- Hong Kong

- /

- Hospitality

- /

- SEHK:9658

Super Hi International (SEHK:9658) Sees Rising Sales but Falling Profits—Is Margin Pressure a Long-Term Risk?

Reviewed by Sasha Jovanovic

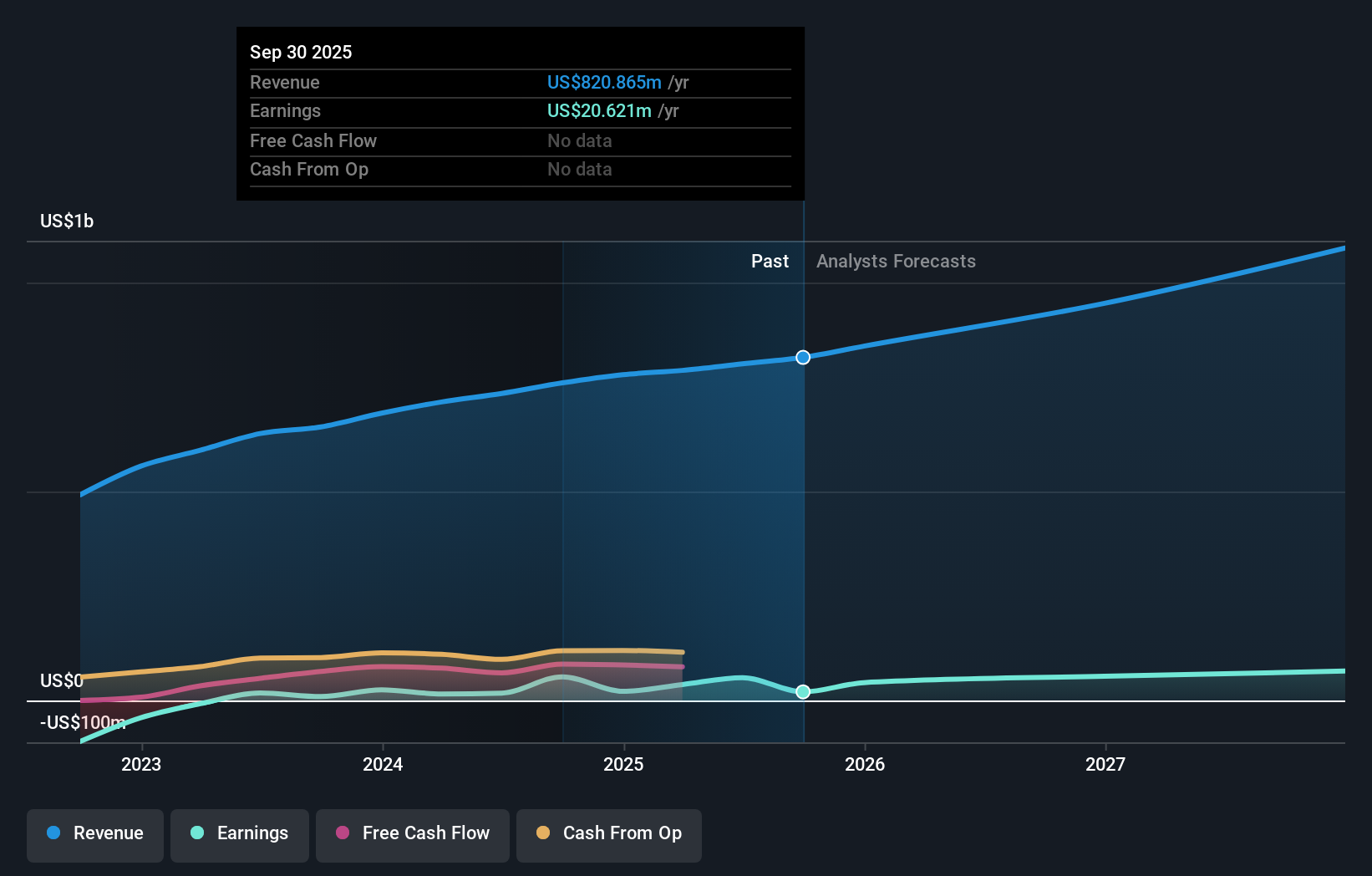

- Super Hi International Holding Ltd. has reported its third quarter 2025 earnings, with sales reaching US$214.05 million, up from US$198.62 million a year earlier, while net income dropped to US$3.61 million from US$37.72 million for the same period last year.

- While revenue improved, the sharp reduction in net income highlights pressures on the company’s profitability despite continued top-line growth.

- We’ll consider how the company’s rising sales but lower earnings may affect the long-term investment narrative for Super Hi International Holding.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Super Hi International Holding Investment Narrative Recap

Super Hi International Holding’s appeal for investors primarily rests on believing in its ability to turn revenue growth strategies, such as late-night dining concepts and global expansion, into sustained profit improvement. The recent earnings report, showing higher sales but a significant drop in net income, puts a spotlight on the company’s capacity to convert top-line gains into profitability. For now, these results don't materially alter the core short-term catalyst, which remains store expansion, but reinforce that profitability risks deserve close attention.

Among recent announcements, the Q3 2025 earnings release stands out as most relevant, revealing continued revenue advancement but a sharp contraction in earnings and margins. This context reinforces the necessity for operational improvements and signals that execution on margin optimization and cost control will likely be closely watched, as the impact of store expansion on earnings efficiency becomes a pivotal theme for investors evaluating Super Hi’s prospects.

However, investors should be aware that while expansion persists, pressure on net margins is a risk that could…

Read the full narrative on Super Hi International Holding (it's free!)

Super Hi International Holding's narrative projects $1.2 billion revenue and $106.5 million earnings by 2028. This requires 14.8% yearly revenue growth and an $84.7 million increase in earnings from the current $21.8 million.

Uncover how Super Hi International Holding's forecasts yield a HK$17.23 fair value, a 19% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members posted two fair value estimates for Super Hi International Holding shares ranging between US$17.23 and US$21.50. As you review these diverse perspectives, keep in mind that recent earnings results have sharpened the focus on the company’s ability to defend margins while pursuing growth.

Explore 2 other fair value estimates on Super Hi International Holding - why the stock might be worth just HK$17.23!

Build Your Own Super Hi International Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Super Hi International Holding research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Super Hi International Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Super Hi International Holding's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9658

Super Hi International Holding

An investment holding company, engages in the restaurant operation, delivery business, and others in Asia, North America, Europe, Oceania, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.