- Hong Kong

- /

- Consumer Services

- /

- SEHK:919

Modern Healthcare Technology Holdings (HKG:919) Shareholders Will Want The ROCE Trajectory To Continue

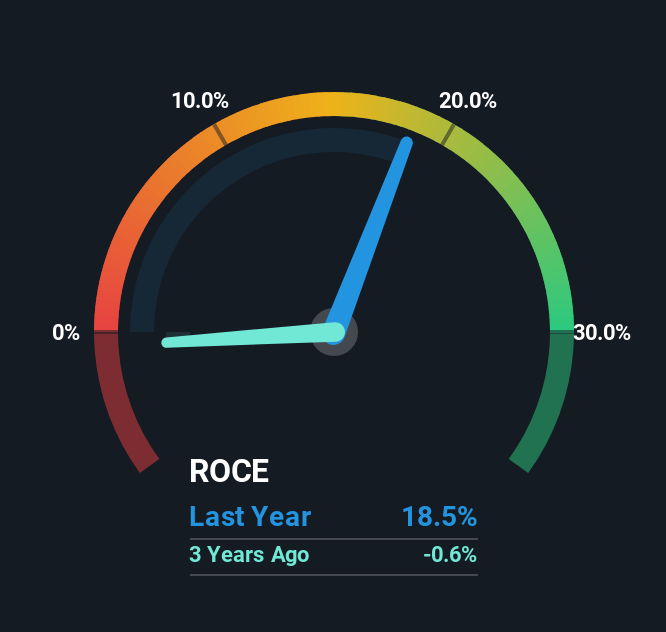

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So on that note, Modern Healthcare Technology Holdings (HKG:919) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What Is It?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Modern Healthcare Technology Holdings, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.19 = HK$43m ÷ (HK$562m - HK$328m) (Based on the trailing twelve months to September 2025).

Thus, Modern Healthcare Technology Holdings has an ROCE of 19%. On its own, that's a standard return, however it's much better than the 10% generated by the Consumer Services industry.

View our latest analysis for Modern Healthcare Technology Holdings

Historical performance is a great place to start when researching a stock so above you can see the gauge for Modern Healthcare Technology Holdings' ROCE against it's prior returns. If you'd like to look at how Modern Healthcare Technology Holdings has performed in the past in other metrics, you can view this free graph of Modern Healthcare Technology Holdings' past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

Modern Healthcare Technology Holdings' ROCE growth is quite impressive. The figures show that over the last five years, ROCE has grown 184% whilst employing roughly the same amount of capital. Basically the business is generating higher returns from the same amount of capital and that is proof that there are improvements in the company's efficiencies. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

On a separate but related note, it's important to know that Modern Healthcare Technology Holdings has a current liabilities to total assets ratio of 58%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

The Key Takeaway

As discussed above, Modern Healthcare Technology Holdings appears to be getting more proficient at generating returns since capital employed has remained flat but earnings (before interest and tax) are up. Given the stock has declined 18% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

One more thing, we've spotted 2 warning signs facing Modern Healthcare Technology Holdings that you might find interesting.

While Modern Healthcare Technology Holdings may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:919

Modern Healthcare Technology Holdings

An investment holding company, provides beauty and wellness services in Hong Kong, Mainland China, Singapore, and Australia.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026