- Hong Kong

- /

- Consumer Services

- /

- SEHK:1830

Perfect Medical (SEHK:1830) Net Profit Margin Drops to 16.2%, Challenging Turnaround Expectations

Reviewed by Simply Wall St

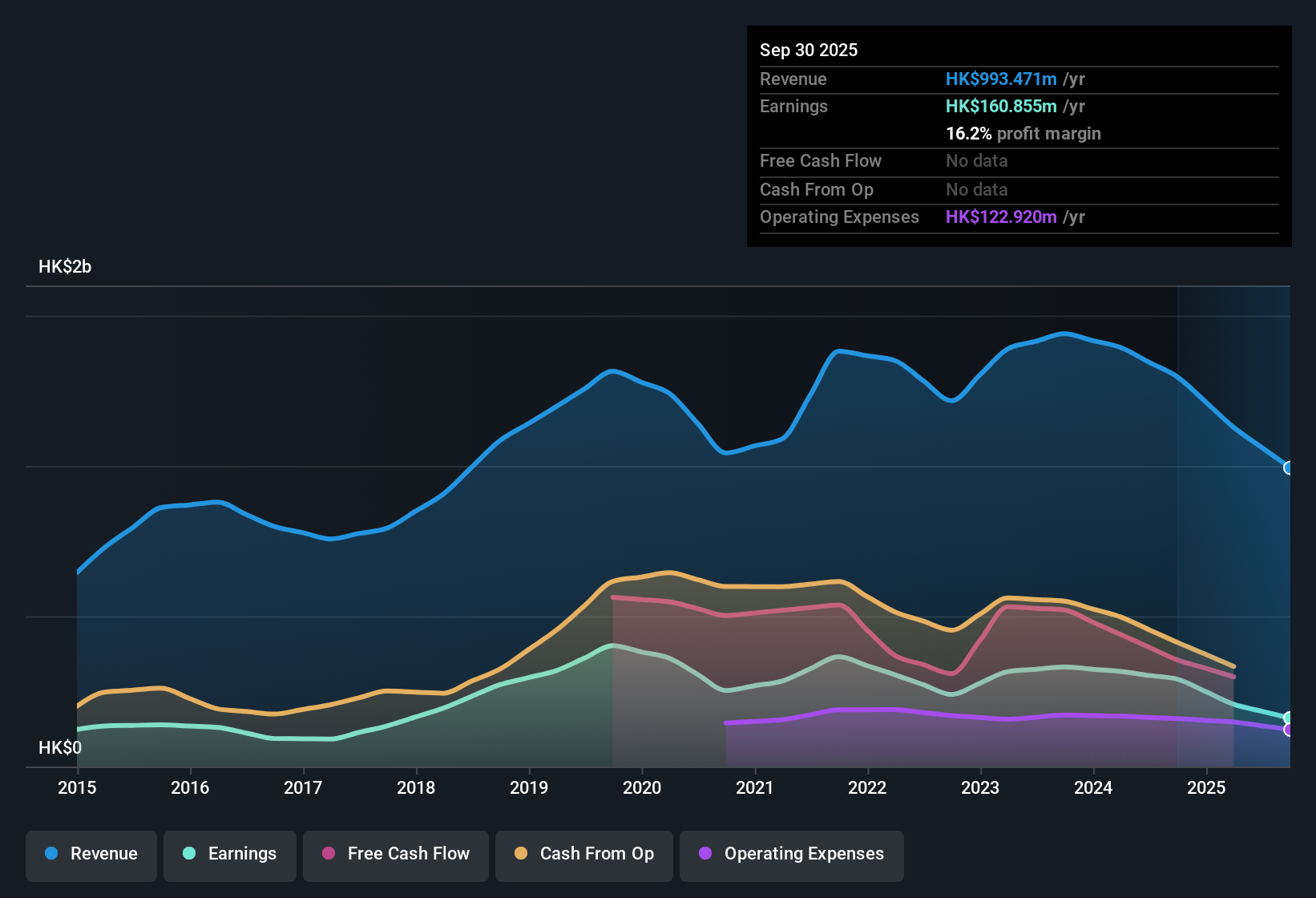

Perfect Medical Health Management (SEHK:1830) just posted its first-half 2026 results, booking revenue of HK$994.2 million and net income of HK$160.9 million, with basic EPS at HK$0.128 for the period. The company has seen revenue move from HK$675.2 million in H2 2024 to HK$620.3 million in H1 2025, and then HK$507.6 million in H2 2025, accompanied by basic EPS figures of HK$0.119, HK$0.112, and HK$0.053 over those periods, respectively. Margins have compressed, setting a cautious tone for investors as they weigh current results against the backdrop of recent earnings declines.

See our full analysis for Perfect Medical Health Management.The numbers are in, but the real insight comes from comparing them with the widely followed narratives and market expectations. Let’s see where the figures match up with prevailing views and where they might shake up the story.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Drops to 16.2% From 22.4%

- Net profit margin slipped from 22.4% to 16.2% over the past year, despite trailing twelve months net income reaching HK$160.9 million.

- The AI-generated narrative notes this margin pressure highlights ongoing competition and operational challenges. The company’s broad service offering across medical and beauty treatments positions it to capture diverse revenue streams.

- The drop in profit margins contrasts with management’s push to expand higher-margin services in multiple Asian markets.

- Some investors may point to the company’s resilient geographic footprint. However, the margin contraction indicates the level of discipline needed to sustain profits as regional rivals scale up.

Trading at a 79% Discount to DCF Fair Value

- The current share price of HK$1.40 is 79.1% below its estimated DCF fair value of HK$6.69. The stock’s P/E ratio (10.9x) is notably lower than the peer average of 58x and above the consumer services industry average of 7.3x.

- The prevailing outlook finds that this steep discount attracts value-oriented attention, particularly as the company is expected to outpace the Hong Kong market with earnings projected to expand 23.18% annually.

- Despite the discount, past profit declines and an unstable dividend record present caution for investors, highlighting that multiple valuation signals should be considered alongside core performance.

- The valuation gap may close if management delivers on growth forecasts. However, margin slippage remains a key reason investors have been hesitant.

Earnings Forecasts Outpace Market Even After 5-Year Decline

- Although earnings averaged a decline of 5.6% per year over the last five years, Perfect Medical Health Management’s future earnings are forecast to grow 23.18% annually and revenue growth is projected at 10.1% per year, both well above the Hong Kong sector average.

- This view highlights how the expectation of a sharp turnaround contrasts with recent declines and will test whether the company’s brand longevity can deliver on high expectations for market outperformance.

- Investors monitoring potential upside will watch for evidence that new service lines and geographic expansion translate into sustained revenue and profit growth.

- The contrast between recent declines and optimistic forecasts may drive near-term volatility, even as the company’s diversification supports its growth outlook.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Perfect Medical Health Management's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite future growth projections, the company’s declining margins and inconsistent profit trends create uncertainty regarding its ability to deliver steady earnings performance.

If stable results are your priority, discover stable growth stocks screener (2075 results) to uncover companies that consistently grow revenue and earnings year after year, minimizing surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1830

Perfect Medical Health Management

An investment holding company, engages in the provision of medical, aesthetic medical, and beauty and wellness services in Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.