- Hong Kong

- /

- Hospitality

- /

- SEHK:1215

Kai Yuan Holdings Limited (HKG:1215) Screens Well But There Might Be A Catch

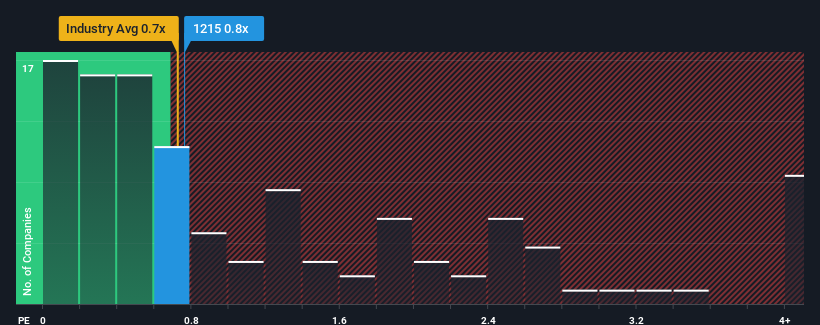

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Hospitality industry in Hong Kong, you could be forgiven for feeling indifferent about Kai Yuan Holdings Limited's (HKG:1215) P/S ratio of 0.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Kai Yuan Holdings

What Does Kai Yuan Holdings' P/S Mean For Shareholders?

The revenue growth achieved at Kai Yuan Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. Those who are bullish on Kai Yuan Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kai Yuan Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Kai Yuan Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 15% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's curious that Kai Yuan Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What We Can Learn From Kai Yuan Holdings' P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We didn't quite envision Kai Yuan Holdings' P/S sitting in line with the wider industry, considering the revenue growth over the last three-year is higher than the current industry outlook. When we see strong revenue with faster-than-industry growth, we can only assume potential risks are what might be placing pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

It is also worth noting that we have found 2 warning signs for Kai Yuan Holdings that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kai Yuan Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1215

Kai Yuan Holdings

An investment holding company, owns and operates hotels in Hong Kong and France.

Slightly overvalued with imperfect balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion