The Cross-Harbour (Holdings) Limited's (HKG:32) investors are due to receive a payment of HK$0.06 per share on 23rd of December. Based on this payment, the dividend yield will be 3.8%, which is fairly typical for the industry.

Our analysis indicates that 32 is potentially overvalued!

Cross-Harbour (Holdings)'s Distributions May Be Difficult To Sustain

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. Cross-Harbour (Holdings) isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Recent, EPS has fallen by 27.2%, so this could continue over the next year. This means the company will be unprofitable and managers could face the tough choice between continuing to pay the dividend or taking pressure off the balance sheet.

Cross-Harbour (Holdings) Has A Solid Track Record

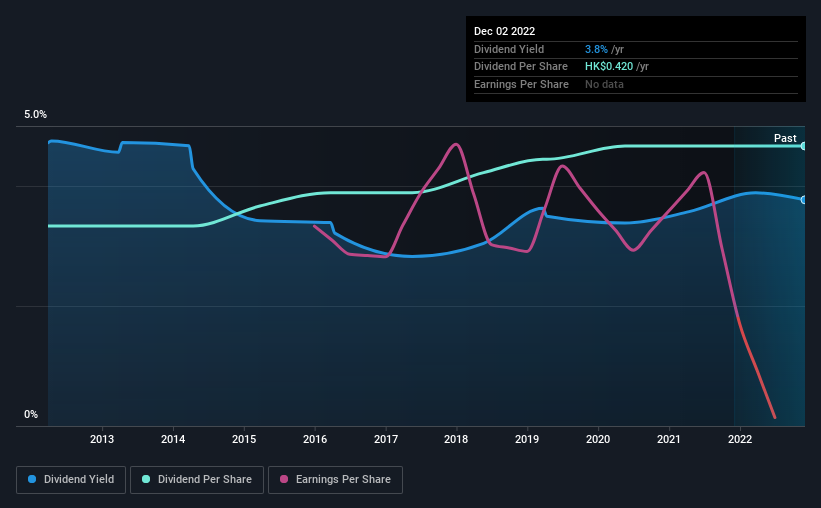

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of HK$0.30 in 2012 to the most recent total annual payment of HK$0.42. This means that it has been growing its distributions at 3.4% per annum over that time. Slow and steady dividend growth might not sound that exciting, but dividends have been stable for ten years, which we think makes this a fairly attractive offer.

Dividend Growth Potential Is Shaky

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Cross-Harbour (Holdings)'s EPS has fallen by approximately 27% per year during the past five years. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

Cross-Harbour (Holdings)'s Dividend Doesn't Look Sustainable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. Although they have been consistent in the past, we think the payments are a little high to be sustained. This company is not in the top tier of income providing stocks.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Taking the debate a bit further, we've identified 3 warning signs for Cross-Harbour (Holdings) that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:32

Cross-Harbour (Holdings)

An investment holding company, engages in motoring school operation, treasury management, securities investment, and electronic toll operation businesses in Hong Kong.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success