- Hong Kong

- /

- Consumer Services

- /

- SEHK:382

Here's Why Edvantage Group Holdings (HKG:382) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Edvantage Group Holdings (HKG:382). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Edvantage Group Holdings

Edvantage Group Holdings' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. Shareholders will be happy to know that Edvantage Group Holdings' EPS has grown 25% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

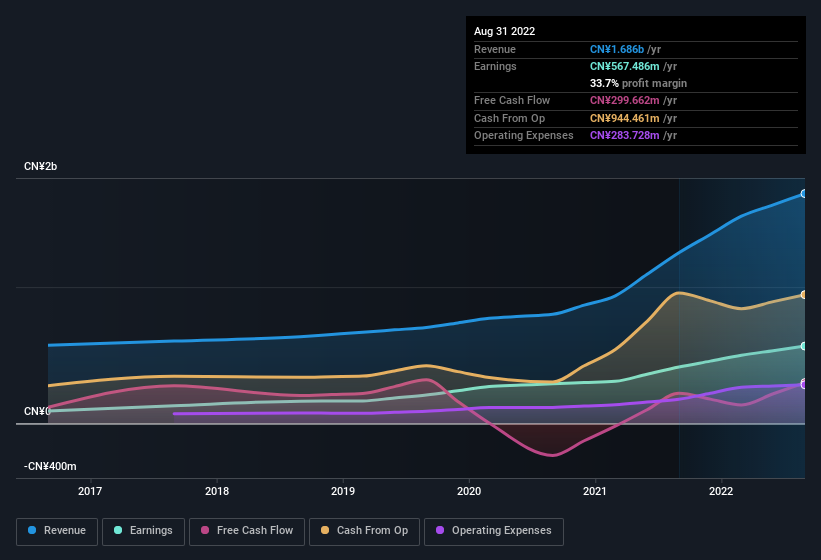

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Edvantage Group Holdings' EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Edvantage Group Holdings' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Edvantage Group Holdings Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Edvantage Group Holdings top brass are certainly in sync, not having sold any shares, over the last year. But the real excitement comes from the CN¥1.0m that Executive Chairman Yung Chau Liu spent buying shares (at an average price of about CN¥3.40). Purchases like this clue us in to the to the faith management has in the business' future.

It's commendable to see that insiders have been buying shares in Edvantage Group Holdings, but there is more evidence of shareholder friendly management. Namely, Edvantage Group Holdings has a very reasonable level of CEO pay. The median total compensation for CEOs of companies similar in size to Edvantage Group Holdings, with market caps between CN¥1.4b and CN¥5.4b, is around CN¥2.6m.

Edvantage Group Holdings' CEO took home a total compensation package worth CN¥1.8m in the year leading up to August 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Does Edvantage Group Holdings Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Edvantage Group Holdings' strong EPS growth. And that's not the only positive either. We have both insider buying and reasonable and remuneration to consider. On balance the message seems to be that this stock is worth looking at, at least for a while. You should always think about risks though. Case in point, we've spotted 2 warning signs for Edvantage Group Holdings you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Edvantage Group Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Edvantage Group Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:382

Edvantage Group Holdings

An investment holding company, operates private higher and vocational education institutions in the People’s Republic of China, Australia, and Singapore.

Undervalued with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives