- Hong Kong

- /

- Hospitality

- /

- SEHK:1566

Here's What We Think About CA Cultural Technology Group's (HKG:1566) CEO Pay

Jason Chong became the CEO of CA Cultural Technology Group Limited (HKG:1566) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for CA Cultural Technology Group.

See our latest analysis for CA Cultural Technology Group

How Does Total Compensation For Jason Chong Compare With Other Companies In The Industry?

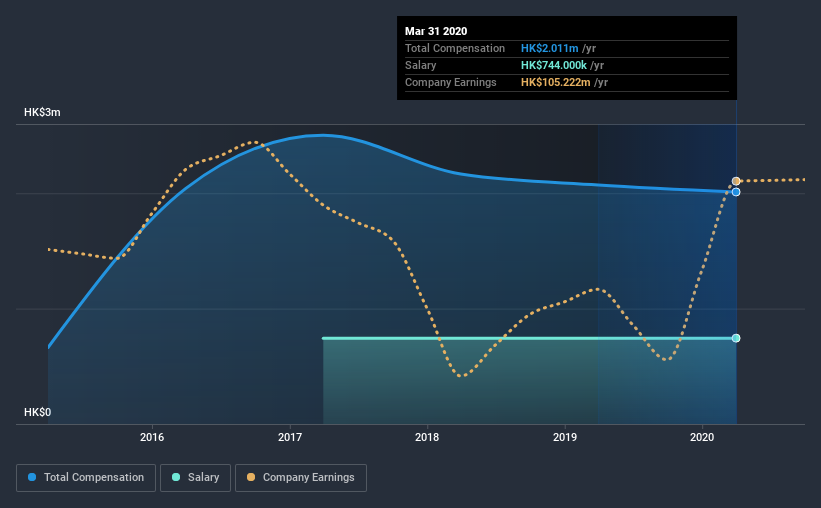

Our data indicates that CA Cultural Technology Group Limited has a market capitalization of HK$2.3b, and total annual CEO compensation was reported as HK$2.0m for the year to March 2020. That's mostly flat as compared to the prior year's compensation. We think total compensation is more important but our data shows that the CEO salary is lower, at HK$744k.

In comparison with other companies in the industry with market capitalizations ranging from HK$776m to HK$3.1b, the reported median CEO total compensation was HK$7.0m. That is to say, Jason Chong is paid under the industry median. Moreover, Jason Chong also holds HK$732m worth of CA Cultural Technology Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$744k | HK$744k | 37% |

| Other | HK$1.3m | HK$1.3m | 63% |

| Total Compensation | HK$2.0m | HK$2.1m | 100% |

On an industry level, around 87% of total compensation represents salary and 13% is other remuneration. CA Cultural Technology Group sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

CA Cultural Technology Group Limited's Growth

CA Cultural Technology Group Limited has seen its earnings per share (EPS) increase by 9.0% a year over the past three years. It saw its revenue drop 26% over the last year.

We generally like to see a little revenue growth, but the modest EPSgrowth gives us some relief. It's hard to reach a conclusion about business performance right now. This may be one to watch. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has CA Cultural Technology Group Limited Been A Good Investment?

With a three year total loss of 19% for the shareholders, CA Cultural Technology Group Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As previously discussed, Jason is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. But then, EPS growth is lacking and so are the returns to shareholders. So while we would not say that Jason is generously paid, it would be good to see an improvement in business performance before there is talk about a raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 6 warning signs for CA Cultural Technology Group (of which 2 don't sit too well with us!) that you should know about in order to have a holistic understanding of the stock.

Important note: CA Cultural Technology Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

When trading CA Cultural Technology Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1566

CA Cultural Technology Group

An investment holding company, engages in the establishment and operation of indoor theme parks in the People’s Republic of China, Japan, and Hong Kong.

Good value slight.

Market Insights

Community Narratives