- Hong Kong

- /

- Hospitality

- /

- SEHK:9658

Should You Be Adding Super Hi International Holding (HKG:9658) To Your Watchlist Today?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Super Hi International Holding (HKG:9658). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Super Hi International Holding

How Fast Is Super Hi International Holding Growing Its Earnings Per Share?

In the last three years Super Hi International Holding's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Super Hi International Holding's EPS shot from US$0.039 to US$0.087, over the last year. It's not often a company can achieve year-on-year growth of 122%.

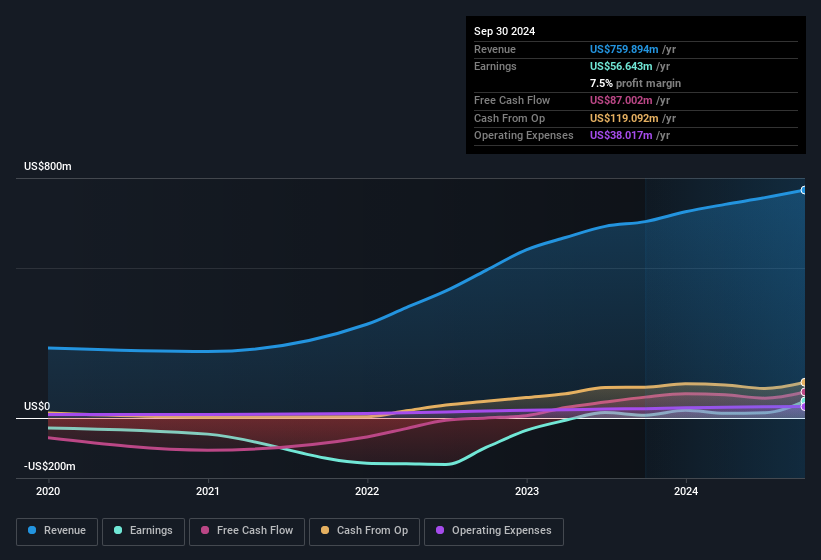

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Super Hi International Holding maintained stable EBIT margins over the last year, all while growing revenue 16% to US$760m. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Super Hi International Holding?

Are Super Hi International Holding Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

First and foremost; there we saw no insiders sell Super Hi International Holding shares in the last year. Even better, though, is that the CEO & Executive Director, Lijuan Yang, bought a whopping US$3.0m worth of shares, paying about US$13.99 per share, on average. Big buys like that may signal an opportunity; actions speak louder than words.

The good news, alongside the insider buying, for Super Hi International Holding bulls is that insiders (collectively) have a meaningful investment in the stock. Given insiders own a significant chunk of shares, currently valued at US$739m, they have plenty of motivation to push the business to succeed. This should keep them focused on creating long term value for shareholders.

Should You Add Super Hi International Holding To Your Watchlist?

Super Hi International Holding's earnings have taken off in quite an impressive fashion. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Super Hi International Holding belongs near the top of your watchlist. You still need to take note of risks, for example - Super Hi International Holding has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Super Hi International Holding isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9658

Super Hi International Holding

An investment holding company, engages in the restaurant operation, delivery business, and others in Asia, North America, Europe, Oceania, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives