Tao Heung Holdings Limited (HKG:573) has announced that it will pay a dividend of HK$0.03 per share on the 18th of October. This means the annual payment is 7.9% of the current stock price, which is above the average for the industry.

Check out our latest analysis for Tao Heung Holdings

Tao Heung Holdings' Distributions May Be Difficult To Sustain

A big dividend yield for a few years doesn't mean much if it can't be sustained. While Tao Heung Holdings is not profitable, it is paying out less than 75% of its free cash flow, which means that there is plenty left over for reinvestment into the business. In general, cash flows are more important than the more traditional measures of profit so we feel pretty comfortable with the dividend at this level.

Over the next year, EPS might fall by 63.9% based on recent performance. This means that the company won't turn a profit over the next year, but with healthy cash flows at the moment the dividend could still be okay to continue.

Dividend Volatility

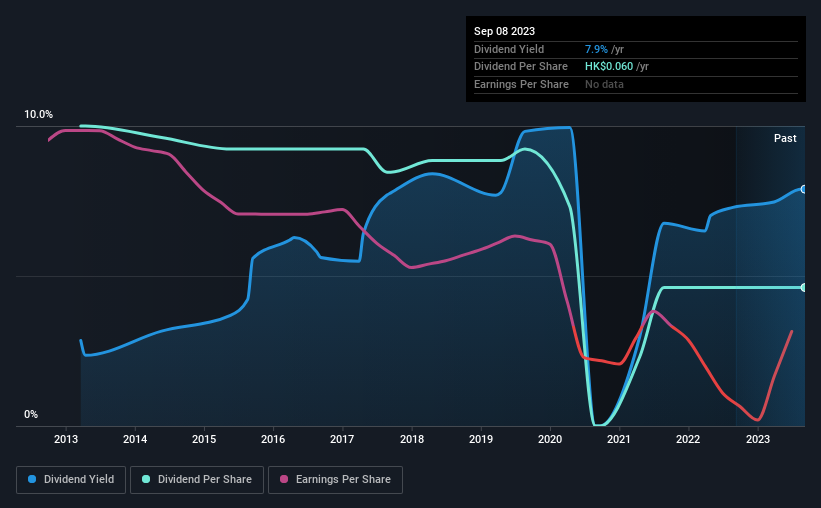

Although the company has a long dividend history, it has been cut at least once in the last 10 years. The dividend has gone from an annual total of HK$0.13 in 2013 to the most recent total annual payment of HK$0.06. This works out to be a decline of approximately 7.4% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Tao Heung Holdings' EPS has fallen by approximately 64% per year during the past five years. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in.

Tao Heung Holdings' Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about Tao Heung Holdings' payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. We don't think Tao Heung Holdings is a great stock to add to your portfolio if income is your focus.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for Tao Heung Holdings you should be aware of, and 1 of them is potentially serious. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Tao Heung Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:573

Tao Heung Holdings

An investment holding company, operates a chain of restaurants and bakeries in Hong Kong and Mainland China.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion