- Hong Kong

- /

- Hospitality

- /

- SEHK:780

Assessing Tongcheng Travel Holdings (SEHK:780) Valuation After Recent Share Price Gains

Reviewed by Kshitija Bhandaru

Tongcheng Travel Holdings (SEHK:780) has captured some attention lately, especially as its stock delivered a 4% gain over the past month and climbed 11% in the past 3 months. These moves have investors wondering what is driving the momentum and how it might unfold next.

See our latest analysis for Tongcheng Travel Holdings.

Tongcheng Travel Holdings has been picking up steam lately. A solid 30-day share price return has helped push its 12-month total shareholder return to over 11%. Investors are becoming more optimistic that the recent momentum could signal new growth in the months ahead.

If the strong run in online travel has you thinking about other opportunities, now’s a great time to uncover fast growing stocks with high insider ownership

With shares up significantly and estimates suggesting Tongcheng Travel still trades at around a 13% discount to consensus price targets, the question now is whether there is more room to run or if future growth is already reflected in the price.

Most Popular Narrative: 11.3% Undervalued

Despite the recent rally, the consensus among analysts points to further upside, with their fair value estimate still noticeably above the latest close. This sets the stage for a closer look at the powerful growth drivers fueling such optimism.

Expansion into lower-tier Chinese cities, propelled by targeted high-value user acquisition and leveraging growing internet and smartphone adoption, is unlocking a large, increasingly digitized user base. This supports robust revenue growth and higher order frequency through the platform.

Curious what bold assumptions power this bullish outlook? The narrative hints at a new wave of user adoption, rapidly accelerating revenues, and ambitious margin gains. Want to know which financial forecasts and strategic bets shape that target value? There’s more to unpack when you read the full narrative.

Result: Fair Value of $25.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on Tencent’s ecosystem and the maturing travel market could slow future user growth and put pressure on margins if conditions shift.

Find out about the key risks to this Tongcheng Travel Holdings narrative.

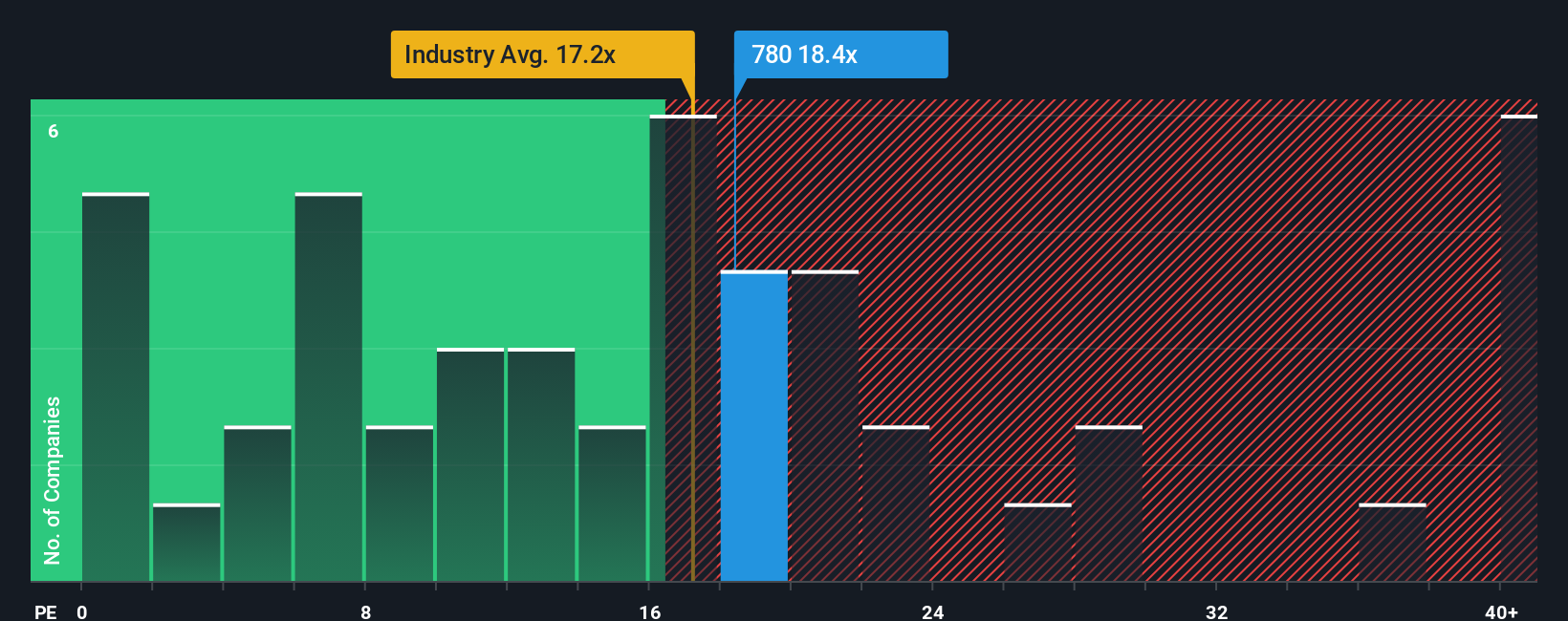

Another View: Market Ratios Suggest a Different Story

Looking at how the market values Tongcheng Travel Holdings compared to its peers presents a more cautious picture. The company trades at a price-to-earnings ratio of 19.3x, making it pricier than both the hospitality industry average (15.7x) and its direct peers (13.4x), as well as above its fair ratio (18.8x). This suggests investors are paying a premium, which could limit upside if optimism fades. Should investors trust the optimism reflected in today’s price, or is caution warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tongcheng Travel Holdings Narrative

If the consensus view does not align with your thinking, or you want to analyze the numbers yourself, you can craft your own independent narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Tongcheng Travel Holdings.

Looking for more investment ideas?

Smart investors never settle for one opportunity. Give yourself an edge by checking out hand-picked ideas using powerful filters you will not want to miss.

- Tap into tomorrow's medical breakthroughs by reviewing these 31 healthcare AI stocks, which offers the potential to transform healthcare through AI-powered innovations.

- Secure income with confidence by seeing these 19 dividend stocks with yields > 3%, which provides reliable yields above 3% for steady cash flow in changing markets.

- Catch the next wave in digital finance and blockchain with these 78 cryptocurrency and blockchain stocks, which drives the evolution of decentralized technology and future payment systems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongcheng Travel Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:780

Tongcheng Travel Holdings

An investment holding company, provides travel related services in the People’s Republic of China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives