- Hong Kong

- /

- Hospitality

- /

- SEHK:200

Melco International Development (HKG:200) Has A Somewhat Strained Balance Sheet

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Melco International Development Limited (HKG:200) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Melco International Development

What Is Melco International Development's Net Debt?

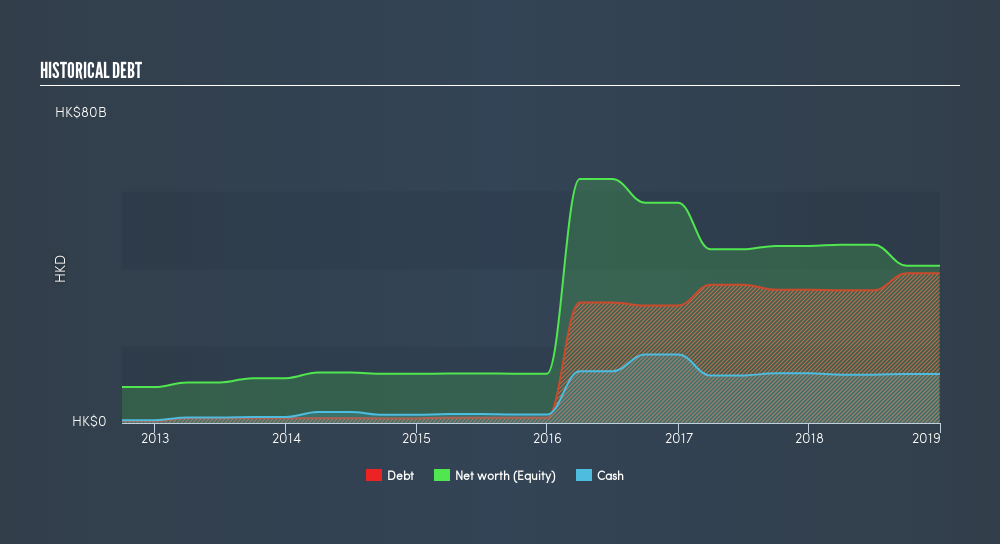

You can click the graphic below for the historical numbers, but it shows that as of December 2018 Melco International Development had HK$41.1b of debt, an increase on HK$36.8b, over one year. However, it does have HK$12.7b in cash offsetting this, leading to net debt of about HK$28.4b.

How Healthy Is Melco International Development's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Melco International Development had liabilities of HK$17.4b due within 12 months and liabilities of HK$39.9b due beyond that. Offsetting these obligations, it had cash of HK$12.7b as well as receivables valued at HK$2.15b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by HK$42.5b.

Given this deficit is actually higher than the company's market capitalization of HK$30.6b, we think shareholders really should watch Melco International Development's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

While we wouldn't blink an eye at Melco International Development's net debt to EBITDA ratio of 3.1, we think its super-low interest cover of 1.7 times is a bad sign. It seems that the business incurs large depreciation and amortisation charges, so maybe its debt load is heavier than it would first appear, since EBITDA is arguably a generous measure of earnings. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. On a slightly more positive note, Melco International Development grew its EBIT at 12% over the last year, further increasing its ability to manage debt. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Melco International Development can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Melco International Development actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

Melco International Development's interest cover and level of total liabilities definitely weigh on it, in our esteem. But the good news is it seems to be able to convert EBIT to free cash flow with ease. Taking the abovementioned factors together we do think Melco International Development's debt poses some risks to the business. While that debt can boost returns, we think the company has enough leverage now. In light of our reservations about the company's balance sheet, it seems sensible to check if insiders have been selling shares recently.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:200

Melco International Development

An investment holding company, engages in the leisure and entertainment business in Macau, the Philippines, and Cyprus.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026