- Hong Kong

- /

- Consumer Services

- /

- SEHK:1593

We Think Chen Lin Education Group Holdings (HKG:1593) Is Taking Some Risk With Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Chen Lin Education Group Holdings Limited (HKG:1593) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Chen Lin Education Group Holdings

What Is Chen Lin Education Group Holdings's Debt?

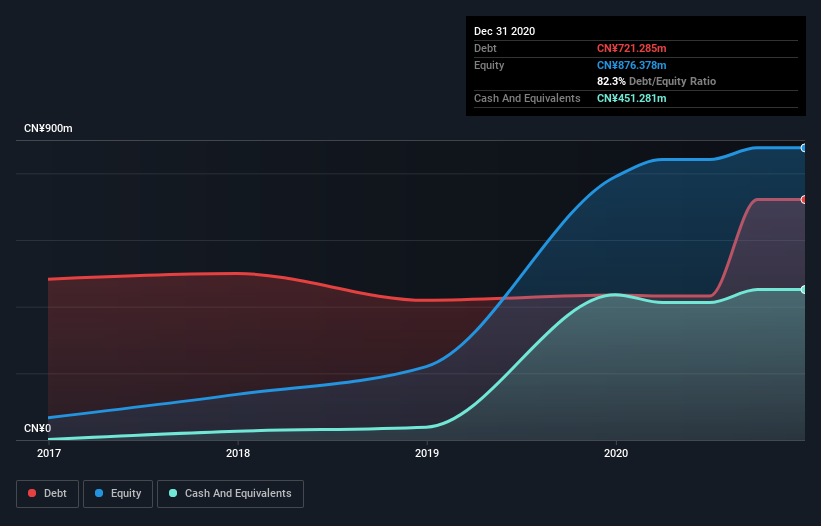

You can click the graphic below for the historical numbers, but it shows that as of December 2020 Chen Lin Education Group Holdings had CN¥721.3m of debt, an increase on CN¥435.1m, over one year. However, it also had CN¥451.3m in cash, and so its net debt is CN¥270.0m.

A Look At Chen Lin Education Group Holdings' Liabilities

The latest balance sheet data shows that Chen Lin Education Group Holdings had liabilities of CN¥585.7m due within a year, and liabilities of CN¥554.5m falling due after that. Offsetting these obligations, it had cash of CN¥451.3m as well as receivables valued at CN¥39.4m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥649.5m.

Chen Lin Education Group Holdings has a market capitalization of CN¥1.90b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Chen Lin Education Group Holdings's net debt is sitting at a very reasonable 1.9 times its EBITDA, while its EBIT covered its interest expense just 5.9 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. Unfortunately, Chen Lin Education Group Holdings's EBIT flopped 14% over the last four quarters. If that sort of decline is not arrested, then the managing its debt will be harder than selling broccoli flavoured ice-cream for a premium. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Chen Lin Education Group Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Chen Lin Education Group Holdings created free cash flow amounting to 10% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Our View

To be frank both Chen Lin Education Group Holdings's conversion of EBIT to free cash flow and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. Once we consider all the factors above, together, it seems to us that Chen Lin Education Group Holdings's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Chen Lin Education Group Holdings (of which 1 shouldn't be ignored!) you should know about.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1593

Chen Lin Education Group Holdings

Provides private tertiary education services in the People’s Republic of China.

Very low risk with weak fundamentals.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026