- Hong Kong

- /

- Hospitality

- /

- SEHK:9658

Super Hi International Holding Ltd.'s (HKG:9658) Shares May Have Run Too Fast Too Soon

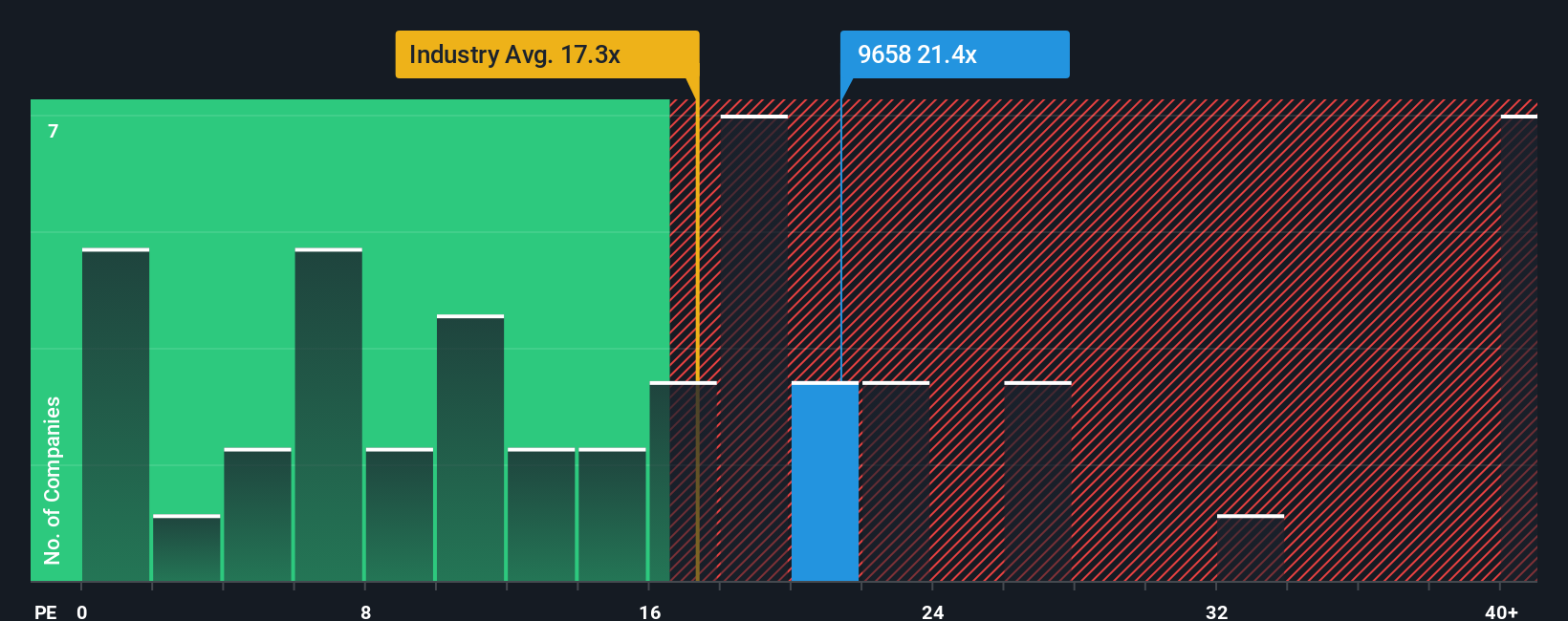

When close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may consider Super Hi International Holding Ltd. (HKG:9658) as a stock to avoid entirely with its 21.4x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

Super Hi International Holding certainly has been doing a good job lately as it's been growing earnings more than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Super Hi International Holding

Is There Enough Growth For Super Hi International Holding?

The only time you'd be truly comfortable seeing a P/E as steep as Super Hi International Holding's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 198%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Looking ahead now, EPS is anticipated to climb by 4.7% per annum during the coming three years according to the six analysts following the company. That's shaping up to be materially lower than the 14% each year growth forecast for the broader market.

In light of this, it's alarming that Super Hi International Holding's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On Super Hi International Holding's P/E

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Super Hi International Holding currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Super Hi International Holding with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9658

Super Hi International Holding

An investment holding company, engages in the restaurant operation, delivery business, and others in Asia, North America, Europe, Oceania, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives