- Hong Kong

- /

- Hospitality

- /

- SEHK:1405

High Insider Ownership Growth Companies On SEHK

Reviewed by Simply Wall St

The Hong Kong market has shown resilience amid global economic fluctuations, with the Hang Seng Index gaining 5.12% recently. This positive momentum provides a conducive environment for identifying promising growth companies with high insider ownership on the SEHK. In such a dynamic market, stocks with significant insider ownership can be particularly attractive as they often indicate strong confidence from those closest to the company’s operations and future prospects.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

| Akeso (SEHK:9926) | 20.5% | 54.7% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 78.9% |

| DPC Dash (SEHK:1405) | 38.2% | 104.2% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| MicroTech Medical (Hangzhou) (SEHK:2235) | 25.8% | 105% |

Underneath we present a selection of stocks filtered out by our screen.

DPC Dash (SEHK:1405)

Simply Wall St Growth Rating: ★★★★★☆

Overview: DPC Dash Ltd, with a market cap of HK$8.47 billion, operates a chain of fast-food restaurants in the People’s Republic of China through its subsidiaries.

Operations: The company's revenue primarily comes from its fast-food restaurant operations in the People’s Republic of China, amounting to CN¥3.72 billion.

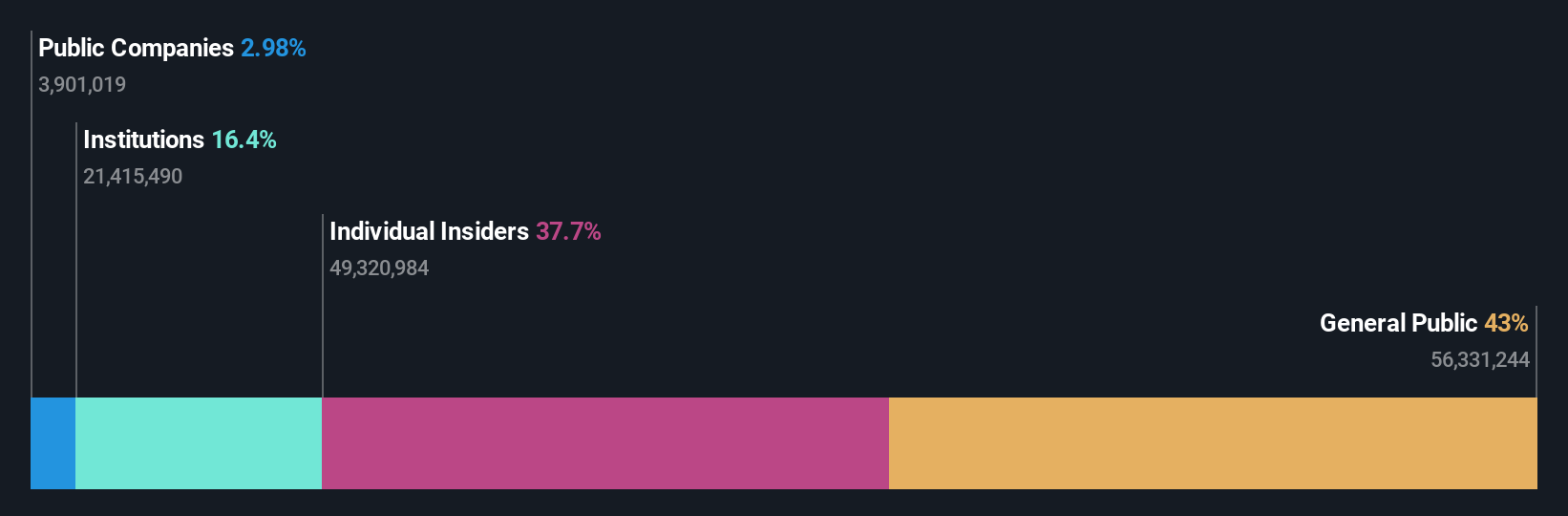

Insider Ownership: 38.2%

Earnings Growth Forecast: 104.2% p.a.

DPC Dash, a growth company with high insider ownership in Hong Kong, has shown impressive revenue growth of 24.9% per year and is expected to become profitable within the next three years. Recent earnings for H1 2024 reported sales of CNY 2.04 billion, up from CNY 1.38 billion a year ago, with net income rising to CNY 10.91 million. The company was recently added to the S&P Global BMI Index and celebrated its 900th store opening in Chengdu as part of an ambitious expansion strategy aiming for 1,000 stores by year's end.

- Get an in-depth perspective on DPC Dash's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that DPC Dash is trading beyond its estimated value.

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company operating in the People's Republic of China with a market cap of approximately HK$802.90 billion.

Operations: The company's revenue segments include Core Local Commerce at CN¥228.13 billion and New Initiatives at CN¥77.56 billion.

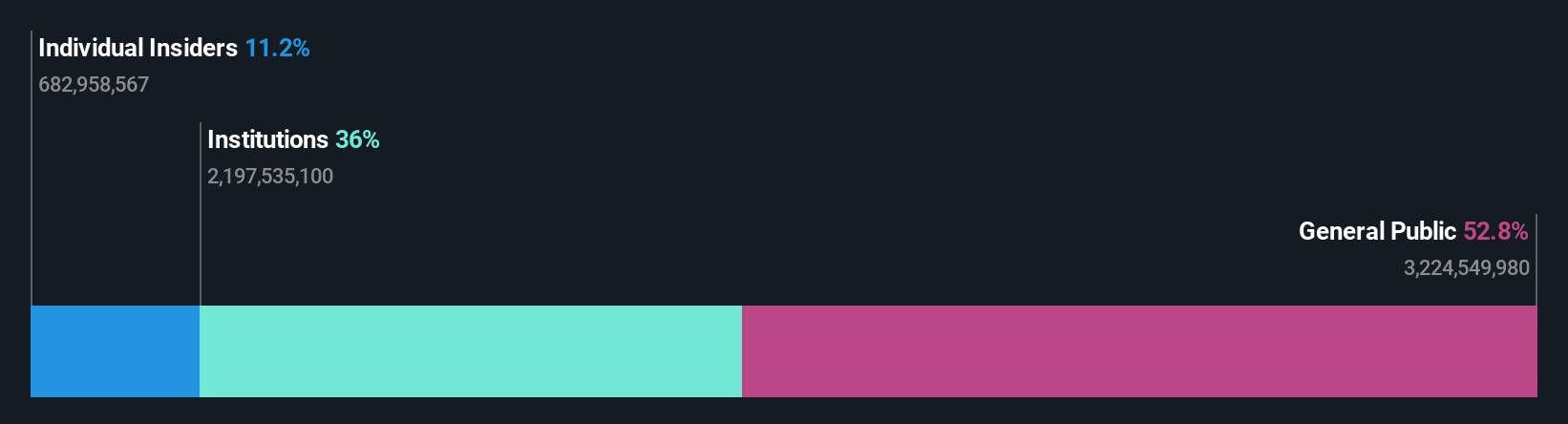

Insider Ownership: 11.6%

Earnings Growth Forecast: 25.8% p.a.

Meituan has demonstrated solid growth, with earnings increasing by 175.5% over the past year and revenue for H1 2024 rising to CNY 155.53 billion from CNY 126.58 billion a year ago. The company has an active buyback program, repurchasing shares worth HKD 7.17 billion in recent tranches. Insider ownership remains high, supporting confidence in its forecasted annual profit growth of 25.8%, which outpaces the Hong Kong market average of 11.8%.

- Click to explore a detailed breakdown of our findings in Meituan's earnings growth report.

- Our valuation report unveils the possibility Meituan's shares may be trading at a premium.

Techtronic Industries (SEHK:669)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$209.46 billion.

Operations: The company's revenue segments include $13.23 billion from Power Equipment and $965.09 million from Floorcare & Cleaning products.

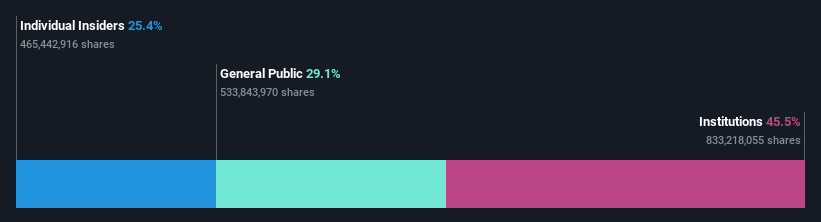

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries has demonstrated consistent growth, with earnings increasing to US$550.37 million for H1 2024 from US$475.78 million a year ago. Revenue is forecast to grow annually at 8.5%, surpassing the Hong Kong market average of 7.3%. Insider ownership remains significant, aligning with its projected annual profit growth of 15.32%, above the market's 11.8%. Recent executive changes and dividend increases further indicate strong internal confidence in future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Techtronic Industries.

- The valuation report we've compiled suggests that Techtronic Industries' current price could be inflated.

Taking Advantage

- Reveal the 47 hidden gems among our Fast Growing SEHK Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1405

DPC Dash

Operates a chain of fast-food restaurants in the People’s Republic of China.

High growth potential with excellent balance sheet.