- Hong Kong

- /

- Consumer Services

- /

- SEHK:1830

Perfect Medical Health Management And 2 Other Penny Stocks To Watch Closely

Reviewed by Simply Wall St

Global markets faced a challenging week, with U.S. stocks ending lower due to tariff uncertainties and mixed economic data, while European indices showed resilience despite trade policy concerns. In such fluctuating market conditions, investors often seek opportunities in undervalued areas like penny stocks—an investment category that remains relevant for those looking to capitalize on potential growth at lower price points. While the term "penny stock" might seem outdated, these smaller or newer companies can offer significant upside when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.83 | HK$44.43B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$723.66M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.93 | £148.21M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.95M | ★★★★☆☆ |

| Warpaint London (AIM:W7L) | £4.00 | £322.74M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.26 | £161.24M | ★★★★★☆ |

Click here to see the full list of 5,706 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Perfect Medical Health Management (SEHK:1830)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Perfect Medical Health Management Limited is an investment holding company that provides medical, aesthetic medical, and beauty services across Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore with a market cap of HK$2.61 billion.

Operations: The company generates HK$1.30 billion in revenue from its medical, aesthetic medical, and beauty and wellness services.

Market Cap: HK$2.61B

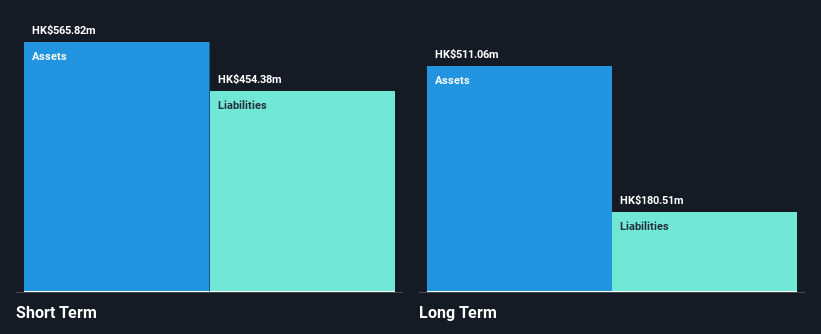

Perfect Medical Health Management, with a market cap of HK$2.61 billion, operates across multiple regions offering medical and beauty services. Despite a decline in half-year sales to HK$620.27 million and net income to HK$140.84 million, the company maintains strong financial health with no debt and sufficient short-term assets to cover liabilities. It faces challenges with declining profit margins and unsustainable dividend coverage from earnings or cash flow but benefits from high-quality past earnings and a seasoned management team averaging 13.9 years in tenure. The stock trades significantly below estimated fair value, presenting potential opportunities for investors mindful of volatility risks.

- Dive into the specifics of Perfect Medical Health Management here with our thorough balance sheet health report.

- Understand Perfect Medical Health Management's earnings outlook by examining our growth report.

RH PetroGas (SGX:T13)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RH PetroGas Limited is an investment holding company focused on the exploration, development, and production of oil and gas resources in Indonesia with a market cap of SGD142.82 million.

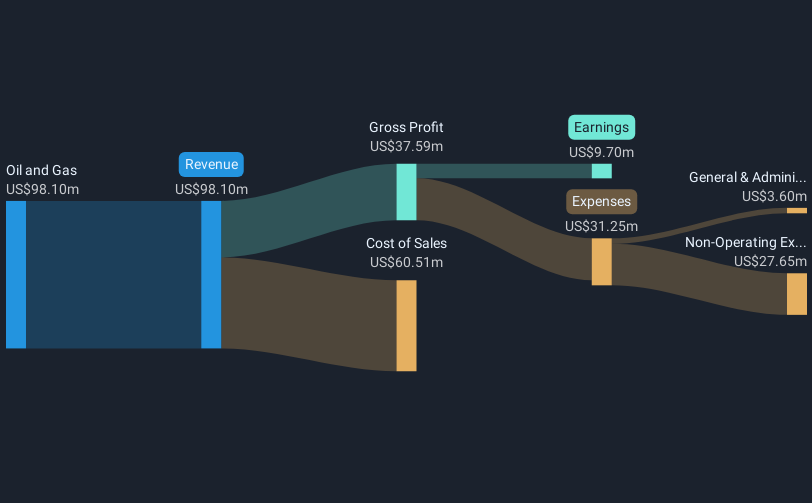

Operations: The company generates revenue of $98.10 million from its oil and gas operations.

Market Cap: SGD142.82M

RH PetroGas, with a market cap of SGD142.82 million, has shown robust financial performance in recent quarters, reporting a net income increase to USD 10.46 million for the nine months ending September 2024. Despite a large one-off loss impacting its results, the company remains debt-free and maintains stable weekly volatility at 4%. The management team is seasoned with an average tenure of 12.1 years, though the board's experience is limited with an average tenure of 2.3 years. Trading significantly below estimated fair value, RH PetroGas presents potential opportunities amidst forecasted earnings declines over the next three years.

- Navigate through the intricacies of RH PetroGas with our comprehensive balance sheet health report here.

- Examine RH PetroGas' earnings growth report to understand how analysts expect it to perform.

Topscore Fashion (SHSE:603608)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Topscore Fashion Co., Ltd. operates in the fashion shoes and apparel sector, as well as mobile Internet marketing in China, with a market cap of CN¥1.41 billion.

Operations: The company's revenue segment includes CN¥1.13 billion from its operations in China.

Market Cap: CN¥1.41B

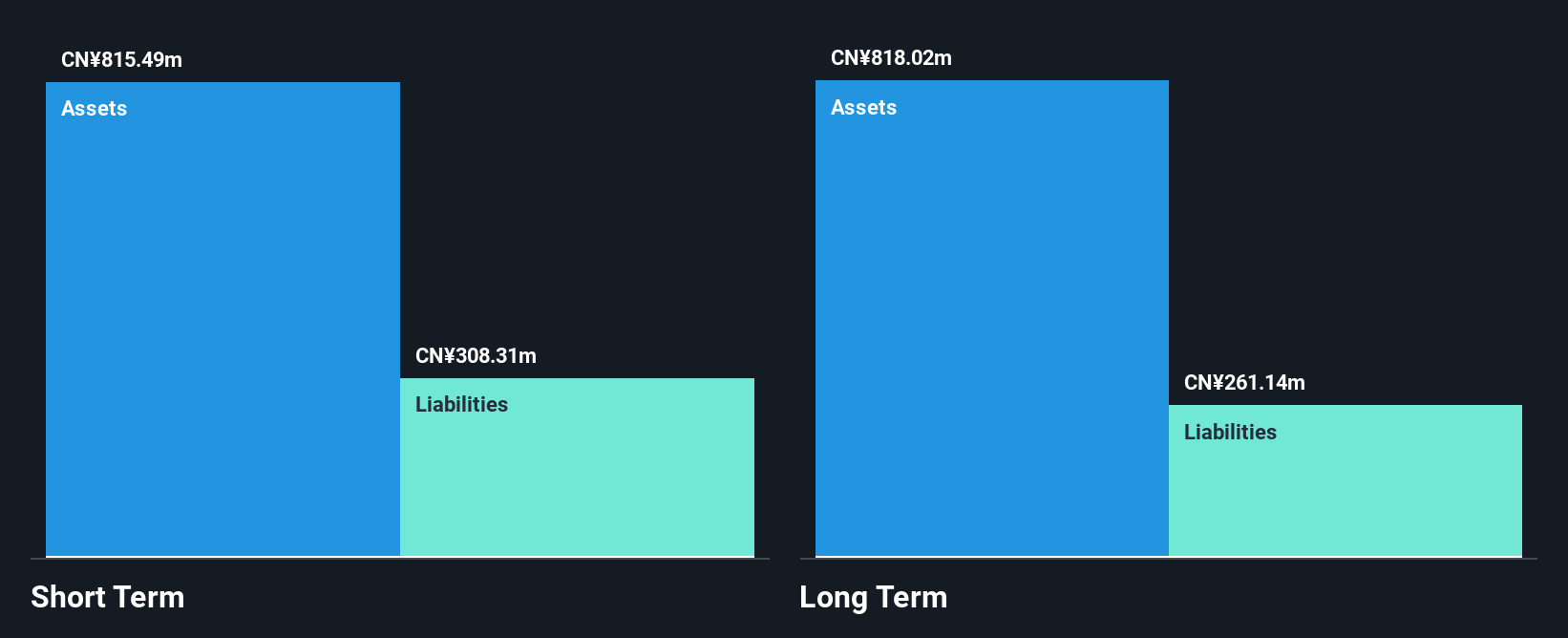

Topscore Fashion Co., Ltd. has a market cap of CN¥1.41 billion and operates primarily in the fashion and mobile Internet marketing sectors in China, generating CN¥1.13 billion in revenue domestically. Despite being unprofitable with a negative return on equity of -3.55%, the company is trading at 46.1% below its estimated fair value, indicating potential undervaluation for investors seeking opportunities within penny stocks. The company's short-term assets significantly exceed both its short-term and long-term liabilities, suggesting solid liquidity management, while its debt level is well covered by operating cash flow despite an increase in debt-to-equity ratio over five years.

- Click to explore a detailed breakdown of our findings in Topscore Fashion's financial health report.

- Assess Topscore Fashion's previous results with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Penny Stocks list of 5,706 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1830

Perfect Medical Health Management

An investment holding company, engages in the provision of medical, aesthetic medical, and beauty and well services in Hong Kong, the People’s Republic of China, Macau, Australia, and Singapore.

Flawless balance sheet and good value.

Market Insights

Community Narratives