- Hong Kong

- /

- Consumer Services

- /

- SEHK:2001

China New Higher Education Group Limited (HKG:2001) Held Back By Insufficient Growth Even After Shares Climb 28%

The China New Higher Education Group Limited (HKG:2001) share price has done very well over the last month, posting an excellent gain of 28%. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

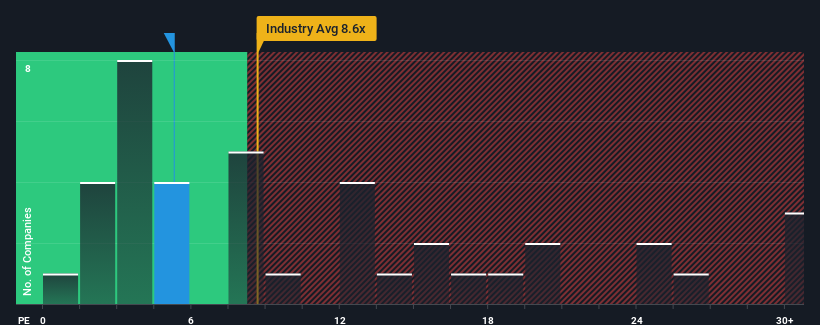

Even after such a large jump in price, China New Higher Education Group may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 5.3x, since almost half of all companies in Hong Kong have P/E ratios greater than 9x and even P/E's higher than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, China New Higher Education Group has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for China New Higher Education Group

Is There Any Growth For China New Higher Education Group?

The only time you'd be truly comfortable seeing a P/E as low as China New Higher Education Group's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a decent 14% gain to the company's bottom line. Pleasingly, EPS has also lifted 166% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 10% per annum over the next three years. With the market predicted to deliver 16% growth per year, the company is positioned for a weaker earnings result.

With this information, we can see why China New Higher Education Group is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On China New Higher Education Group's P/E

Despite China New Higher Education Group's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that China New Higher Education Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You always need to take note of risks, for example - China New Higher Education Group has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on China New Higher Education Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2001

China New Higher Education Group

An investment holding company, provides private education services in the People's Republic of China.

Undervalued with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026