- China

- /

- Electrical

- /

- SHSE:601218

Fu Shou Yuan International Group And 2 Other Penny Stocks With Promising Fundamentals

Reviewed by Simply Wall St

As global markets navigate uncertainties surrounding the incoming Trump administration and fluctuating interest rates, investors are increasingly seeking opportunities that balance potential growth with financial stability. Penny stocks, while often seen as a throwback to earlier market trends, continue to offer intriguing prospects due to their affordability and potential for significant returns. In this article, we will explore three penny stocks that stand out for their promising fundamentals and financial resilience.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.21 | MYR340.59M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.83 | HK$526.87M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$69.16M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.885 | MYR293.77M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.55 | MYR771.82M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.15 | £810.04M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.81 | A$148.62M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.895 | £387.38M | ★★★★☆☆ |

| SHAPE Australia (ASX:SHA) | A$2.88 | A$238.78M | ★★★★★★ |

Click here to see the full list of 5,789 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$8.77 billion, operates in the People's Republic of China offering burial and funeral services through its subsidiaries.

Operations: The company generates revenue primarily from burial services (CN¥1.78 billion) and funeral services (CN¥357.97 million) in the People's Republic of China.

Market Cap: HK$8.77B

Fu Shou Yuan International Group, with a market cap of HK$8.77 billion, shows mixed financial health indicators relevant to penny stock investors. The company has more cash than total debt and its operating cash flow covers debt well, indicating solid liquidity management. However, it reported a decline in earnings growth over the past year and lower net profit margins compared to last year. Despite stable weekly volatility and no significant shareholder dilution recently, the dividend track record is unstable and recent earnings have decreased significantly from CN¥1.52 billion to CN¥1.10 billion for the half-year ending June 2024.

- Dive into the specifics of Fu Shou Yuan International Group here with our thorough balance sheet health report.

- Explore Fu Shou Yuan International Group's analyst forecasts in our growth report.

Tian An China Investments (SEHK:28)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian An China Investments Company Limited is an investment holding company that focuses on investing in, developing, and managing properties across the People's Republic of China, Hong Kong, the United Kingdom, and Australia with a market cap of HK$5.53 billion.

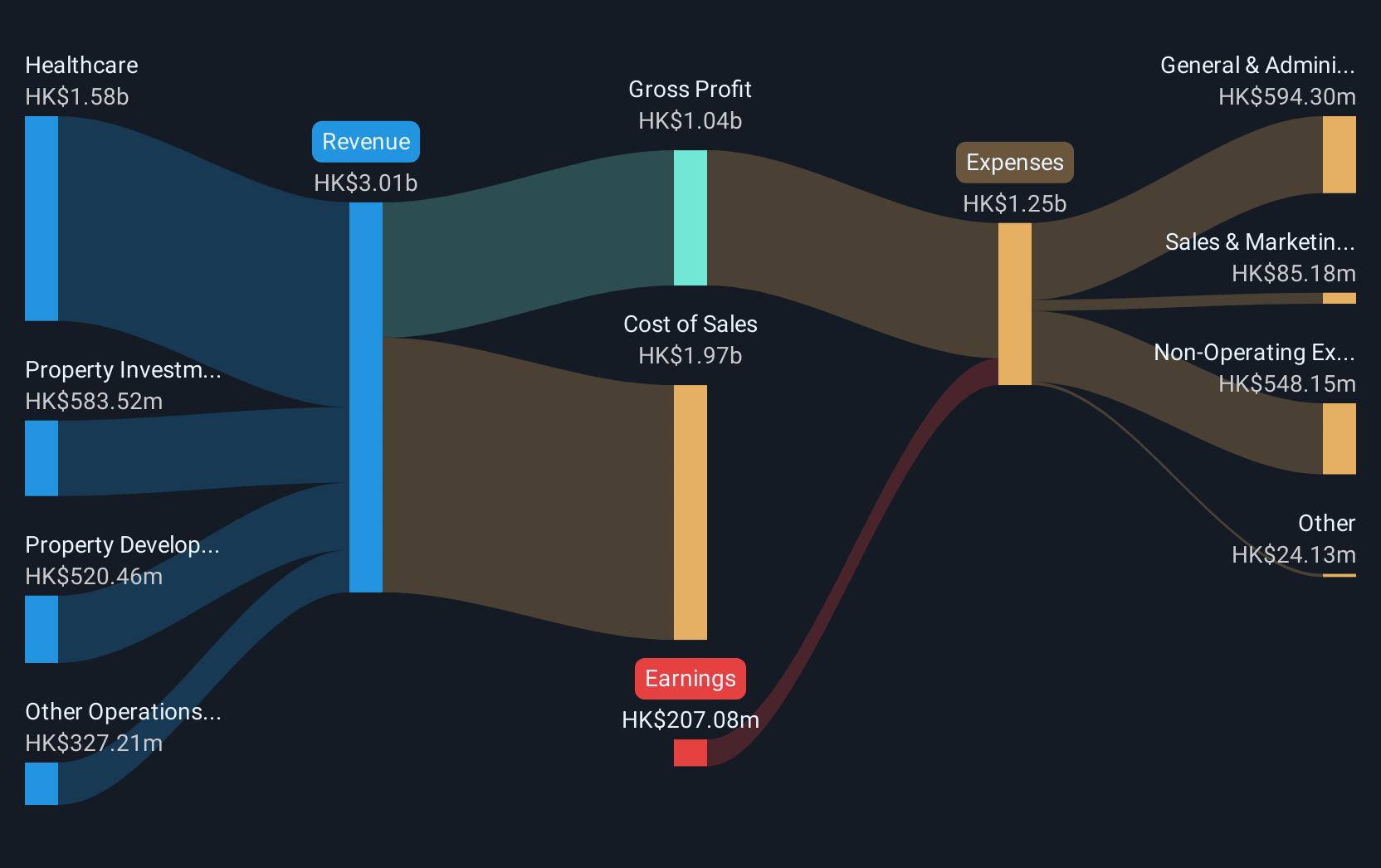

Operations: The company's revenue is primarily derived from property development (HK$1.10 billion) and property investment (HK$581.17 million).

Market Cap: HK$5.53B

Tian An China Investments, with a market cap of HK$5.53 billion, presents a mixed picture for penny stock investors. The company's short-term assets exceed both its short and long-term liabilities, indicating solid asset coverage. However, earnings growth has been negative over the past year despite a reliable dividend yield of 5.31%. The net profit margin has decreased from last year, and the debt to equity ratio has risen over five years but remains satisfactory at 6.1%. Recent financial results were impacted by large one-off gains, complicating profit assessments for the period ending June 2024.

- Unlock comprehensive insights into our analysis of Tian An China Investments stock in this financial health report.

- Explore historical data to track Tian An China Investments' performance over time in our past results report.

Jiangsu JIXIN Wind Energy Technology (SHSE:601218)

Simply Wall St Financial Health Rating: ★★★★★★

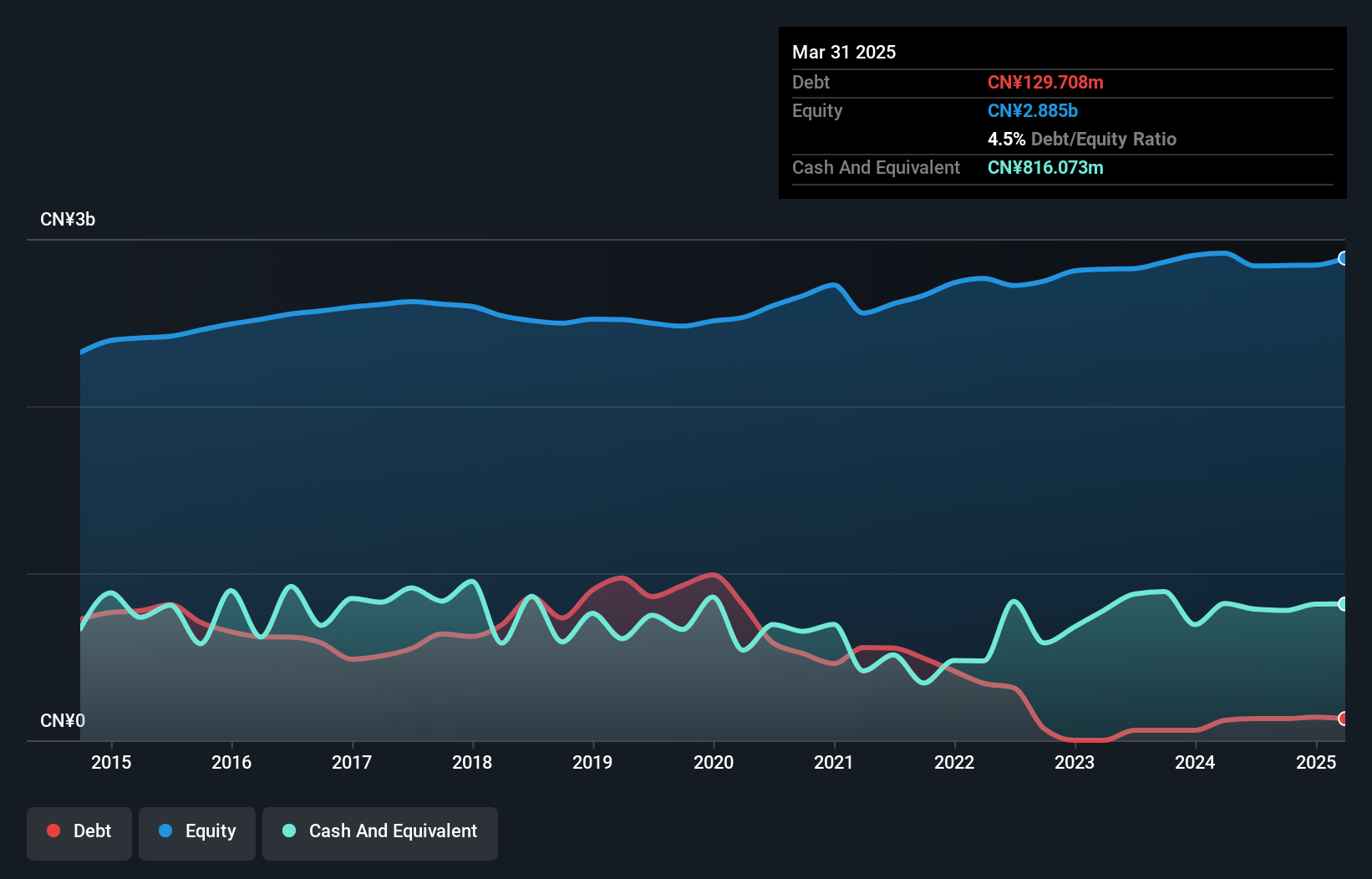

Overview: Jiangsu JIXIN Wind Energy Technology Co., Ltd. operates in the wind energy sector and has a market cap of CN¥3.30 billion.

Operations: Jiangsu JIXIN Wind Energy Technology Co., Ltd. has not reported distinct revenue segments.

Market Cap: CN¥3.3B

Jiangsu JIXIN Wind Energy Technology, with a market cap of CN¥3.30 billion, offers a complex profile for penny stock investors. The company has reduced its debt to equity ratio significantly over five years and holds more cash than total debt, ensuring financial stability. However, recent earnings have declined by 51.7% year-over-year, with net profit margins dropping from 10.3% to 5.6%. While the board is experienced and interest coverage is not an issue, the management team lacks tenure experience. Despite trading below estimated fair value, profitability challenges persist amid declining earnings growth trends.

- Click here and access our complete financial health analysis report to understand the dynamics of Jiangsu JIXIN Wind Energy Technology.

- Examine Jiangsu JIXIN Wind Energy Technology's past performance report to understand how it has performed in prior years.

Next Steps

- Discover the full array of 5,789 Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601218

Jiangsu JIXIN Wind Energy Technology

Jiangsu JIXIN Wind Energy Technology Co., Ltd.

Flawless balance sheet low.

Market Insights

Community Narratives