- Hong Kong

- /

- Consumer Services

- /

- SEHK:1317

Such Is Life: How China Maple Leaf Educational Systems (HKG:1317) Shareholders Saw Their Shares Drop 58%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The nature of investing is that you win some, and you lose some. And unfortunately for China Maple Leaf Educational Systems Limited (HKG:1317) shareholders, the stock is a lot lower today than it was a year ago. To wit the share price is down 58% in that time. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 14% in three years. The falls have accelerated recently, with the share price down 19% in the last three months. But this could be related to the weak market, which is down 9.4% in the same period.

View our latest analysis for China Maple Leaf Educational Systems

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the China Maple Leaf Educational Systems share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past. It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

China Maple Leaf Educational Systems's revenue is actually up 18% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

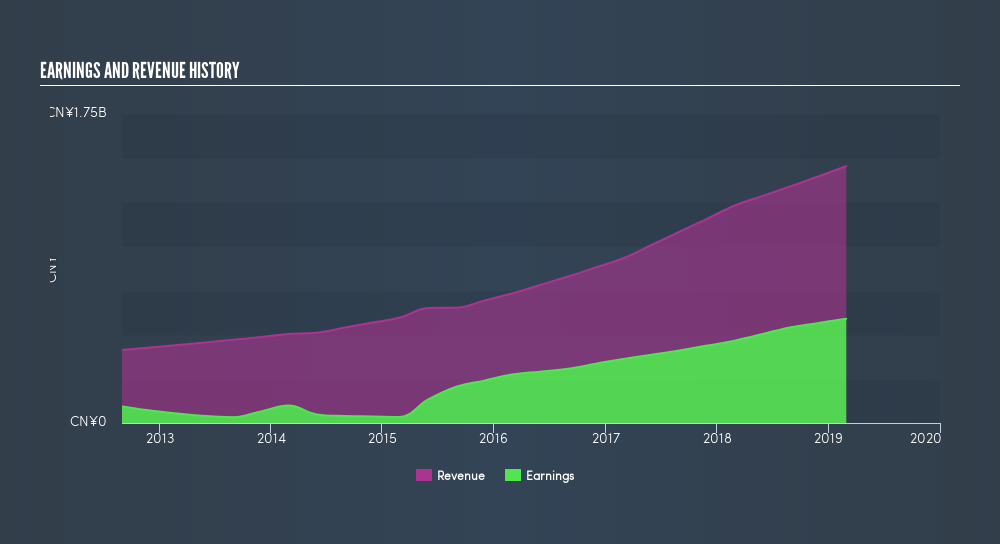

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for China Maple Leaf Educational Systems in this interactive graph of future profit estimates.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between China Maple Leaf Educational Systems's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. China Maple Leaf Educational Systems's TSR of was a loss of 57% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

China Maple Leaf Educational Systems shareholders are down 57% for the year (even including dividends), falling short of the market return. The market shed around 16%, no doubt weighing on the stock price. The three-year loss of 2.8% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. If you want to research this stock further, the data on insider buying is an obvious place to start. You can click here to see who has been buying shares - and the price they paid.

China Maple Leaf Educational Systems is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:1317

China Maple Leaf Educational Systems

Operates private and preschools in the People’s Republic of China, Malaysia, Singapore, and internationally.

Good value with questionable track record.

Market Insights

Community Narratives