Stock Analysis

Fu Shou Yuan International Group And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and economic fluctuations, investors are increasingly looking toward smaller-cap stocks for potential opportunities. Penny stocks, though often seen as relics of past market eras, continue to offer intriguing possibilities due to their affordability and growth potential. In this article, we'll explore three penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.595 | MYR2.96B | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.975 | £190.6M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.76 | MYR131.64M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.28 | CN¥2.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.925 | MYR307.05M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.54 | MYR2.57B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$127.64M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.05 | £404.29M | ★★★★☆☆ |

Click here to see the full list of 5,794 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.99 billion, operates in the People’s Republic of China providing burial and funeral services through its subsidiaries.

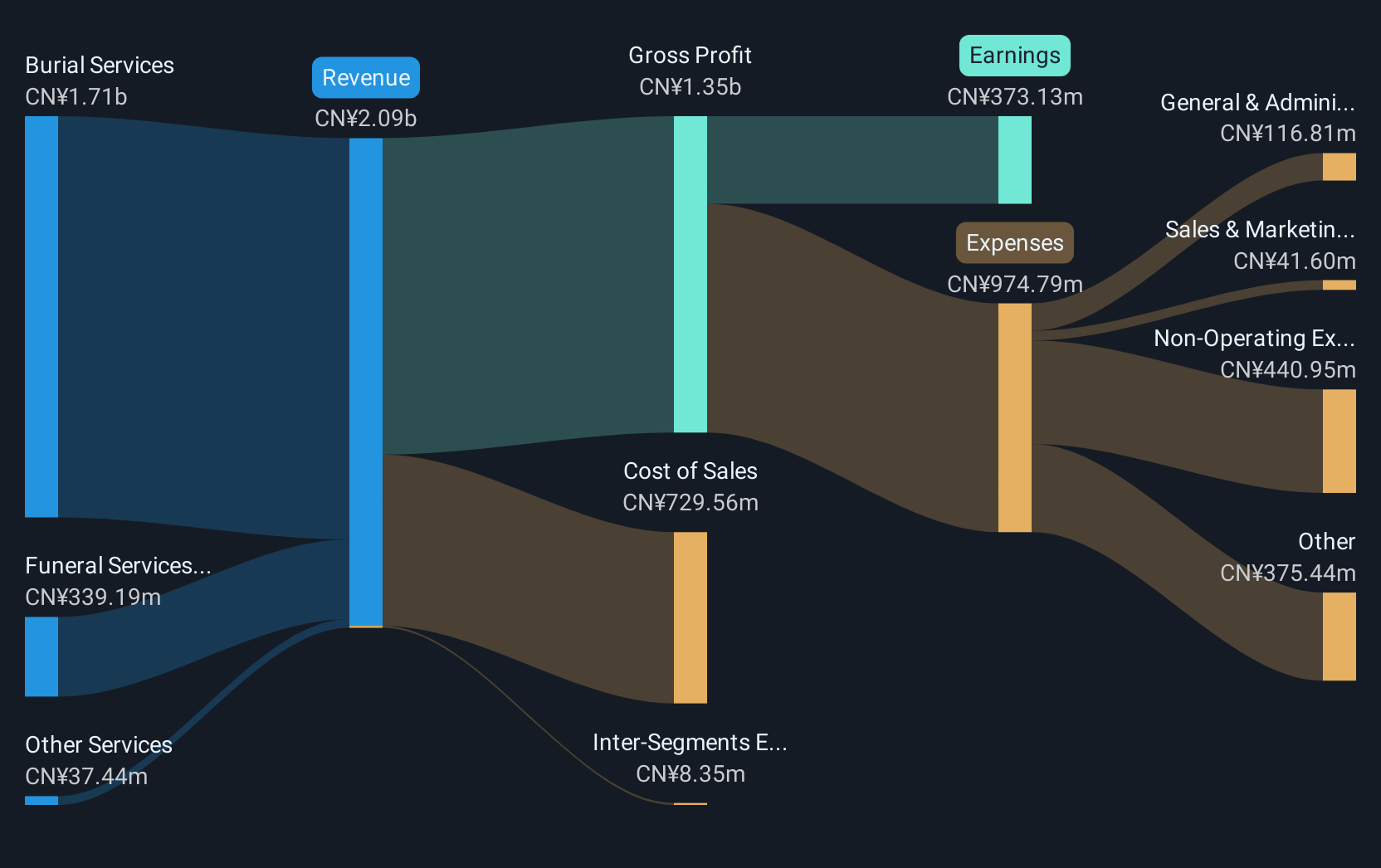

Operations: The company's revenue is primarily derived from burial services (CN¥1.78 billion) and funeral services (CN¥357.97 million), supplemented by other services amounting to CN¥73.22 million.

Market Cap: HK$8.99B

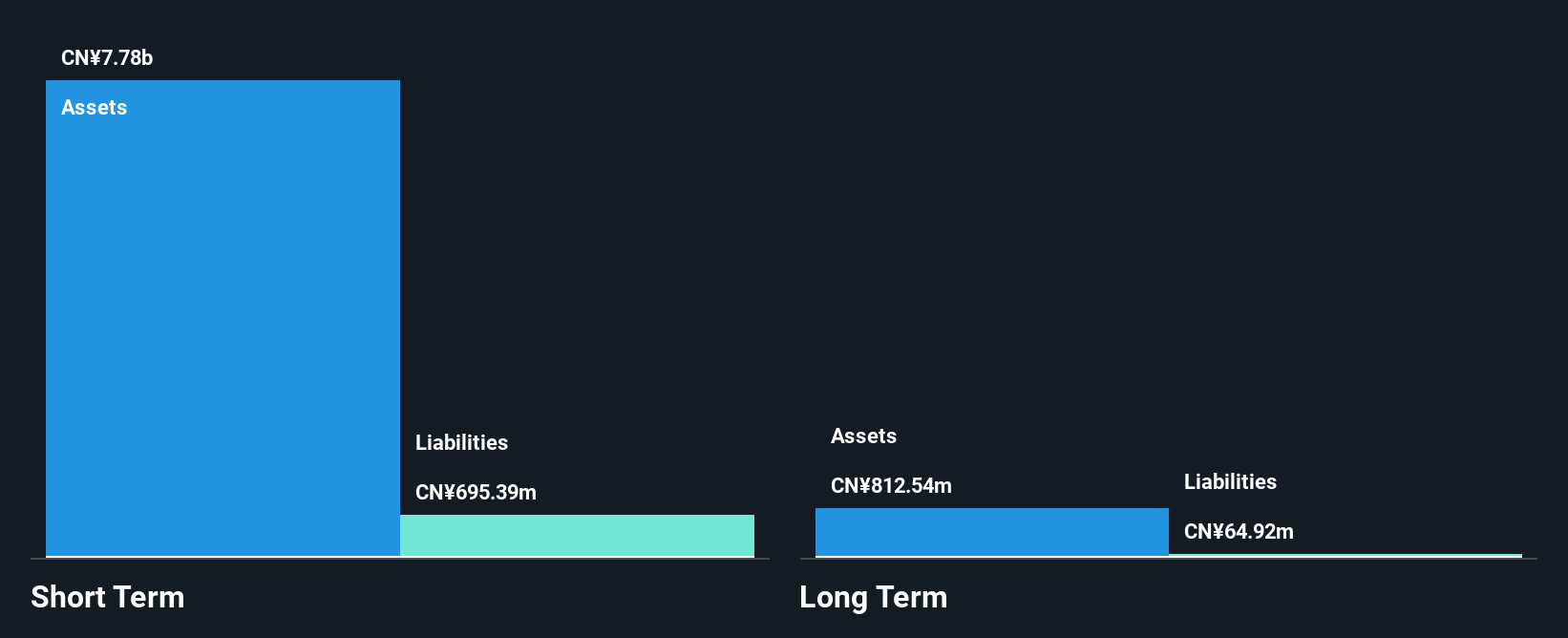

Fu Shou Yuan International Group, with a market cap of HK$8.99 billion, has faced challenges recently, reporting decreased sales and net income for the first half of 2024 compared to the previous year. Despite stable weekly volatility and no significant shareholder dilution over the past year, earnings growth has been negative recently. The company maintains high-quality earnings and its debt level is well-covered by cash flow; however, its return on equity remains low at 11.1%. While short-term assets exceed liabilities comfortably, a decrease in interim dividends highlights potential financial caution amidst declining profit margins.

- Click here to discover the nuances of Fu Shou Yuan International Group with our detailed analytical financial health report.

- Explore Fu Shou Yuan International Group's analyst forecasts in our growth report.

Linklogis (SEHK:9959)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linklogis Inc., with a market cap of HK$3.32 billion, is an investment holding company that offers supply chain finance technology and data-driven solutions in Mainland China.

Operations: The company's revenue is primarily derived from Supply Chain Finance Technology Solutions, with CN¥590.19 million from Anchor Cloud and CN¥255.31 million from FI Cloud, supplemented by Emerging Solutions generating CN¥35.39 million from Cross-Border Cloud and CN¥8.96 million from SME Credit Tech Solutions.

Market Cap: HK$3.32B

Linklogis Inc., with a market cap of HK$3.32 billion, has been actively repurchasing shares, completing buybacks totaling HKD 278 million recently. Despite being unprofitable, the company maintains a positive cash runway exceeding three years and holds more cash than debt. Revenue from supply chain finance technology solutions shows growth, though net losses have increased due to higher impairment and operating expenses aimed at product expansion. The management team is experienced with an average tenure of 3.8 years, while insider selling has been significant in recent months. Revenue growth is forecasted at 10.25% annually amidst stable weekly volatility.

- Navigate through the intricacies of Linklogis with our comprehensive balance sheet health report here.

- Understand Linklogis' earnings outlook by examining our growth report.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services in Singapore, Malaysia, China, and internationally, with a market cap of SGD298.91 million.

Operations: The company generates revenue primarily from its Primary Healthcare segment, amounting to SGD171.06 million.

Market Cap: SGD298.91M

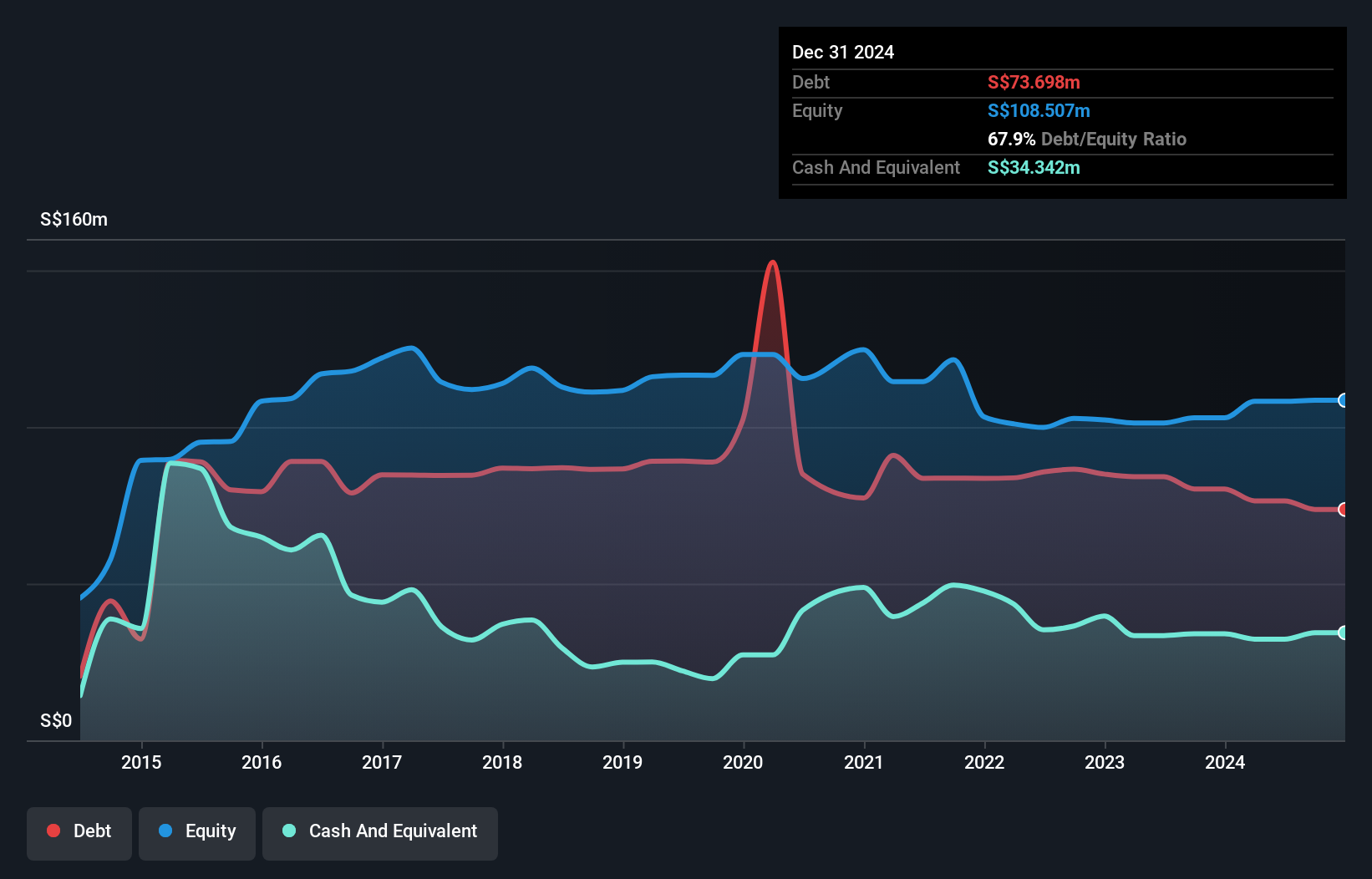

Q & M Dental Group (Singapore) Limited, with a market cap of SGD298.91 million, has shown robust earnings growth of 135.2% over the past year, significantly outpacing its five-year average decline. The company reported half-year revenue of SGD88.79 million and net income of SGD9.8 million, reflecting improved profit margins from 3.8% to 8.7%. Despite high debt levels with a net debt to equity ratio at 40.8%, interest payments are well covered by EBIT at 4.5 times coverage, and operating cash flow also covers debt effectively at 47.6%. However, short-term assets do not cover long-term liabilities fully; this could be a concern for potential investors in penny stocks seeking financial stability alongside growth prospects in the healthcare sector.

- Jump into the full analysis health report here for a deeper understanding of Q & M Dental Group (Singapore).

- Assess Q & M Dental Group (Singapore)'s future earnings estimates with our detailed growth reports.

Taking Advantage

- Gain an insight into the universe of 5,794 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9959

Linklogis

An investment holding company, provides supply chain finance technology and data-driven emerging solutions in Mainland China.