- Hong Kong

- /

- Hospitality

- /

- SEHK:419

Investors Give Huayi Tencent Entertainment Company Limited (HKG:419) Shares A 27% Hiding

Huayi Tencent Entertainment Company Limited (HKG:419) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 47% share price drop.

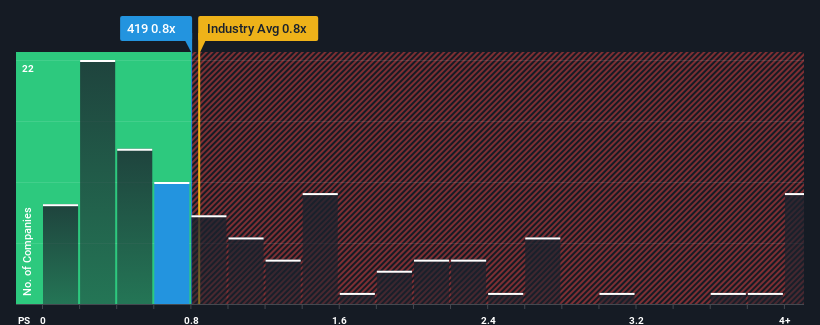

Although its price has dipped substantially, there still wouldn't be many who think Huayi Tencent Entertainment's price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in Hong Kong's Hospitality industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Huayi Tencent Entertainment

What Does Huayi Tencent Entertainment's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Huayi Tencent Entertainment over the last year, which is not ideal at all. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Huayi Tencent Entertainment will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Huayi Tencent Entertainment's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Comparing that to the industry, which is only predicted to deliver 19% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Huayi Tencent Entertainment's P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Huayi Tencent Entertainment looks to be in line with the rest of the Hospitality industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Huayi Tencent Entertainment's P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with Huayi Tencent Entertainment (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hony Media Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:419

Hony Media Group

Offers digitized operation services for the healthcare industry in Mainland China and internationally.

Moderate risk and overvalued.

Market Insights

Community Narratives