- Hong Kong

- /

- Hospitality

- /

- SEHK:45

Hongkong and Shanghai Hotels (HKG:45) Has Debt But No Earnings; Should You Worry?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that The Hongkong and Shanghai Hotels, Limited (HKG:45) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for Hongkong and Shanghai Hotels

What Is Hongkong and Shanghai Hotels's Debt?

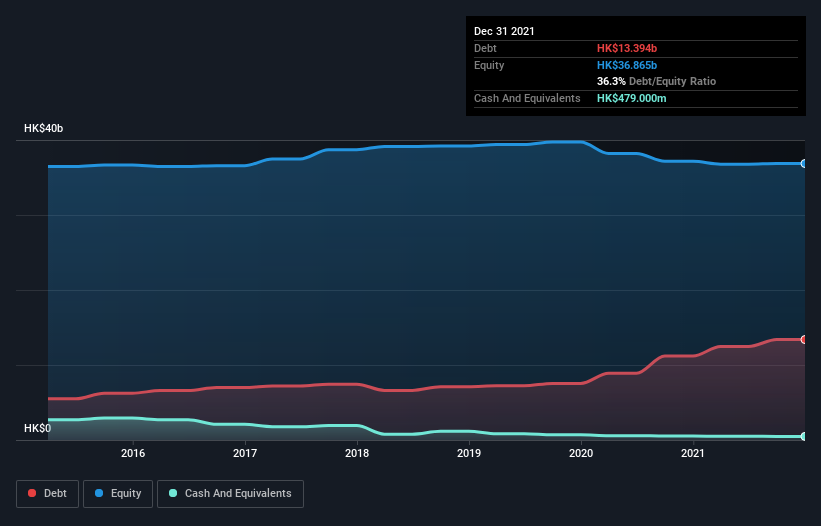

As you can see below, at the end of December 2021, Hongkong and Shanghai Hotels had HK$13.4b of debt, up from HK$11.2b a year ago. Click the image for more detail. However, because it has a cash reserve of HK$479.0m, its net debt is less, at about HK$12.9b.

How Healthy Is Hongkong and Shanghai Hotels' Balance Sheet?

According to the last reported balance sheet, Hongkong and Shanghai Hotels had liabilities of HK$3.76b due within 12 months, and liabilities of HK$15.1b due beyond 12 months. On the other hand, it had cash of HK$479.0m and HK$378.0m worth of receivables due within a year. So it has liabilities totalling HK$18.0b more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of HK$13.8b, we think shareholders really should watch Hongkong and Shanghai Hotels's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Hongkong and Shanghai Hotels can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year Hongkong and Shanghai Hotels wasn't profitable at an EBIT level, but managed to grow its revenue by 28%, to HK$3.5b. With any luck the company will be able to grow its way to profitability.

Caveat Emptor

While we can certainly appreciate Hongkong and Shanghai Hotels's revenue growth, its earnings before interest and tax (EBIT) loss is not ideal. To be specific the EBIT loss came in at HK$105m. Considering that alongside the liabilities mentioned above make us nervous about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it had negative free cash flow of HK$662m over the last twelve months. That means it's on the risky side of things. For riskier companies like Hongkong and Shanghai Hotels I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Hongkong and Shanghai Hotels might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:45

Hongkong and Shanghai Hotels

An investment holding company, owns, develops, and manages hotels, and commercial and residential properties in China, rest of Asia, the United States, and Europe.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives