- Hong Kong

- /

- Hospitality

- /

- SEHK:6862

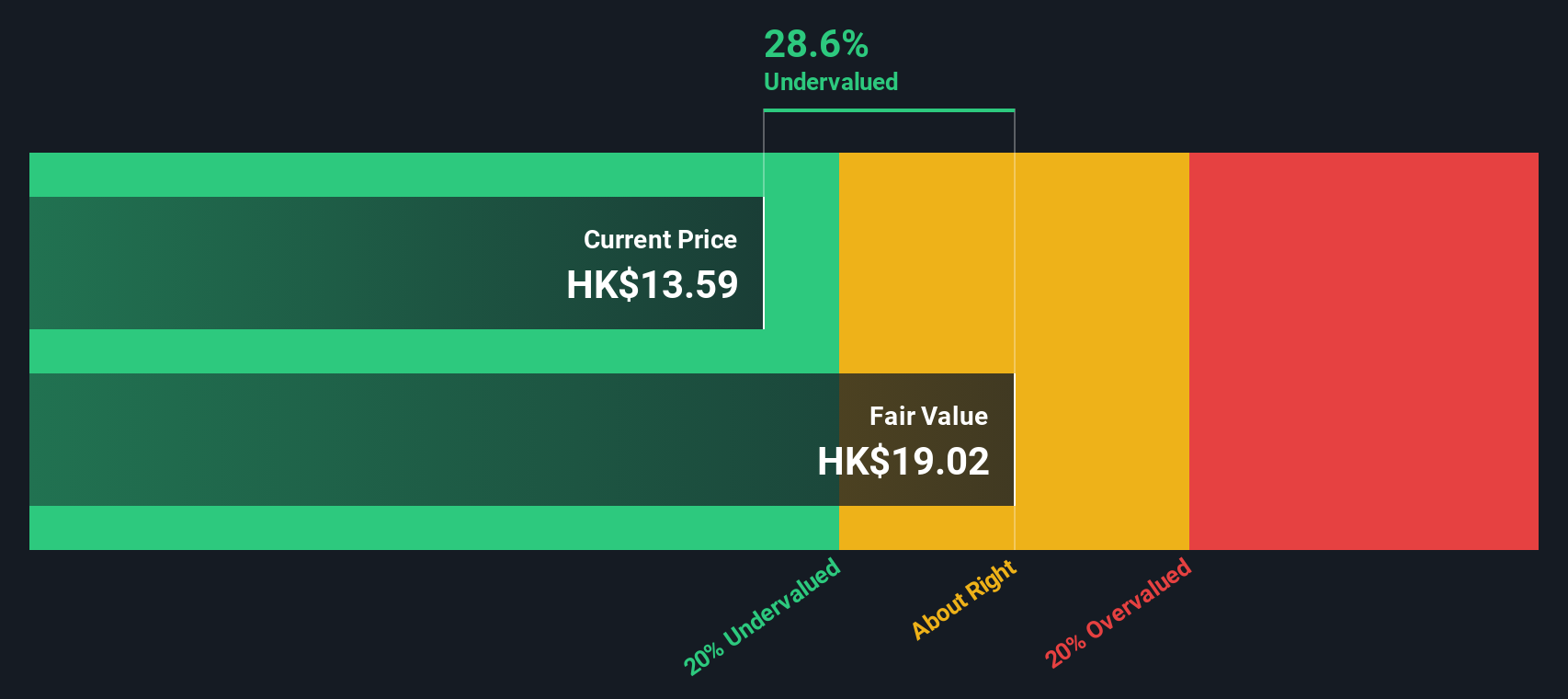

Is Haidilao (SEHK:6862) Now Undervalued? A Fresh Look at Its Recent Valuation Shift

Reviewed by Simply Wall St

Price-to-Earnings of 15.4x: Is it justified?

Based on the preferred valuation multiple, Haidilao International Holding appears undervalued relative to both its peers and the broader Hong Kong Hospitality industry. Its current price-to-earnings ratio stands at 15.4x, compared to an industry average of 16.8x and a peer group average of 20.4x.

The price-to-earnings ratio is a widely used metric that compares a company's current share price to its per-share earnings. For consumer-facing businesses like Haidilao, it helps investors gauge whether the market expects strong future growth or is discounting the stock due to potential challenges.

This lower multiple suggests the market may be cautious about the company’s future prospects or is potentially overlooking some underlying strengths. Considering Haidilao continues to post quality earnings and earnings growth, the current valuation could present an opportunity for value-focused investors.

Result: Fair Value of $19.05 (UNDERVALUED)

See our latest analysis for Haidilao International Holding.However, persistent revenue growth concerns and recent negative returns over multiple periods could still weigh on investor confidence going forward.

Find out about the key risks to this Haidilao International Holding narrative.Another View: The SWS DCF Model Perspective

Looking from a different angle, our DCF model also points to Haidilao being undervalued. While both approaches align, this agreement raises an important question: is the market missing something or just being cautious?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Haidilao International Holding Narrative

If you see things differently or would rather analyze the numbers yourself, you can easily shape your own view in just a few minutes, Do it your way.

A great starting point for your Haidilao International Holding research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next smart investing move?

Great investors keep searching for fresh opportunities. Don’t let your next winning idea slip by. Simply Wall Street’s tailored screeners can help you spot trends most overlook.

- Uncover high-potential contenders with strong balance sheets using our penny stocks with strong financials and see which emerging names are making waves on solid ground.

- Catalyze your portfolio’s growth by targeting game-changers transforming healthcare through artificial intelligence. Find them with our healthcare AI stocks.

- Boost your income strategy by tapping into companies offering impressive yields. Start mapping out consistent returns with the dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haidilao International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SEHK:6862

Haidilao International Holding

An investment holding company, engages in the restaurant operation and delivery businesses in Mainland China, Hong Kong, Macau, and Taiwan.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives