- Hong Kong

- /

- Consumer Services

- /

- SEHK:2469

3 Asian Penny Stocks With Market Cap Of US$900M To Consider

Reviewed by Simply Wall St

As global markets experience mixed performances, with some regions hitting record highs and others facing challenges, investors are increasingly looking to diversify their portfolios. Penny stocks, typically smaller or newer companies, offer a unique opportunity for those willing to explore beyond the well-known names. Despite being an outdated term, penny stocks remain relevant by presenting growth potential at lower price points when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.102 | SGD43.35M | ✅ 2 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.36 | HK$858.09M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.17 | HK$1.81B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.425 | SGD172.25M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.13 | HK$1.89B | ✅ 4 ⚠️ 1 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.44 | THB2.66B | ✅ 3 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.28 | SGD8.97B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.93 | THB1.37B | ✅ 2 ⚠️ 2 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.235 | SGD47.52M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.30 | SGD905.36M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 988 stocks from our Asian Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Fenbi (SEHK:2469)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fenbi Ltd. is an investment holding company offering non-formal vocational education and training services in the People’s Republic of China, with a market cap of HK$6.28 billion.

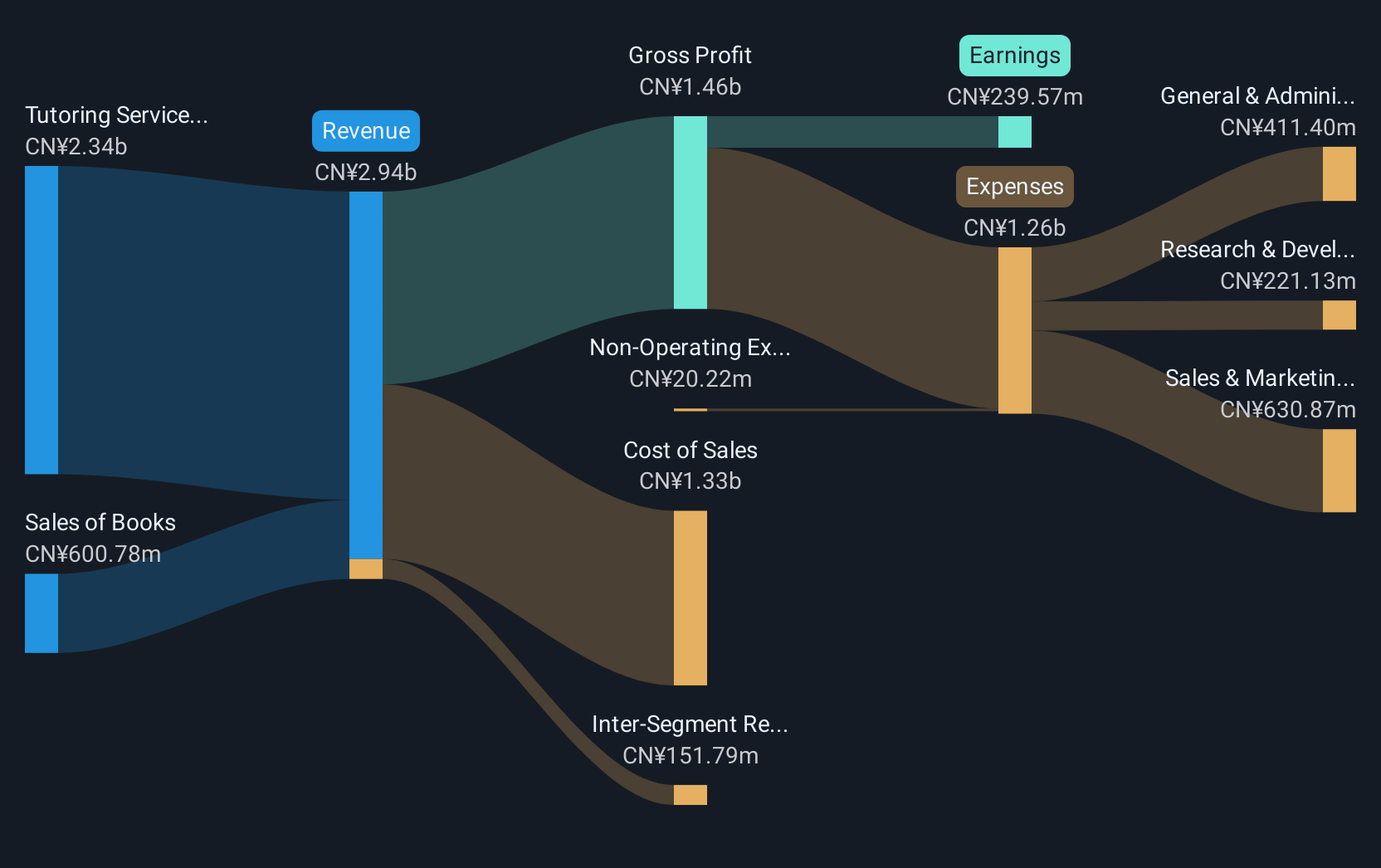

Operations: The company generates revenue primarily through tutoring services, which account for CN¥2.34 billion, and sales of books totaling CN¥600.78 million.

Market Cap: HK$6.28B

Fenbi Ltd., an investment holding company in China, has demonstrated strong financial performance with earnings growth of 27% over the past year, surpassing its five-year average. The company's revenue streams from tutoring services and book sales contribute significantly to its CN¥2.94 billion revenue. Despite having a relatively inexperienced board with an average tenure of 2.5 years, Fenbi maintains a solid financial position with no debt and sufficient short-term assets to cover liabilities. Recent developments include the resignation of non-executive Director Mr. Li Xin and the expiration of a buyback plan in May 2025.

- Navigate through the intricacies of Fenbi with our comprehensive balance sheet health report here.

- Examine Fenbi's earnings growth report to understand how analysts expect it to perform.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, and the United Kingdom, with a market cap of HK$6.60 billion.

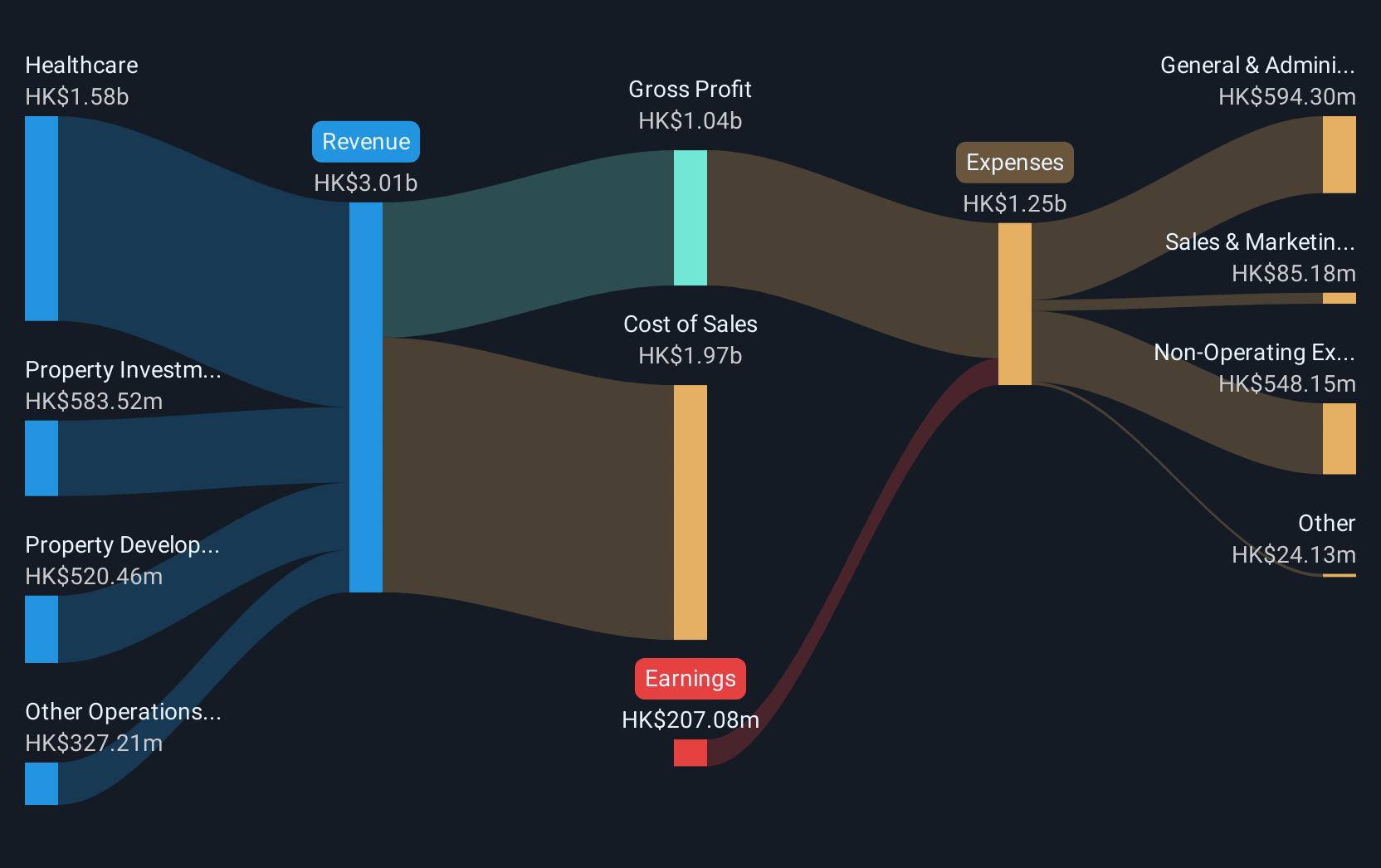

Operations: The company's revenue segments include Healthcare generating HK$1.58 billion, Property Investment contributing HK$583.52 million, and Property Development adding HK$520.46 million.

Market Cap: HK$6.6B

Tian An China Investments is currently unprofitable, with earnings declining by 3.6% annually over the past five years. Despite this, its management and board are highly experienced, averaging tenures of 6.5 and 20.8 years respectively. The company has a robust financial structure, with short-term assets of HK$24.9 billion exceeding both short- and long-term liabilities, while cash reserves surpass total debt levels. Operating cash flow effectively covers its debt obligations at 52.5%. Trading significantly below estimated fair value suggests potential for future appreciation if profitability improves amidst stable weekly volatility of 4%.

- Click here to discover the nuances of Tian An China Investments with our detailed analytical financial health report.

- Explore historical data to track Tian An China Investments' performance over time in our past results report.

Far East Hospitality Trust (SGX:Q5T)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Far East Hospitality Trust is a Singapore-focused hotel and serviced residence hospitality trust listed on the Main Board of the Singapore Exchange, with a market cap of SGD1.17 billion.

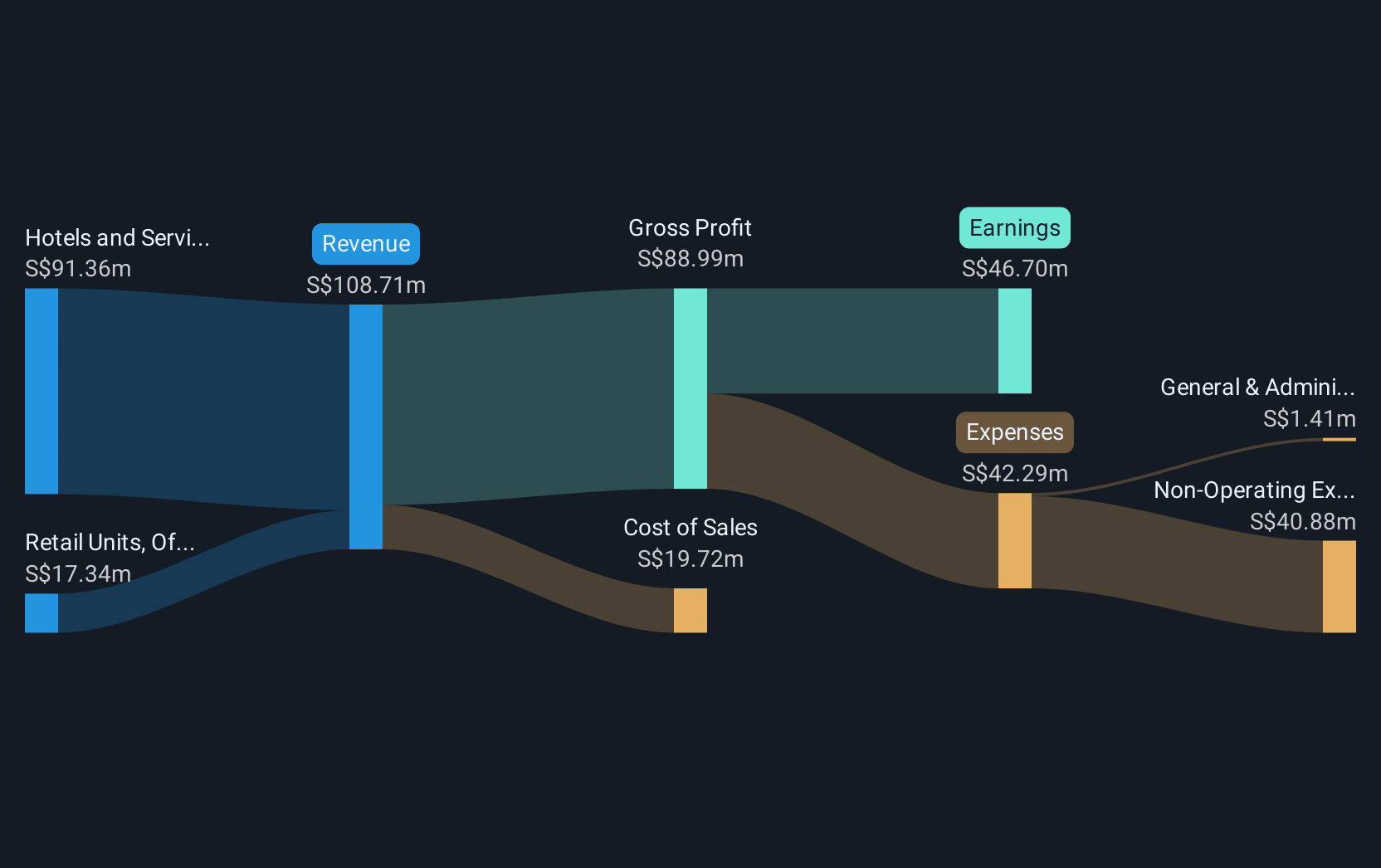

Operations: The trust generates revenue primarily from its Hotels and Serviced Residences segment, amounting to SGD91.36 million, and from Retail Units, Offices and Others, which contribute SGD17.34 million.

Market Cap: SGD1.17B

Far East Hospitality Trust, a Singapore-focused hospitality trust, maintains a satisfactory net debt to equity ratio of 37.7% and covers its interest payments well with EBIT at 3.5 times coverage. Despite stable weekly volatility at 3%, the trust's earnings have faced challenges, showing negative growth over the past year and lower profit margins compared to previous periods. Short-term assets of SGD67.9 million exceed short-term liabilities but fall short against long-term liabilities of SGD724.7 million. Trading below estimated fair value indicates potential for appreciation if earnings forecasts materialize amidst an experienced management team averaging 3.9 years in tenure.

- Unlock comprehensive insights into our analysis of Far East Hospitality Trust stock in this financial health report.

- Learn about Far East Hospitality Trust's future growth trajectory here.

Make It Happen

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 985 more companies for you to explore.Click here to unveil our expertly curated list of 988 Asian Penny Stocks.

- Contemplating Other Strategies? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2469

Fenbi

An investment holding company, provides non-formal vocational education and training services in the People’s Republic of China.

Flawless balance sheet with moderate growth potential.

Market Insights

Community Narratives