- Hong Kong

- /

- Hospitality

- /

- SEHK:9869

3 Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

In the current global market landscape, investors are navigating a mix of economic signals, with the U.S. Federal Reserve holding interest rates steady while European markets respond positively to rate cuts by the ECB. Amidst these developments, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies and strong fundamentals.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.00 | NT$527.67 | 50% |

| Brookline Bancorp (NasdaqGS:BRKL) | US$12.06 | US$24.01 | 49.8% |

| Sichuan Injet Electric (SZSE:300820) | CN¥50.58 | CN¥101.01 | 49.9% |

| Nordic Waterproofing Holding (OM:NWG) | SEK170.60 | SEK340.70 | 49.9% |

| Elekta (OM:EKTA B) | SEK64.60 | SEK128.36 | 49.7% |

| Kinaxis (TSX:KXS) | CA$171.05 | CA$340.41 | 49.8% |

| AeroEdge (TSE:7409) | ¥1733.00 | ¥3445.33 | 49.7% |

| GemPharmatech (SHSE:688046) | CN¥13.06 | CN¥25.94 | 49.7% |

| QuinStreet (NasdaqGS:QNST) | US$23.71 | US$47.35 | 49.9% |

| Equifax (NYSE:EFX) | US$267.52 | US$531.27 | 49.6% |

Here's a peek at a few of the choices from the screener.

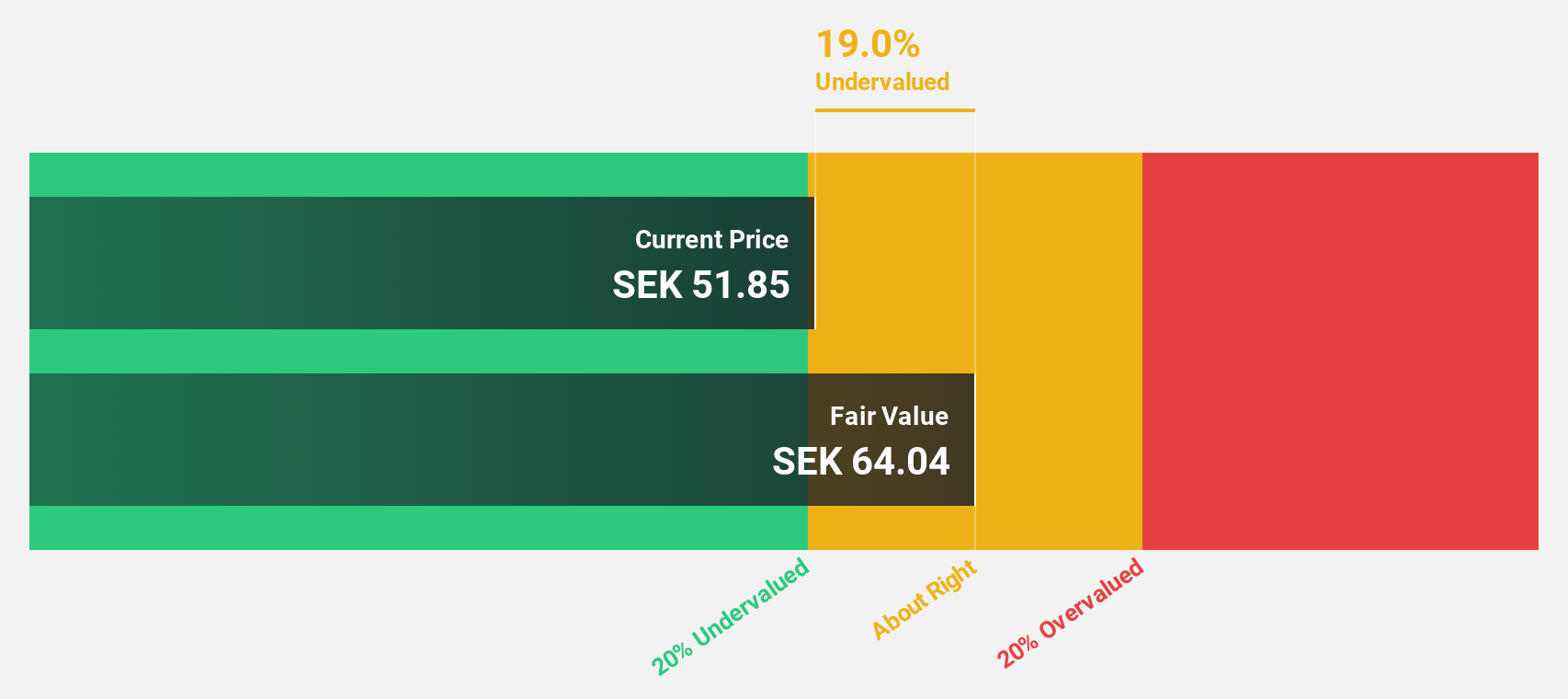

NCAB Group (OM:NCAB)

Overview: NCAB Group AB (publ) is a company that manufactures and sells printed circuit boards (PCBs) across Sweden, the Nordic region, the rest of Europe, North America, and Asia, with a market cap of SEK12.47 billion.

Operations: The company's revenue is segmented into East with SEK210.60 million, Europe with SEK1.91 billion, Nordic with SEK756.10 million, and North America with SEK786.70 million.

Estimated Discount To Fair Value: 10.5%

NCAB Group's third-quarter earnings show a decline in sales and net income compared to the previous year, with SEK 898 million in sales and SEK 50.2 million in net income. Despite this, the stock trades at SEK 66.1, below its estimated fair value of SEK 73.87, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 24.4% annually, outpacing the Swedish market's growth rate of 13.4%.

- According our earnings growth report, there's an indication that NCAB Group might be ready to expand.

- Get an in-depth perspective on NCAB Group's balance sheet by reading our health report here.

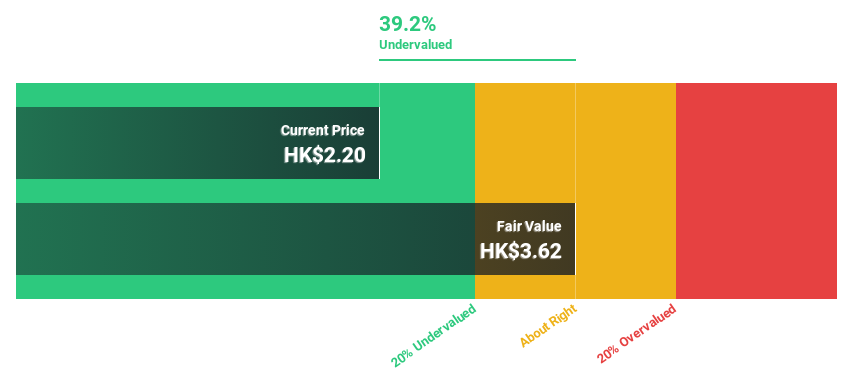

Helens International Holdings (SEHK:9869)

Overview: Helens International Holdings Company Limited operates bar and franchise businesses in the People's Republic of China and Hong Kong, with a market cap of HK$2.51 billion.

Operations: The company generates CN¥939.92 million from its bar operations and franchise business in the PRC and Hong Kong.

Estimated Discount To Fair Value: 45.4%

Helens International Holdings is trading at HK$2.09, significantly below its estimated fair value of HK$3.83, indicating it is undervalued based on cash flows. With revenue expected to grow 18.4% annually and earnings projected to increase by over 42%, the company shows robust growth potential compared to the Hong Kong market averages. However, its high share price volatility and unsustainable dividend coverage are notable concerns for investors evaluating long-term stability.

- In light of our recent growth report, it seems possible that Helens International Holdings' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Helens International Holdings' balance sheet health report.

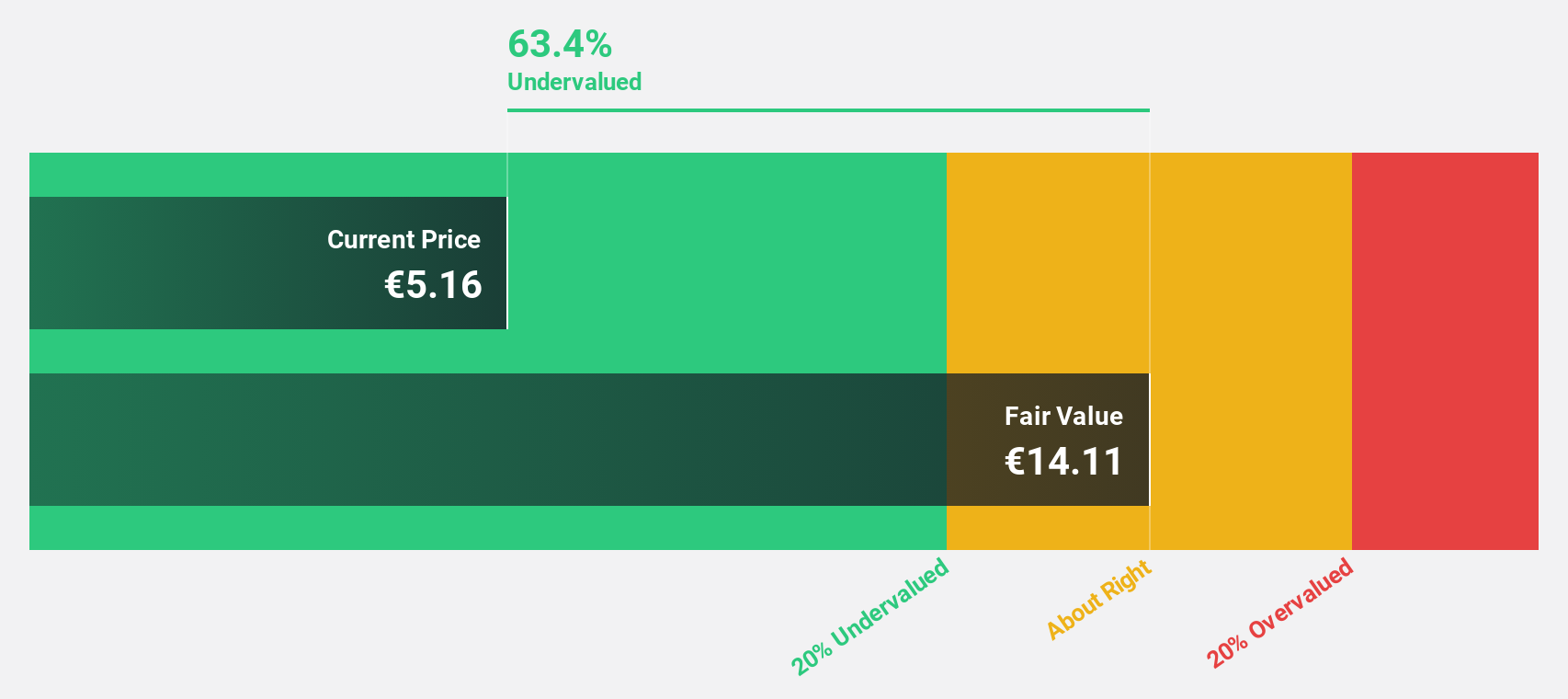

Deutsche Pfandbriefbank (XTRA:PBB)

Overview: Deutsche Pfandbriefbank AG operates in commercial real estate and public investment finance across Europe and the USA, with a market cap of approximately €736.92 million.

Operations: The company's revenue primarily comes from Real Estate Finance, generating €255 million, with an additional €108 million from Non-Core activities.

Estimated Discount To Fair Value: 30.6%

Deutsche Pfandbriefbank is trading at €5.43, significantly below its estimated fair value of €7.82, highlighting its undervaluation based on cash flows. Despite low return on equity forecasts and a high level of bad loans at 4.1%, the bank's earnings are expected to grow significantly by 35.1% annually, outpacing both revenue growth and the German market average. Recent fixed-income offerings totaling over €1 billion bolster its financial position amidst these challenges.

- Insights from our recent growth report point to a promising forecast for Deutsche Pfandbriefbank's business outlook.

- Take a closer look at Deutsche Pfandbriefbank's balance sheet health here in our report.

Key Takeaways

- Access the full spectrum of 913 Undervalued Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Helens International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9869

Helens International Holdings

An investment holding company, engages in the bar operations and franchise business in the People’s Republic of China (PRC) and Hong Kong.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives