- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

Fu Shou Yuan International Group (HKG:1448) Is Paying Out Less In Dividends Than Last Year

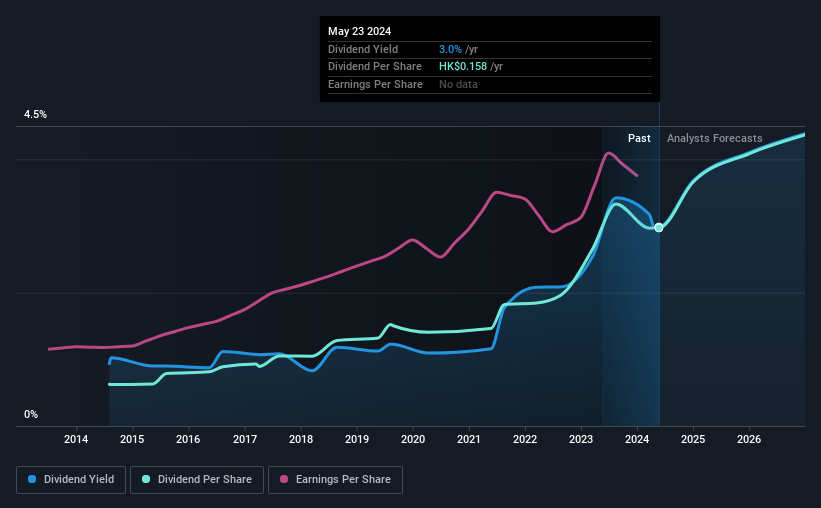

Fu Shou Yuan International Group Limited's (HKG:1448) dividend is being reduced from last year's payment covering the same period to CN¥0.0686 on the 28th of June. Based on this payment, the dividend yield will be 3.0%, which is lower than the average for the industry.

Check out our latest analysis for Fu Shou Yuan International Group

Fu Shou Yuan International Group's Dividend Is Well Covered By Earnings

Even a low dividend yield can be attractive if it is sustained for years on end. Prior to this announcement, Fu Shou Yuan International Group's dividend was comfortably covered by both cash flow and earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to expand by 48.4%. If the dividend continues on this path, the payout ratio could be 36% by next year, which we think can be pretty sustainable going forward.

Fu Shou Yuan International Group Has A Solid Track Record

Even over a long history of paying dividends, the company's distributions have been remarkably stable. Since 2014, the annual payment back then was CN¥0.031, compared to the most recent full-year payment of CN¥0.147. This implies that the company grew its distributions at a yearly rate of about 17% over that duration. We can see that payments have shown some very nice upward momentum without faltering, which provides some reassurance that future payments will also be reliable.

The Dividend Has Growth Potential

Some investors will be chomping at the bit to buy some of the company's stock based on its dividend history. It's encouraging to see that Fu Shou Yuan International Group has been growing its earnings per share at 9.4% a year over the past five years. Shareholders are getting plenty of the earnings returned to them, which combined with strong growth makes this quite appealing.

We Really Like Fu Shou Yuan International Group's Dividend

It is generally not great to see the dividend being cut, but we don't think this should happen much if at all in the future given that Fu Shou Yuan International Group has the makings of a solid income stock moving forward. Reducing the amount it is paying as a dividend can protect the company's balance sheet, keeping the dividend sustainable for longer. Taking this all into consideration, this looks like it could be a good dividend opportunity.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Earnings growth generally bodes well for the future value of company dividend payments. See if the 6 Fu Shou Yuan International Group analysts we track are forecasting continued growth with our free report on analyst estimates for the company. Is Fu Shou Yuan International Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026