- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

SEHK Growth Companies With High Insider Ownership For October 2024

Reviewed by Simply Wall St

As the Hong Kong market benefits from China's robust stimulus measures, investors are increasingly looking for growth opportunities with strong insider ownership. High insider ownership can signal confidence in a company's future prospects, making such stocks particularly appealing in the current economic climate.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 32.7% |

| Akeso (SEHK:9926) | 20.5% | 54.5% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Lianlian DigiTech (SEHK:2598) | 19.7% | 92.3% |

Underneath we present a selection of stocks filtered out by our screen.

Kuaishou Technology (SEHK:1024)

Simply Wall St Growth Rating: ★★★★☆☆

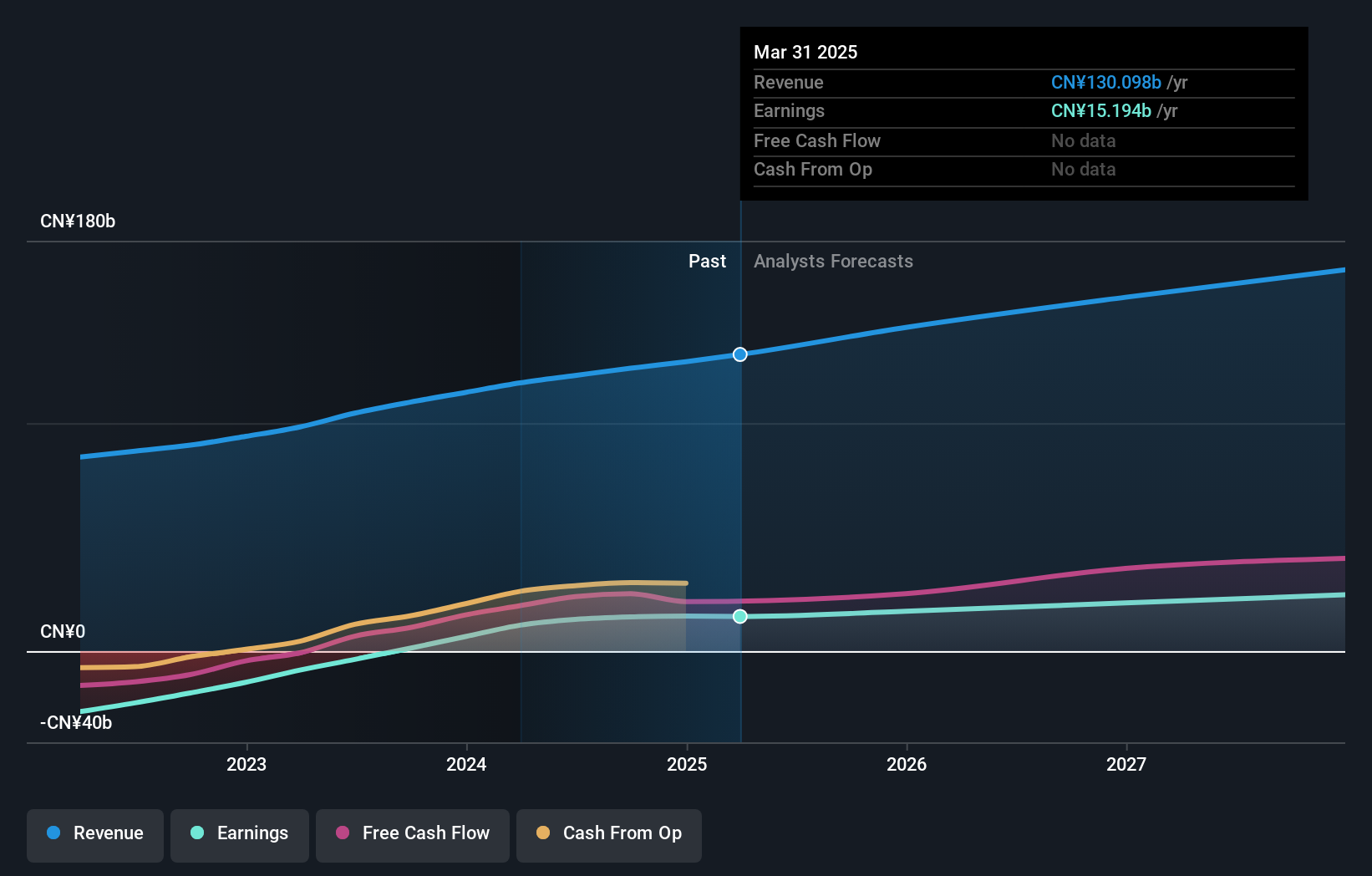

Overview: Kuaishou Technology, an investment holding company, offers live streaming, online marketing, and other services in the People’s Republic of China with a market cap of HK$236.48 billion.

Operations: The company's revenue segments are Domestic: CN¥117.32 billion and Overseas: CN¥3.57 billion.

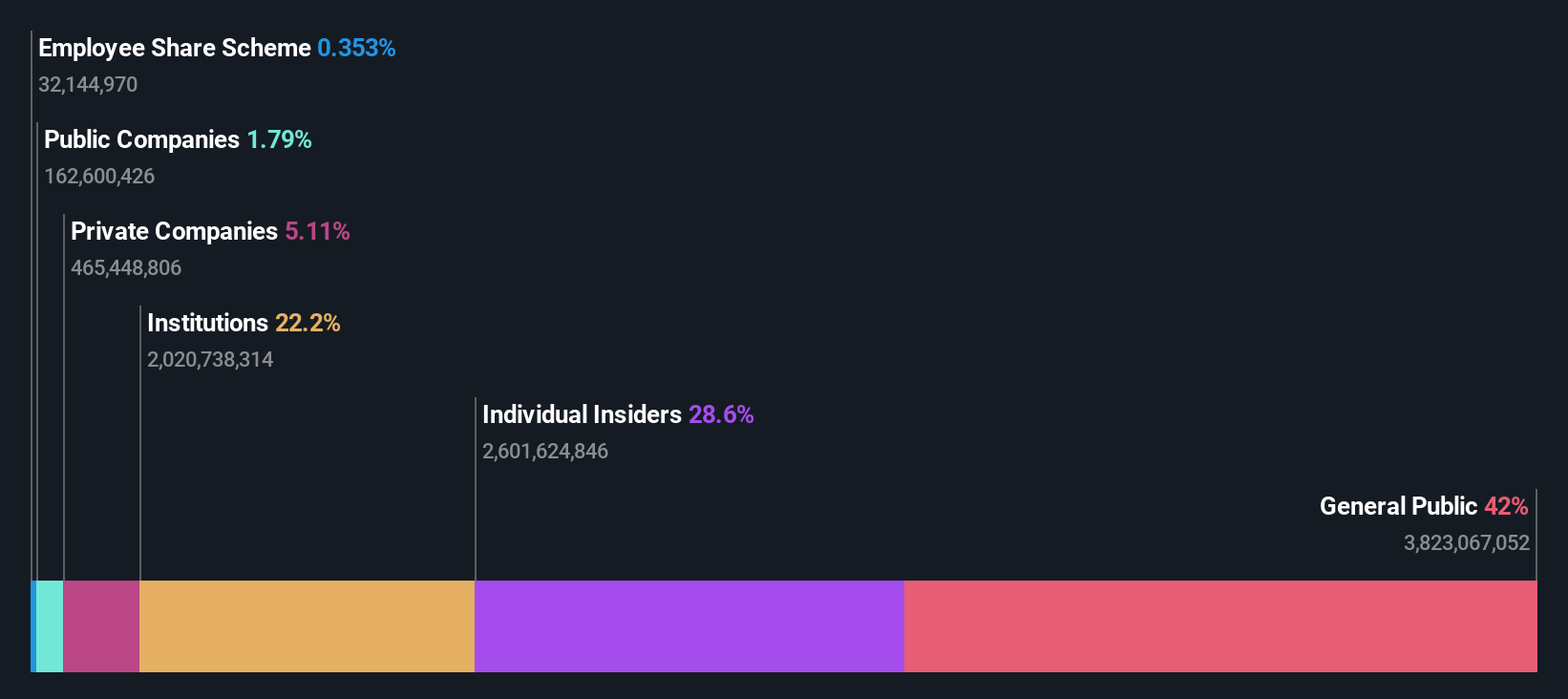

Insider Ownership: 19.4%

Kuaishou Technology, a growth company with high insider ownership in Hong Kong, reported strong financial results for Q2 2024, with sales of CNY 30.98 billion and net income of CNY 3.98 billion. Recent upgrades to its Kling AI video generation model and the launch of a subscription program highlight its commitment to innovation. Despite an expected annual profit growth rate below significant levels, Kuaishou's earnings are forecasted to grow faster than the Hong Kong market average.

- Unlock comprehensive insights into our analysis of Kuaishou Technology stock in this growth report.

- In light of our recent valuation report, it seems possible that Kuaishou Technology is trading behind its estimated value.

BYD (SEHK:1211)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, with a market cap of HK$927.40 billion, operates in the automobiles and batteries sectors across China, Hong Kong, Macau, Taiwan and internationally.

Operations: BYD generates revenue primarily from Automobiles and Related Products at CN¥507.52 billion and Mobile Handset Components, Assembly Service, and Other Products at CN¥154.49 billion.

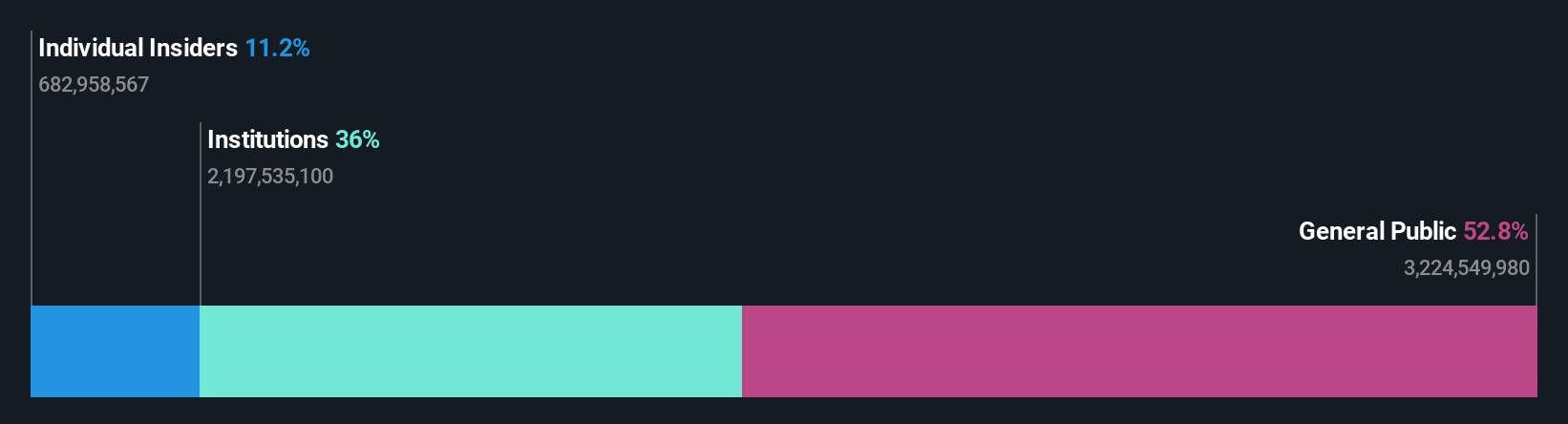

Insider Ownership: 30.1%

BYD has demonstrated robust growth, with earnings increasing by 36.2% over the past year and forecasts indicating revenue growth of 14.1% per year, outpacing the Hong Kong market. Recent results show strong production and sales volumes, with net income rising to CNY 13.63 billion for H1 2024 from CNY 10.95 billion a year ago. The company’s strategic partnership with Uber and expansion into Thailand further bolster its growth prospects despite high levels of non-cash earnings.

- Click here and access our complete growth analysis report to understand the dynamics of BYD.

- In light of our recent valuation report, it seems possible that BYD is trading beyond its estimated value.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of approximately HK$1.02 trillion.

Operations: The company's revenue segments include Core Local Commerce at CN¥228.13 billion and New Initiatives at CN¥77.56 billion.

Insider Ownership: 11.8%

Meituan has shown significant growth, with earnings surging by 175.5% over the past year. Recent results for H1 2024 reported sales of CNY 155.53 billion and net income of CNY 16.72 billion, reflecting strong performance compared to a year ago. The company has also been active in share buybacks, repurchasing shares worth HKD 7.17 billion and $2 billion recently, indicating confidence in its future prospects despite modest insider trading activity.

- Click here to discover the nuances of Meituan with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Meituan is priced higher than what may be justified by its financials.

Turning Ideas Into Actions

- Navigate through the entire inventory of 48 Fast Growing SEHK Companies With High Insider Ownership here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Outstanding track record with flawless balance sheet.