- Hong Kong

- /

- Consumer Services

- /

- SEHK:839

China Education Group (SEHK:839) Net Margins Double, Defying Market Caution on Profitability Rebound

Reviewed by Simply Wall St

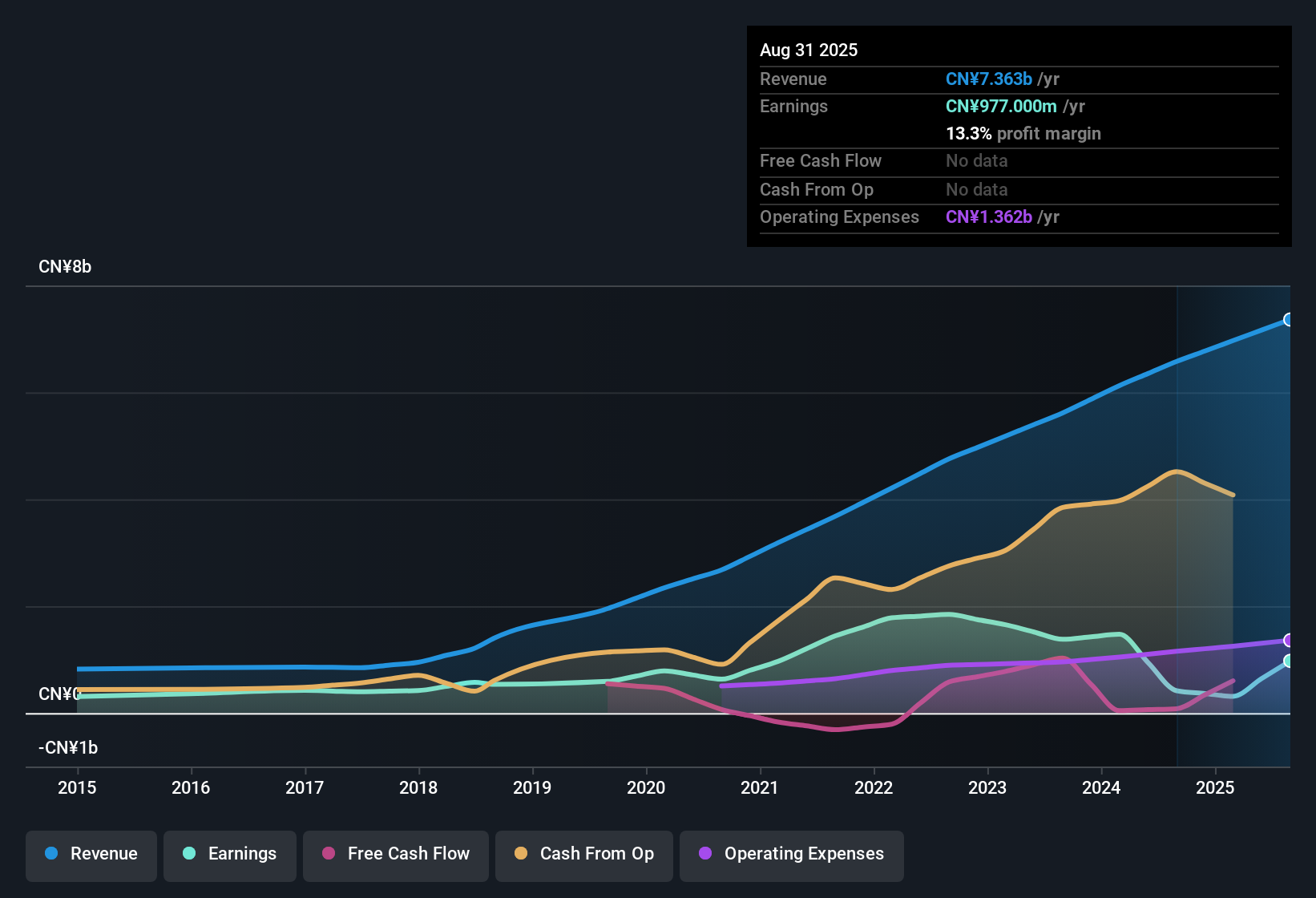

China Education Group Holdings (SEHK:839) just reported its FY2025 results, revealing revenue of $3.7 billion and net income of $10 million, with basic EPS at 0.004 CNY for the latest half. Over the past year, the company has seen revenue rise from $3.3 billion to $3.7 billion across recent periods, with net income turning around from a loss of $653 million to a modest gain. Margins showed a clear rebound as profitability moved off the previous lows, presenting an earnings release shaped by improving numbers and a recovering trajectory.

See our full analysis for China Education Group Holdings.Now, it is time to see how these figures measure up against the dominant market narratives and which stories hold up in the wake of the latest results.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margins Double, Profit Growth Outpaces Market

- Net profit margin jumped to 13.3% for the latest twelve months, nearly doubling from 6.4% a year earlier. Earnings over the same period grew by 133.7%, far outpacing the five-year average.

- In contrast to the improvement in margins and profit growth, the prevailing market perspective emphasizes broad-based demand for vocational and higher education as a structural catalyst. It is also noted that China Education Group’s rebound is especially notable given sector-wide policy scrutiny.

- Compared to the Hong Kong market's projected 4.3% annual earnings growth, the company's 19.1% forecast stands well ahead. This supports the argument that operational focus beyond K-12 and international diversification are paying off.

- The combination of margin expansion and rapid earnings growth following a previous loss reinforces confidence in a continued positive trajectory. However, exposure to changing education policy remains a watchpoint.

Trading at 59% Discount to DCF Fair Value

- Shares currently trade at HK$2.75, which is about 59.5% below the DCF fair value estimate of HK$6.78. The Price-to-Earnings ratio is at 7.2x, undercutting both peer and industry averages (16.5x and 7.6x, respectively).

- Market observers highlight the steep discount against fair value, pointing out that a pricing gap this wide usually reflects caution around sector risks. It also increases the appeal for value-focused investors.

- Despite sector headwinds and a previous period marked by a one-off loss, valuation multiples illustrate investor hesitance. The combination of discounted pricing and robust earnings growth sets the stage for potential upside if policy risks do not materialize.

- The fact that the industry and peers carry higher P/E ratios reinforces the sense that China Education Group's shares, at current levels, are attractively positioned versus the sector, though not without associated risks.

Stable Revenue Growth Trails Market Average

- Over the last twelve months, total revenue reached $7.4 billion, with annual revenue expected to grow 4.3%, which is slower than the broader Hong Kong market’s pace.

- Even as earnings projections and profitability have surged, the narrative points to the company’s below-market revenue growth rate as a reason for cautious optimism.

- Forecasts of 19.1% annual earnings growth suggest the business is leveraging operational improvements more than top-line expansion. This could amplify returns in the short term but may also expose investors if demand softens.

- While momentum in core profitability lends support to positive outlooks, the muted revenue trajectory is a reminder that future upside may depend on sustaining margin gains rather than simply growing sales volume.

Consensus narrative sees the mix of rapid profit recovery and deep value as a compelling turnaround, but calls attention to the importance of policy stability for continued gains. Hold and watch closely for sector developments. 📊 Read the full China Education Group Holdings Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on China Education Group Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite the rebound in earnings, China Education Group’s slower revenue growth has trailed the broader market. This has raised concerns about the sustainability of its recovery.

If you are searching for investments delivering consistent top- and bottom-line expansion, check out stable growth stocks screener (2076 results) to discover companies with more reliable growth momentum.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:839

China Education Group Holdings

An investment holding company, engages in the operation of private higher and secondary vocational education institutions in Mainland China and Australia.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success