- Hong Kong

- /

- Hospitality

- /

- SEHK:2255

Despite currently being unprofitable, Haichang Ocean Park Holdings (HKG:2255) has delivered a 64% return to shareholders over 5 years

It might be of some concern to shareholders to see the Haichang Ocean Park Holdings Ltd. (HKG:2255) share price down 14% in the last month. On the bright side the returns have been quite good over the last half decade. Its return of 64% has certainly bested the market return! Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 31% decline over the last twelve months.

Although Haichang Ocean Park Holdings has shed HK$730m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

View our latest analysis for Haichang Ocean Park Holdings

Because Haichang Ocean Park Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Haichang Ocean Park Holdings saw its revenue shrink by 10% per year. Even though revenue hasn't increased, the stock actually gained 10%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

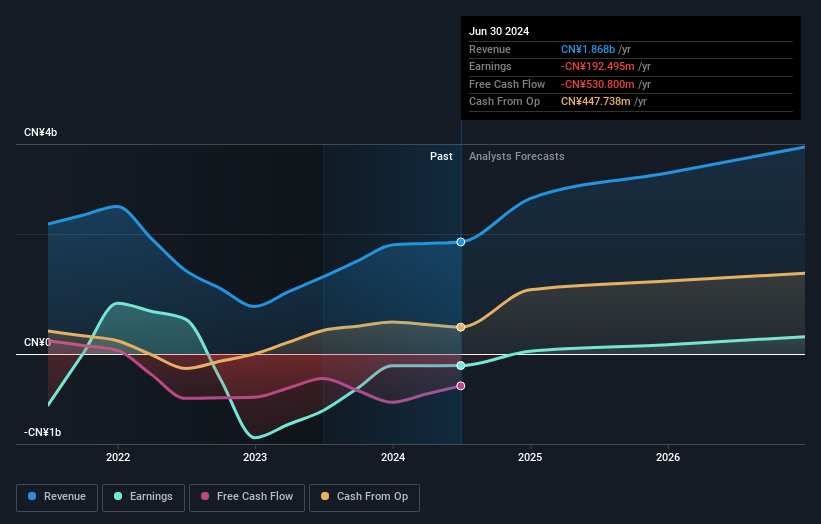

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

While the broader market gained around 23% in the last year, Haichang Ocean Park Holdings shareholders lost 31%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 10% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Haichang Ocean Park Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2255

Haichang Ocean Park Holdings

Develops, constructs, and operates theme parks and ancillary commercial properties in the People’s Republic of China.

High growth potential with imperfect balance sheet.

Market Insights

Community Narratives