- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

3 SEHK Dividend Stocks Yielding Up To 9.2%

Reviewed by Simply Wall St

The Hong Kong market has recently faced challenges, with the benchmark Hang Seng Index seeing a decline amid broader economic pressures and deflationary concerns in China. Despite these headwinds, investors continue to seek opportunities in dividend stocks, which can offer attractive yields even in uncertain times. In this environment, a good dividend stock is typically characterized by a strong balance sheet and consistent payout history, providing potential stability and income for investors navigating volatile markets.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Hongqiao Group (SEHK:1378) | 8.40% | ★★★★★☆ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.11% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.97% | ★★★★★☆ |

| Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

| China Construction Bank (SEHK:939) | 7.01% | ★★★★★☆ |

| PC Partner Group (SEHK:1263) | 8.23% | ★★★★★☆ |

| Tianjin Development Holdings (SEHK:882) | 6.85% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.53% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.58% | ★★★★★☆ |

| Zhejiang Expressway (SEHK:576) | 6.51% | ★★★★★☆ |

Click here to see the full list of 89 stocks from our Top SEHK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Jutal Offshore Oil Services (SEHK:3303)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jutal Offshore Oil Services Limited is an investment holding company involved in the fabrication of facilities and provision of integrated services for the oil and gas, new energy, and refining and chemical industries, with a market cap of HK$1.36 billion.

Operations: Jutal Offshore Oil Services Limited generates revenue primarily from the oil and gas segment, which accounts for CN¥2.98 billion, alongside contributions from the new energy and refinery and chemical segment totaling CN¥64.13 million.

Dividend Yield: 9.2%

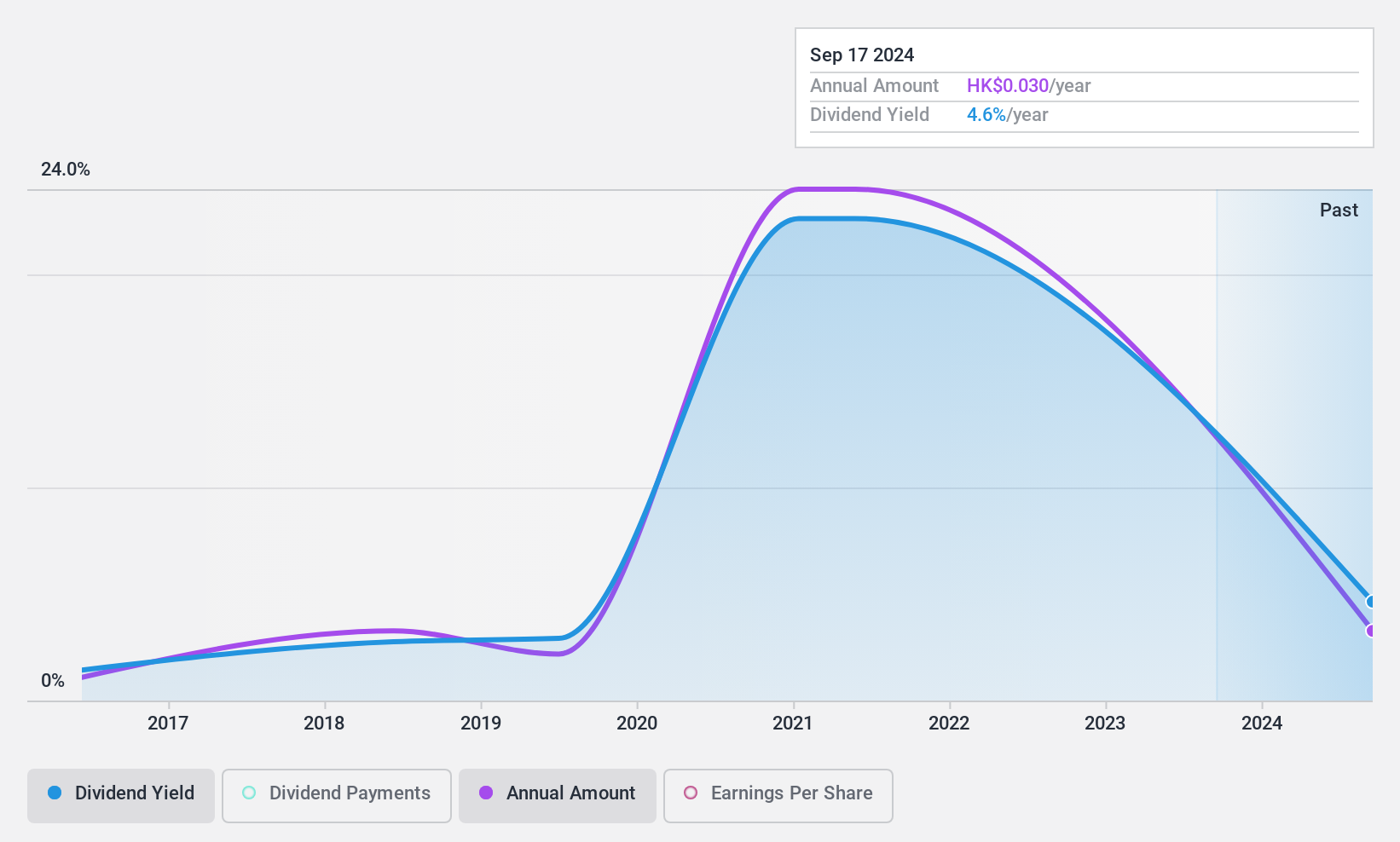

Jutal Offshore Oil Services recently declared an interim dividend of HK$0.03 per share, reflecting its commitment to shareholder returns despite a historically volatile dividend track record. The company’s low payout ratio of 15.5% indicates dividends are well covered by earnings, supported by robust financial performance with sales reaching CNY 1.28 billion and net income at CNY 177.31 million for the first half of 2024. However, past dividend reliability remains a concern for investors seeking stability in income streams.

- Get an in-depth perspective on Jutal Offshore Oil Services' performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Jutal Offshore Oil Services is priced lower than what may be justified by its financials.

China Electronics Huada Technology (SEHK:85)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Electronics Huada Technology Company Limited is an investment holding company focused on the design, development, and sale of integrated circuit chips in the People’s Republic of China with a market cap of HK$2.90 billion.

Operations: The company's revenue segment primarily comprises the design and sale of integrated circuit chips, generating HK$2.57 billion.

Dividend Yield: 7.3%

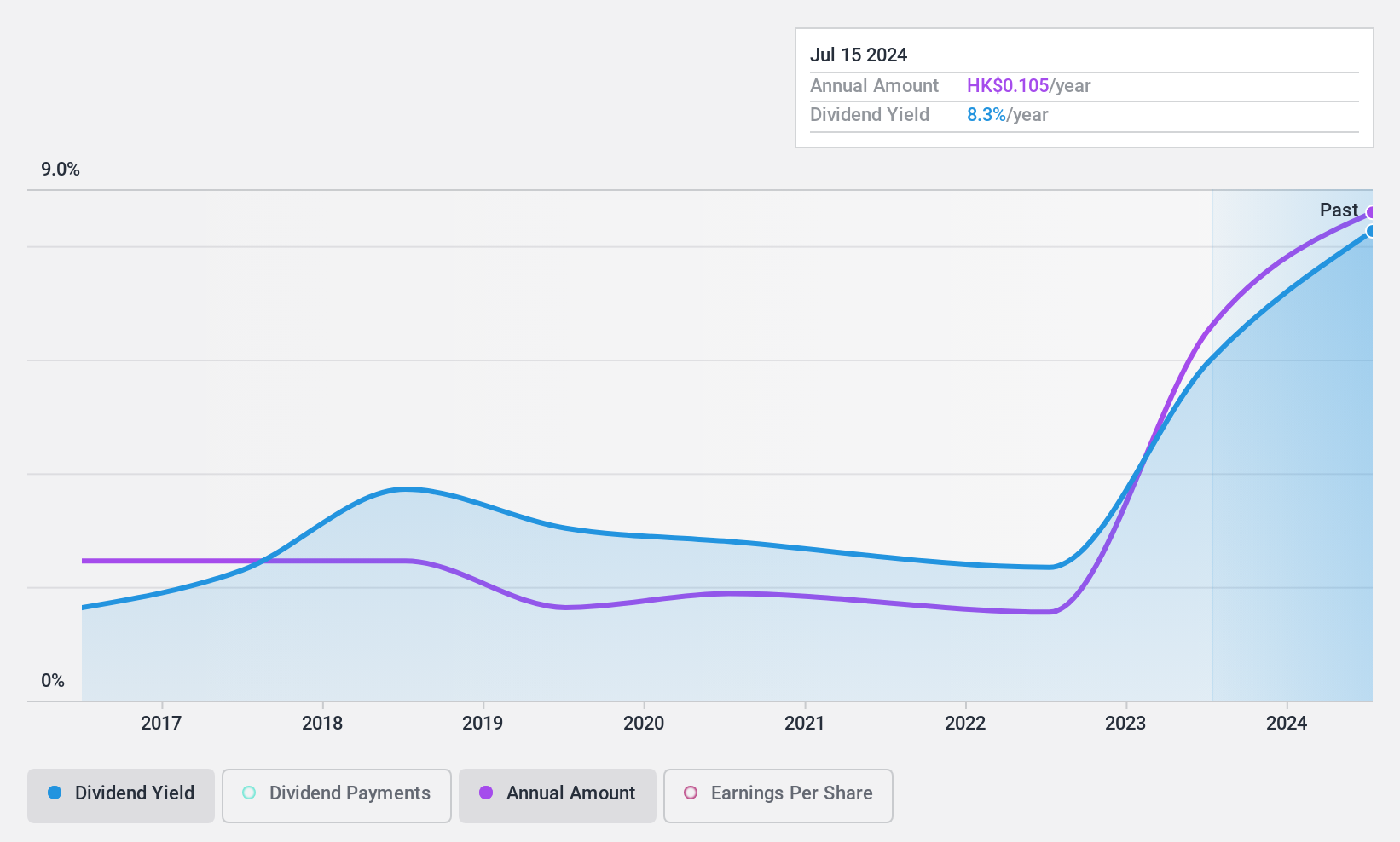

China Electronics Huada Technology's dividend payments are supported by a low payout ratio of 48.1%, indicating coverage by both earnings and cash flows. However, its dividends have been unreliable over the past decade, with volatility in payment amounts. Recent interim results showed a decline in sales to HK$1.36 billion and net income to HK$309.55 million, impacting profit margins negatively compared to last year. Leadership changes may influence future strategic directions and dividend stability.

- Navigate through the intricacies of China Electronics Huada Technology with our comprehensive dividend report here.

- Our valuation report here indicates China Electronics Huada Technology may be overvalued.

Zhongsheng Group Holdings (SEHK:881)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Zhongsheng Group Holdings Limited is an investment holding company that operates in the sale and service of motor vehicles in the People’s Republic of China, with a market cap of HK$29.35 billion.

Operations: Zhongsheng Group Holdings Limited generates its revenue primarily from the sale of motor vehicles and the provision of related services, amounting to CN¥179.81 billion.

Dividend Yield: 6.3%

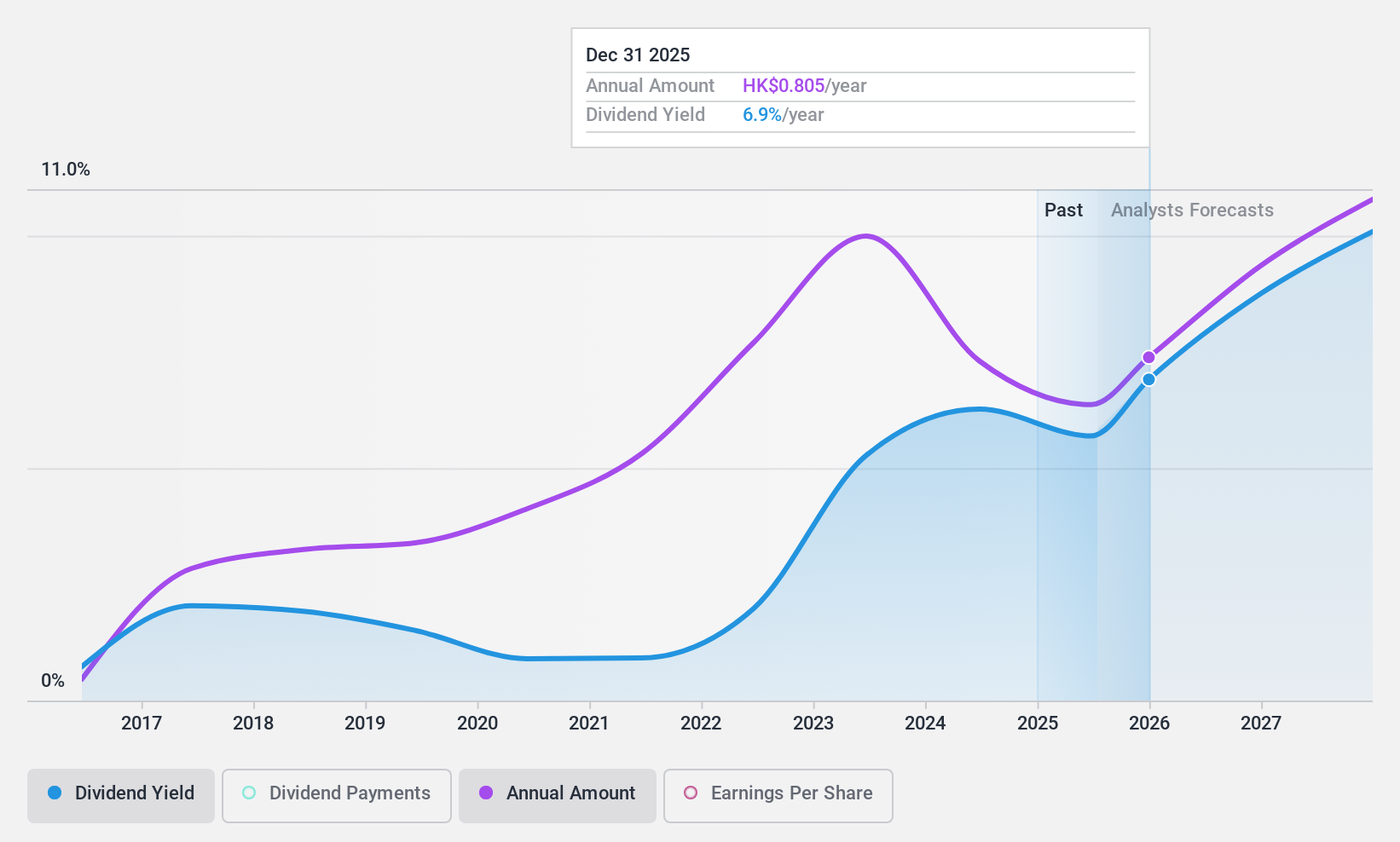

Zhongsheng Group Holdings' dividends are covered by earnings and cash flows, with payout ratios of 49% and 51.6%, respectively, but have been volatile over the past decade. Recent financial results show a decline in net income to CNY 1.58 billion from CNY 3 billion a year ago, affecting profit margins. The company secured a USD 350 million loan to refinance existing debt, which may help reduce borrowing costs and support financial stability.

- Click to explore a detailed breakdown of our findings in Zhongsheng Group Holdings' dividend report.

- According our valuation report, there's an indication that Zhongsheng Group Holdings' share price might be on the cheaper side.

Key Takeaways

- Get an in-depth perspective on all 89 Top SEHK Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet average dividend payer.