- Hong Kong

- /

- Hospitality

- /

- SEHK:9922

Market Participants Recognise Jiumaojiu International Holdings Limited's (HKG:9922) Earnings Pushing Shares 25% Higher

Jiumaojiu International Holdings Limited (HKG:9922) shareholders are no doubt pleased to see that the share price has bounced 25% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 66% share price drop in the last twelve months.

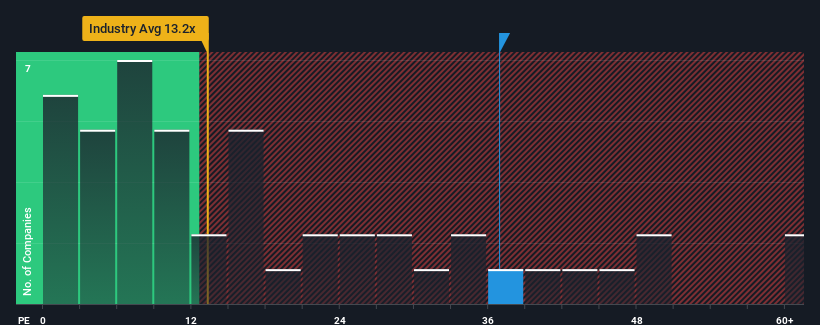

After such a large jump in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider Jiumaojiu International Holdings as a stock to avoid entirely with its 36.9x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Jiumaojiu International Holdings has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Jiumaojiu International Holdings

What Are Growth Metrics Telling Us About The High P/E?

Jiumaojiu International Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Likewise, not much has changed from three years ago as earnings have been stuck during that whole time. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 67% per year over the next three years. With the market only predicted to deliver 16% per annum, the company is positioned for a stronger earnings result.

With this information, we can see why Jiumaojiu International Holdings is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

The strong share price surge has got Jiumaojiu International Holdings' P/E rushing to great heights as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Jiumaojiu International Holdings' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Jiumaojiu International Holdings with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on Jiumaojiu International Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9922

Jiumaojiu International Holdings

Manages and operates Chinese cuisine restaurant brands in the People’s Republic of China, Singapore, Canada, Malaysia, the United States, Thailand, and Indonesia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives