- Hong Kong

- /

- Consumer Services

- /

- SEHK:1765

With EPS Growth And More, Hope Education Group (HKG:1765) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Hope Education Group (HKG:1765). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

Check out our latest analysis for Hope Education Group

How Fast Is Hope Education Group Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. It's no surprise, then, that I like to invest in companies with EPS growth. As a tree reaches steadily for the sky, Hope Education Group's EPS has grown 26% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

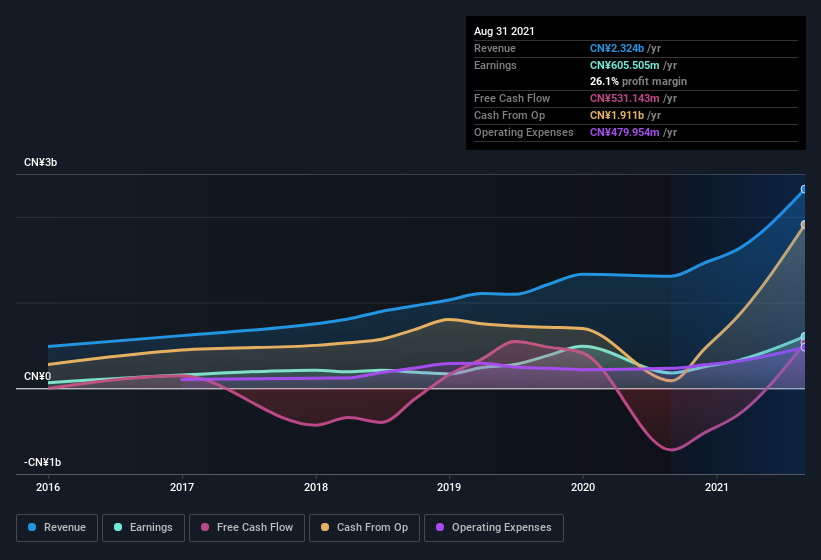

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Hope Education Group shareholders can take confidence from the fact that EBIT margins are up from 26% to 30%, and revenue is growing. Ticking those two boxes is a good sign of growth, in my book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. To that end, right now and today, you can check our visualization of consensus analyst forecasts for future Hope Education Group EPS 100% free.

Are Hope Education Group Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One shining light for Hope Education Group is the serious outlay one insider has made to buy shares, in the last year. Specifically, in one large transaction CEO, President & Executive Director Huiwu Wang paid HK$4.7m, for stock at HK$2.37 per share. It doesn't get much better than that, in terms of large investments from insiders.

I do like that insiders have been buying shares in Hope Education Group, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between CN¥6.4b and CN¥20b, like Hope Education Group, the median CEO pay is around CN¥3.3m.

The CEO of Hope Education Group only received CN¥936k in total compensation for the year ending . That's clearly well below average, so at a glance, that arrangement seems generous to shareholders, and points to a modest remuneration culture. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Hope Education Group To Your Watchlist?

For growth investors like me, Hope Education Group's raw rate of earnings growth is a beacon in the night. But wait, it gets better. We have seen insider buying and the executive pay seems on the modest side of things. On balance the message seems to be that this stock is worth looking at, at least for a while. You still need to take note of risks, for example - Hope Education Group has 4 warning signs we think you should be aware of.

As a growth investor I do like to see insider buying. But Hope Education Group isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1765

XJ International Holdings

An investment holding company, engages in the provision of higher education and secondary vocational education services in China and Malaysia.

Solid track record and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success