- Hong Kong

- /

- Consumer Services

- /

- SEHK:1317

Here's What We Learned About The CEO Pay At China Maple Leaf Educational Systems Limited (HKG:1317)

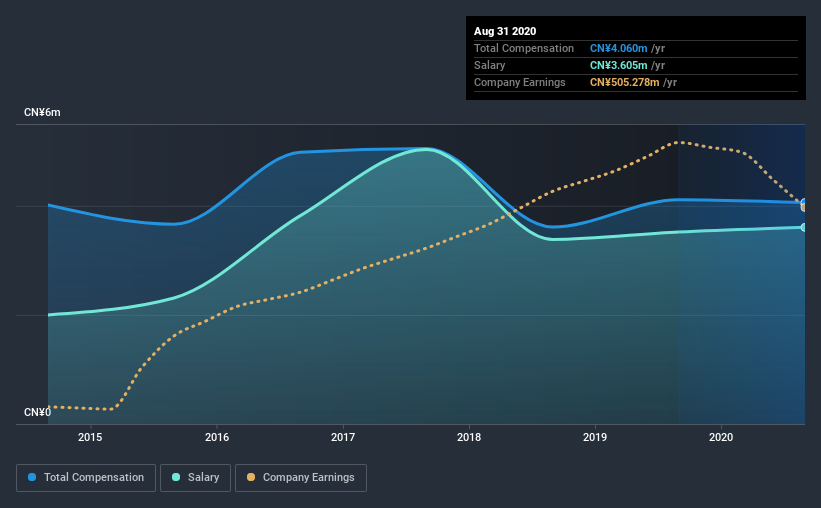

Sherman Jen became the CEO of China Maple Leaf Educational Systems Limited (HKG:1317) in 2016, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for China Maple Leaf Educational Systems

How Does Total Compensation For Sherman Jen Compare With Other Companies In The Industry?

At the time of writing, our data shows that China Maple Leaf Educational Systems Limited has a market capitalization of HK$6.0b, and reported total annual CEO compensation of CN¥4.1m for the year to August 2020. That's mostly flat as compared to the prior year's compensation. Notably, the salary which is CN¥3.61m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations ranging from HK$3.1b to HK$12b, the reported median CEO total compensation was CN¥1.2m. This suggests that Sherman Jen is paid more than the median for the industry. Moreover, Sherman Jen also holds HK$3.0b worth of China Maple Leaf Educational Systems stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥3.6m | CN¥3.5m | 89% |

| Other | CN¥455k | CN¥591k | 11% |

| Total Compensation | CN¥4.1m | CN¥4.1m | 100% |

On an industry level, around 92% of total compensation represents salary and 8.4% is other remuneration. There isn't a significant difference between China Maple Leaf Educational Systems and the broader market, in terms of salary allocation in the overall compensation package. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at China Maple Leaf Educational Systems Limited's Growth Numbers

China Maple Leaf Educational Systems Limited has seen its earnings per share (EPS) increase by 3.6% a year over the past three years. In the last year, its revenue is down 2.7%.

We would prefer it if there was revenue growth, but the modest EPSgrowth gives us some relief. These two metrics are moving in different directions, so while it's hard to be confident judging performance, we think the stock is worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has China Maple Leaf Educational Systems Limited Been A Good Investment?

Given the total shareholder loss of 58% over three years, many shareholders in China Maple Leaf Educational Systems Limited are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, China Maple Leaf Educational Systems pays its CEO higher than the norm for similar-sized companies belonging to the same industry. The growth in the business has been uninspiring, but the shareholder returns for China Maple Leaf Educational Systems have arguably been worse, over the last three years. This doesn't look great when you consider Sherman is taking home compensation north of the industry average. Taking all this into account, it could be hard to get shareholder support for giving Sherman a raise.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We did our research and identified 2 warning signs (and 1 which shouldn't be ignored) in China Maple Leaf Educational Systems we think you should know about.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade China Maple Leaf Educational Systems, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1317

China Maple Leaf Educational Systems

Operates private and preschools in the People’s Republic of China, Malaysia, Singapore, and internationally.

Good value with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion