- Hong Kong

- /

- Hospitality

- /

- SEHK:1655

The Market Doesn't Like What It Sees From Okura Holdings Limited's (HKG:1655) Revenues Yet As Shares Tumble 28%

Okura Holdings Limited (HKG:1655) shares have had a horrible month, losing 28% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 73% loss during that time.

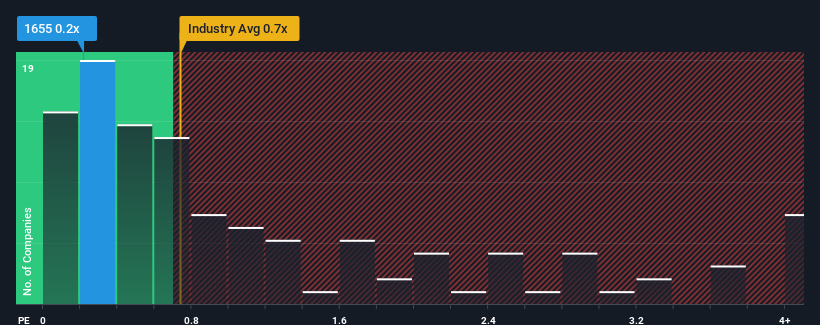

After such a large drop in price, it would be understandable if you think Okura Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.2x, considering almost half the companies in Hong Kong's Hospitality industry have P/S ratios above 0.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Okura Holdings

What Does Okura Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for Okura Holdings, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If that doesn't eventuate, then existing shareholders may have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Okura Holdings will help you shine a light on its historical performance.How Is Okura Holdings' Revenue Growth Trending?

Okura Holdings' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 3.2%. The solid recent performance means it was also able to grow revenue by 20% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 15% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Okura Holdings' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Okura Holdings' P/S

Okura Holdings' recently weak share price has pulled its P/S back below other Hospitality companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Okura Holdings confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Okura Holdings (including 1 which is a bit concerning).

If you're unsure about the strength of Okura Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1655

Okura Holdings

An investment holding company, operates pachinko and pachislot halls in Japan.

Good value with adequate balance sheet.

Market Insights

Community Narratives