- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1024

3 SEHK Stocks Estimated To Be Undervalued By Up To 49%

Reviewed by Simply Wall St

As the Hong Kong market navigates a complex economic landscape, including recent deflationary pressures and central bank interventions in China, investors are keenly observing opportunities that may arise from these fluctuations. In this context, identifying undervalued stocks can be particularly appealing as they offer potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Plover Bay Technologies (SEHK:1523) | HK$5.10 | HK$10.13 | 49.7% |

| BYD Electronic (International) (SEHK:285) | HK$34.35 | HK$63.67 | 46% |

| Giant Biogene Holding (SEHK:2367) | HK$54.35 | HK$99.04 | 45.1% |

| Kuaishou Technology (SEHK:1024) | HK$47.10 | HK$88.35 | 46.7% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.73 | HK$18.79 | 48.2% |

| Meituan (SEHK:3690) | HK$194.90 | HK$382.33 | 49% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.30 | HK$19.49 | 47.2% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$29.80 | HK$55.56 | 46.4% |

| Semiconductor Manufacturing International (SEHK:981) | HK$29.15 | HK$54.31 | 46.3% |

| DPC Dash (SEHK:1405) | HK$66.90 | HK$130.50 | 48.7% |

We're going to check out a few of the best picks from our screener tool.

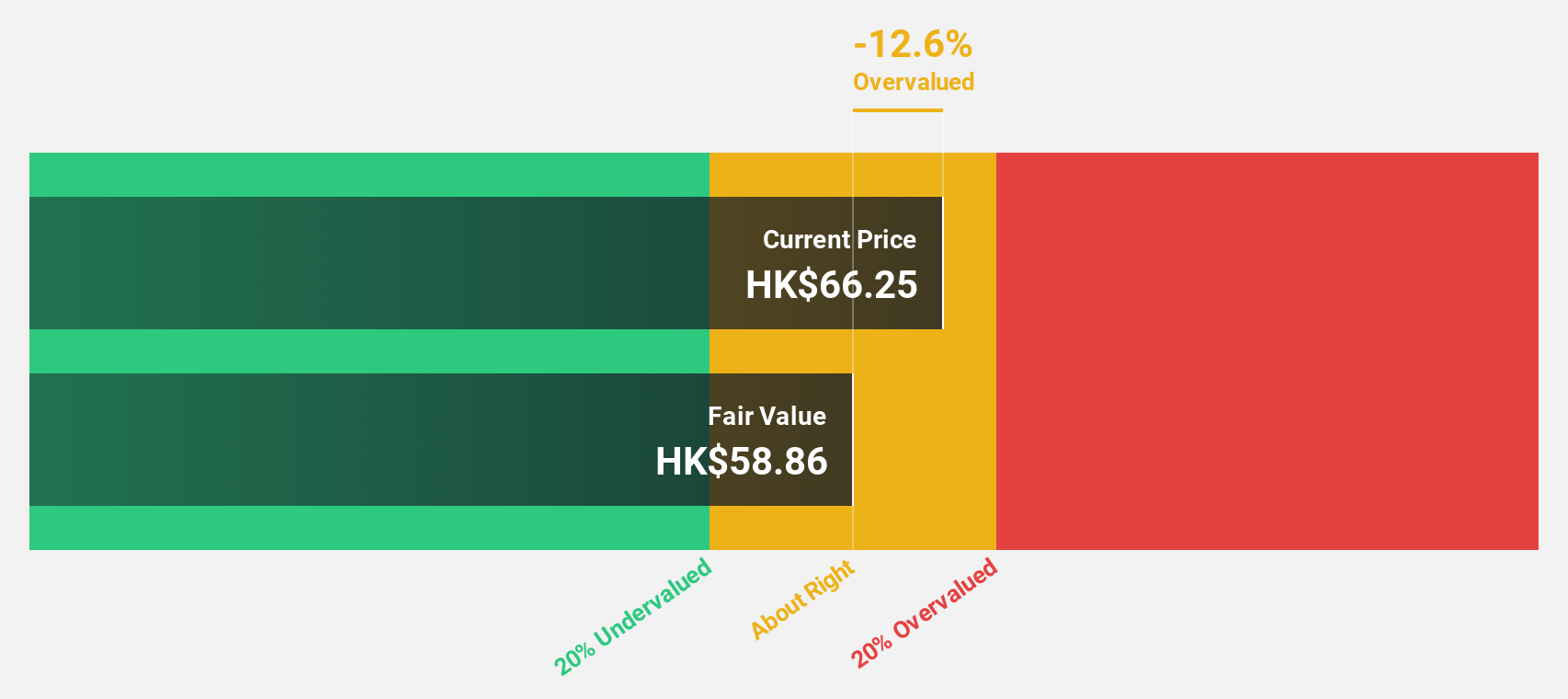

Kuaishou Technology (SEHK:1024)

Overview: Kuaishou Technology is an investment holding company offering live streaming, online marketing, and other services in the People's Republic of China, with a market cap of approximately HK$203.07 billion.

Operations: The company's revenue segments include Domestic operations generating CN¥117.32 billion and Overseas operations contributing CN¥3.57 billion.

Estimated Discount To Fair Value: 46.7%

Kuaishou Technology appears undervalued based on cash flows, trading at approximately HK$47.1, significantly below its estimated fair value of HK$88.35. Recent earnings reports show substantial growth, with net income rising to CNY 3.98 billion in Q2 2024 from CNY 1.48 billion a year earlier. Forecasts suggest annual profit growth of 18.7%, outpacing the Hong Kong market's average and indicating strong potential for future profitability improvements despite slower revenue growth projections.

- Our comprehensive growth report raises the possibility that Kuaishou Technology is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Kuaishou Technology.

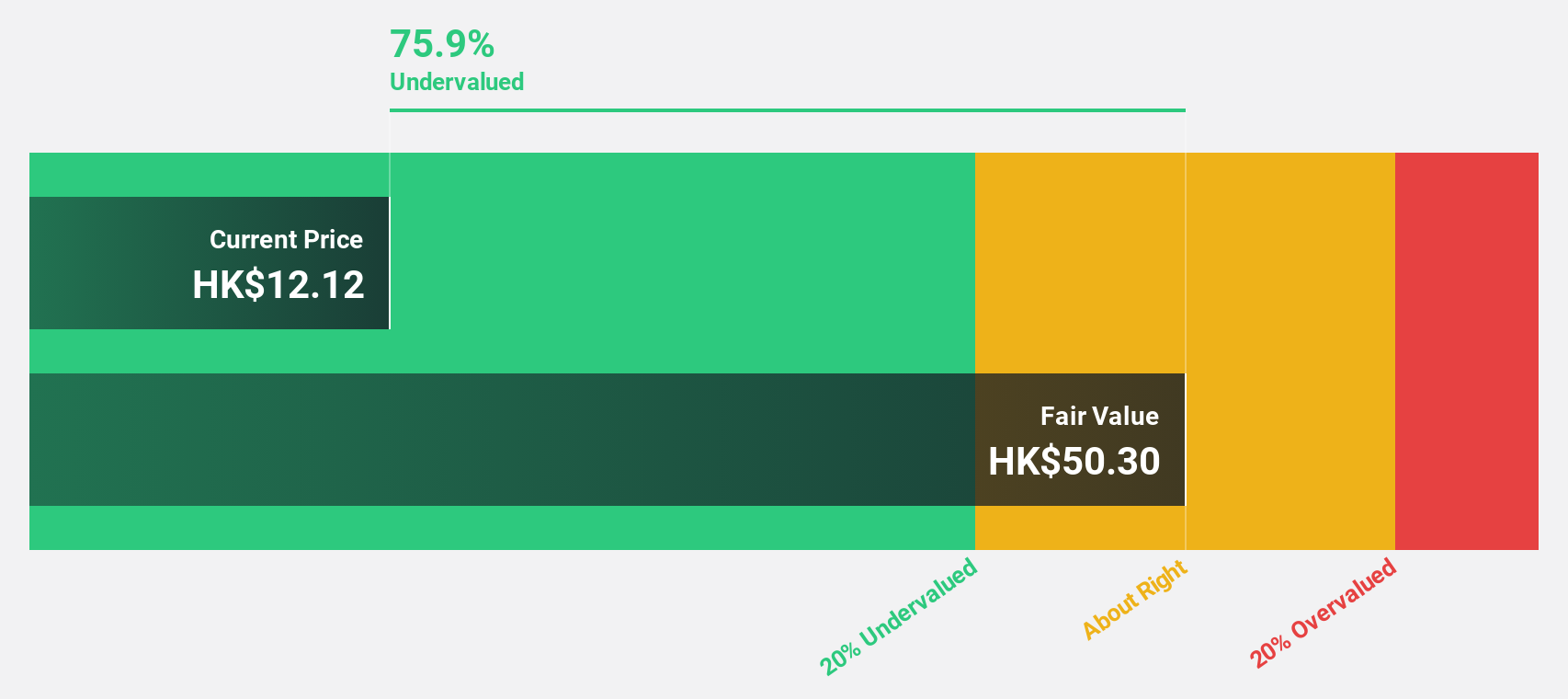

Yadea Group Holdings (SEHK:1585)

Overview: Yadea Group Holdings Ltd. is an investment holding company involved in the development, manufacture, and sale of electric two-wheeled vehicles and related accessories in the People's Republic of China, with a market cap of approximately HK$39.18 billion.

Operations: The company generates revenue primarily from its electric two-wheeled vehicles and related accessories segment, amounting to CN¥31.76 billion, and from batteries and electric drive components, contributing CN¥5.23 billion.

Estimated Discount To Fair Value: 44.7%

Yadea Group Holdings is trading at HK$12.88, significantly below its estimated fair value of HK$23.27, highlighting potential undervaluation based on cash flows. Despite a decline in half-year sales to CNY 14.41 billion from CNY 17.04 billion the previous year, earnings are forecast to grow annually by 17.2%, surpassing the Hong Kong market average. Recent strategic expansions into Thailand and Indonesia aim to bolster its global presence and support sustainable growth in electric vehicles.

- The growth report we've compiled suggests that Yadea Group Holdings' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Yadea Group Holdings' balance sheet health report.

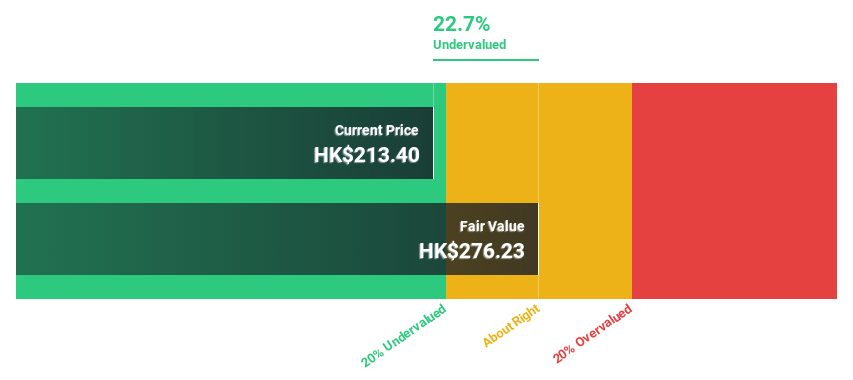

Meituan (SEHK:3690)

Overview: Meituan is a technology retail company in the People’s Republic of China with a market cap of HK$1.16 trillion.

Operations: The company's revenue is primarily derived from two segments: Core Local Commerce, which contributes CN¥228.13 billion, and New Initiatives, accounting for CN¥77.56 billion.

Estimated Discount To Fair Value: 49%

Meituan, trading at HK$194.9, is significantly undervalued compared to its fair value estimate of HK$382.33. The company's earnings are projected to grow 26.34% annually, outpacing the Hong Kong market average of 12.1%. Despite recent insider selling and a low forecasted return on equity of 19%, Meituan's robust cash flow position is supported by substantial share buybacks totaling $2 billion and fixed-income offerings amounting to $1.2 billion in recent months.

- Insights from our recent growth report point to a promising forecast for Meituan's business outlook.

- Get an in-depth perspective on Meituan's balance sheet by reading our health report here.

Summing It All Up

- Explore the 39 names from our Undervalued SEHK Stocks Based On Cash Flows screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kuaishou Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1024

Kuaishou Technology

An investment holding company, provides live streaming, online marketing, and other services in the People’s Republic of China.

Flawless balance sheet and undervalued.