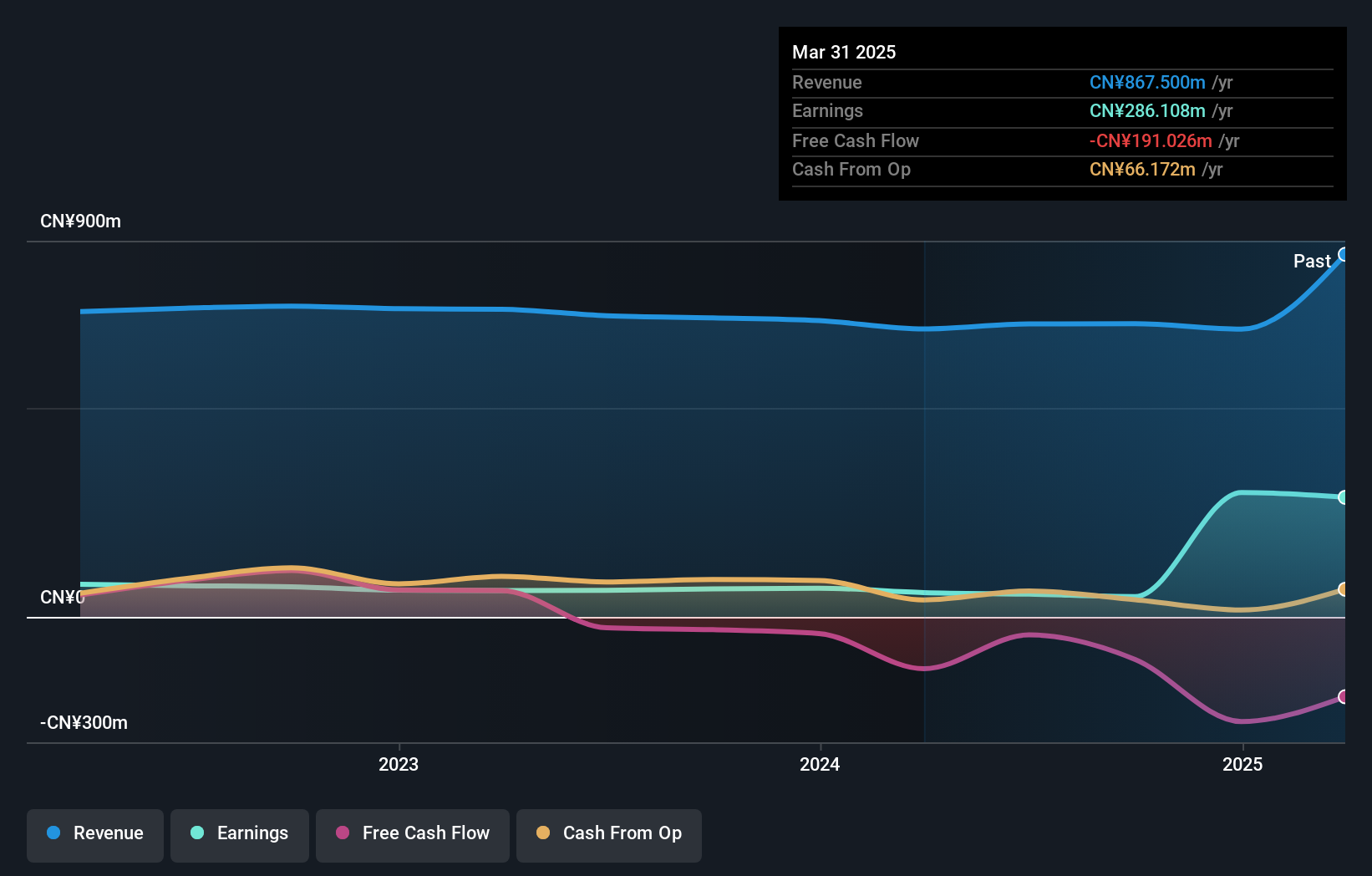

Operations: Nantong JiangTian Chemical generates revenue primarily from its specialty chemicals segment, amounting to CN¥867.50 million. The company has a market capitalization of CN¥5.10 billion.

Nantong JiangTian Chemical, a smaller player in the chemicals sector, has shown impressive earnings growth of 391.8% over the past year, outpacing the industry’s modest 4% increase. Despite its volatile share price recently, it maintains a favorable debt position with more cash than total debt and a debt-to-equity ratio rising to 38.4% from 31.5% over five years. The company's price-to-earnings ratio is an attractive 17.8x compared to the broader CN market's 38.5x, suggesting good value potential despite recent dividend reductions and fluctuating free cash flow figures through various quarters of reporting periods.

- Unlock comprehensive insights into our analysis of Nantong JiangTian Chemical stock in this health report.

Understand Nantong JiangTian Chemical's track record by examining our Past report.

Make It Happen

- Click here to access our complete index of 2599 Asian Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002023

Sichuan Haite High-techLtd

Provides aircraft airborne equipment maintenance services in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives