- Hong Kong

- /

- Hospitality

- /

- SEHK:341

Café de Coral Holdings (HKG:341) Will Pay A Larger Dividend Than Last Year At HK$0.42

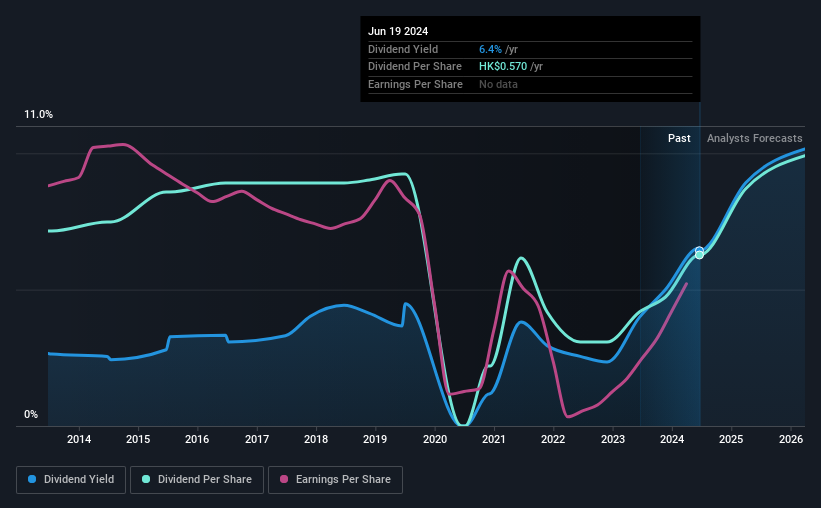

The board of Café de Coral Holdings Limited (HKG:341) has announced that it will be paying its dividend of HK$0.42 on the 24th of September, an increased payment from last year's comparable dividend. This will take the annual payment to 6.4% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Café de Coral Holdings

Café de Coral Holdings' Dividend Is Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Based on the last payment, Café de Coral Holdings' profits didn't cover the dividend, but the company was generating enough cash instead. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

The next year is set to see EPS grow by 59.9%. If the dividend continues along recent trends, we estimate the payout ratio will be 58%, which would make us comfortable with the sustainability of the dividend, despite the levels currently being quite high.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. Since 2014, the annual payment back then was HK$0.65, compared to the most recent full-year payment of HK$0.57. This works out to be a decline of approximately 1.3% per year over that time. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

Dividend Growth Potential Is Shaky

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Café de Coral Holdings' EPS has declined at around 10% a year. Dividend payments are likely to come under some pressure unless EPS can pull out of the nosedive it is in. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this becomes a long term trend.

The Dividend Could Prove To Be Unreliable

In summary, while it's always good to see the dividend being raised, we don't think Café de Coral Holdings' payments are rock solid. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 1 warning sign for Café de Coral Holdings that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:341

Café de Coral Holdings

An investment holding company, engages in the operation of quick service restaurants and casual dining chains in Hong Kong and Mainland China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026