- Hong Kong

- /

- Hospitality

- /

- SEHK:132

Take Care Before Jumping Onto Hing Yip Holdings Limited (HKG:132) Even Though It's 27% Cheaper

Hing Yip Holdings Limited (HKG:132) shares have had a horrible month, losing 27% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 59% share price decline.

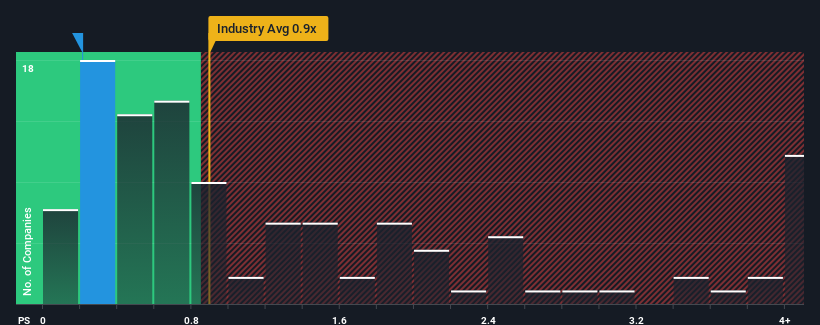

After such a large drop in price, when close to half the companies operating in Hong Kong's Hospitality industry have price-to-sales ratios (or "P/S") above 0.9x, you may consider Hing Yip Holdings as an enticing stock to check out with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Hing Yip Holdings

What Does Hing Yip Holdings' P/S Mean For Shareholders?

The revenue growth achieved at Hing Yip Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hing Yip Holdings will help you shine a light on its historical performance.How Is Hing Yip Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Hing Yip Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 24% shows it's noticeably more attractive.

In light of this, it's peculiar that Hing Yip Holdings' P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

The southerly movements of Hing Yip Holdings' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Hing Yip Holdings revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 4 warning signs for Hing Yip Holdings (3 shouldn't be ignored!) that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hing Yip Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:132

Hing Yip Holdings

An investment holding company, engages in the big data, civil explosives, property investment, financial leasing, hotel operation, and wellness elderly care businesses in Hong Kong and Mainland China.

Slight risk with acceptable track record.

Market Insights

Community Narratives