- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

Does Fu Shou Yuan International Group (HKG:1448) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Fu Shou Yuan International Group Limited (HKG:1448) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Fu Shou Yuan International Group

What Is Fu Shou Yuan International Group's Debt?

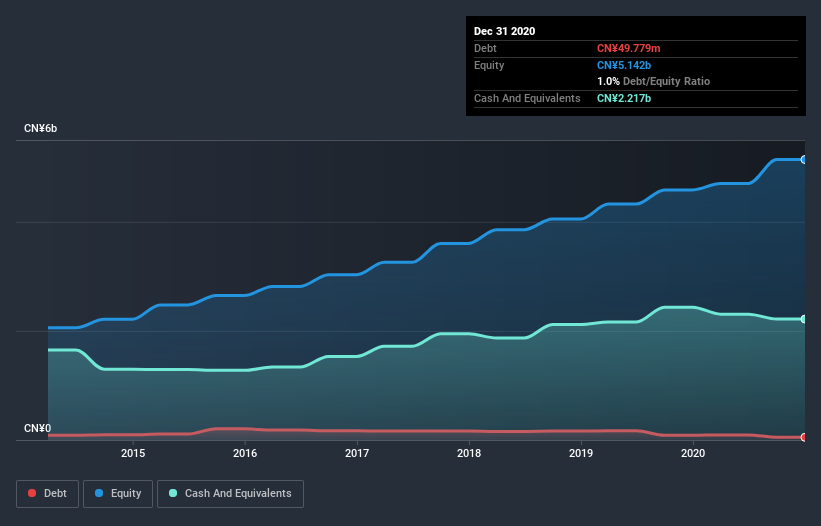

As you can see below, Fu Shou Yuan International Group had CN¥49.8m of debt at December 2020, down from CN¥86.3m a year prior. But it also has CN¥2.22b in cash to offset that, meaning it has CN¥2.17b net cash.

A Look At Fu Shou Yuan International Group's Liabilities

Zooming in on the latest balance sheet data, we can see that Fu Shou Yuan International Group had liabilities of CN¥935.9m due within 12 months and liabilities of CN¥600.2m due beyond that. On the other hand, it had cash of CN¥2.22b and CN¥83.5m worth of receivables due within a year. So it can boast CN¥764.4m more liquid assets than total liabilities.

This surplus suggests that Fu Shou Yuan International Group has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Fu Shou Yuan International Group boasts net cash, so it's fair to say it does not have a heavy debt load!

Fortunately, Fu Shou Yuan International Group grew its EBIT by 6.8% in the last year, making that debt load look even more manageable. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Fu Shou Yuan International Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. While Fu Shou Yuan International Group has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Fu Shou Yuan International Group produced sturdy free cash flow equating to 78% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

While it is always sensible to investigate a company's debt, in this case Fu Shou Yuan International Group has CN¥2.17b in net cash and a decent-looking balance sheet. The cherry on top was that in converted 78% of that EBIT to free cash flow, bringing in CN¥801m. So is Fu Shou Yuan International Group's debt a risk? It doesn't seem so to us. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Fu Shou Yuan International Group is showing 1 warning sign in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Fu Shou Yuan International Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives