- Hong Kong

- /

- Consumer Services

- /

- SEHK:1769

Here's Why We Think Scholar Education Group (HKG:1769) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Scholar Education Group (HKG:1769). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Scholar Education Group

How Fast Is Scholar Education Group Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. It certainly is nice to see that Scholar Education Group has managed to grow EPS by 21% per year over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

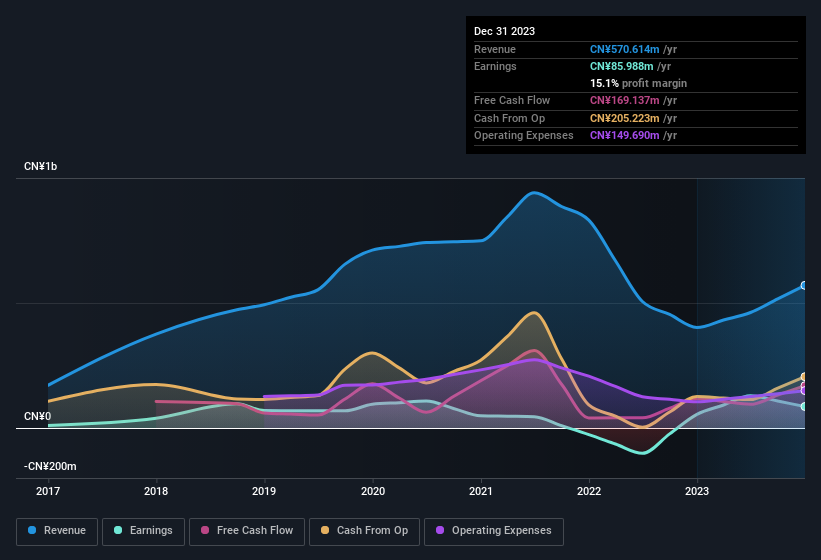

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Scholar Education Group shareholders is that EBIT margins have grown from 11% to 17% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Scholar Education Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

With strong conviction, Scholar Education Group insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Executive Chairman of the Board, Qiyuan Chen, paid CN¥1.0m to buy shares at an average price of CN¥2.76. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

On top of the insider buying, we can also see that Scholar Education Group insiders own a large chunk of the company. In fact, they own 42% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. With that sort of holding, insiders have about CN¥1.2b riding on the stock, at current prices. So there's plenty there to keep them focused!

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Mingzhi Qi, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Scholar Education Group, with market caps between CN¥1.4b and CN¥5.8b, is around CN¥2.8m.

The CEO of Scholar Education Group only received CN¥525k in total compensation for the year ending December 2023. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Scholar Education Group Worth Keeping An Eye On?

You can't deny that Scholar Education Group has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant piece of the pie when it comes to the company's stock, and one has been buying more. Astute investors will want to keep this stock on watch. Before you take the next step you should know about the 2 warning signs for Scholar Education Group (1 makes us a bit uncomfortable!) that we have uncovered.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Scholar Education Group, you'll probably love this curated collection of companies in HK that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1769

Scholar Education Group

An investment holding company, engages in the provision of private education services in the People’s Republic of China and Hong Kong.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives