- Hong Kong

- /

- Hospitality

- /

- SEHK:6862

Haidilao International Holding Ltd.'s (HKG:6862) Business Is Yet to Catch Up With Its Share Price

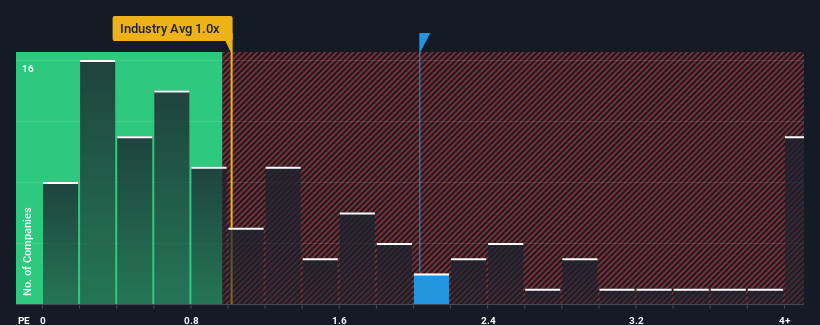

Haidilao International Holding Ltd.'s (HKG:6862) price-to-sales (or "P/S") ratio of 2x may not look like an appealing investment opportunity when you consider close to half the companies in the Hospitality industry in Hong Kong have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Haidilao International Holding

How Has Haidilao International Holding Performed Recently?

Haidilao International Holding could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Haidilao International Holding will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Haidilao International Holding's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 41% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to climb by 15% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 25% per year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Haidilao International Holding's P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It comes as a surprise to see Haidilao International Holding trade at such a high P/S given the revenue forecasts look less than stellar. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Haidilao International Holding with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Haidilao International Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6862

Haidilao International Holding

An investment holding company, engages in the restaurant operation and delivery businesses.

Excellent balance sheet and fair value.