- Hong Kong

- /

- Hospitality

- /

- SEHK:1180

Discover 3 Dividend Stocks Offering Up To 9.8% Yield

Reviewed by Simply Wall St

As global markets navigate the complexities of political shifts and economic signals, investors are keenly observing the impact of regulatory changes on various sectors. With U.S. stocks experiencing fluctuations due to policy uncertainties and interest rate expectations, the search for stable income sources becomes increasingly important. In such a climate, dividend stocks can offer a reliable income stream, providing potential stability amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.94% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.66% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.47% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.88% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.13% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.55% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.43% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.85% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.91% | ★★★★★★ |

Click here to see the full list of 1954 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Paradise Entertainment (SEHK:1180)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Paradise Entertainment Limited is an investment holding company that primarily offers casino management services in Macau, the People's Republic of China, and the United States, with a market cap of HK$999.58 million.

Operations: Paradise Entertainment Limited generates its revenue from various segments, including Gaming Systems (HK$121.46 million), Casino Management Services (HK$681.22 million), and Innovative and Renewable Energy Solutions Business (HK$10.15 million).

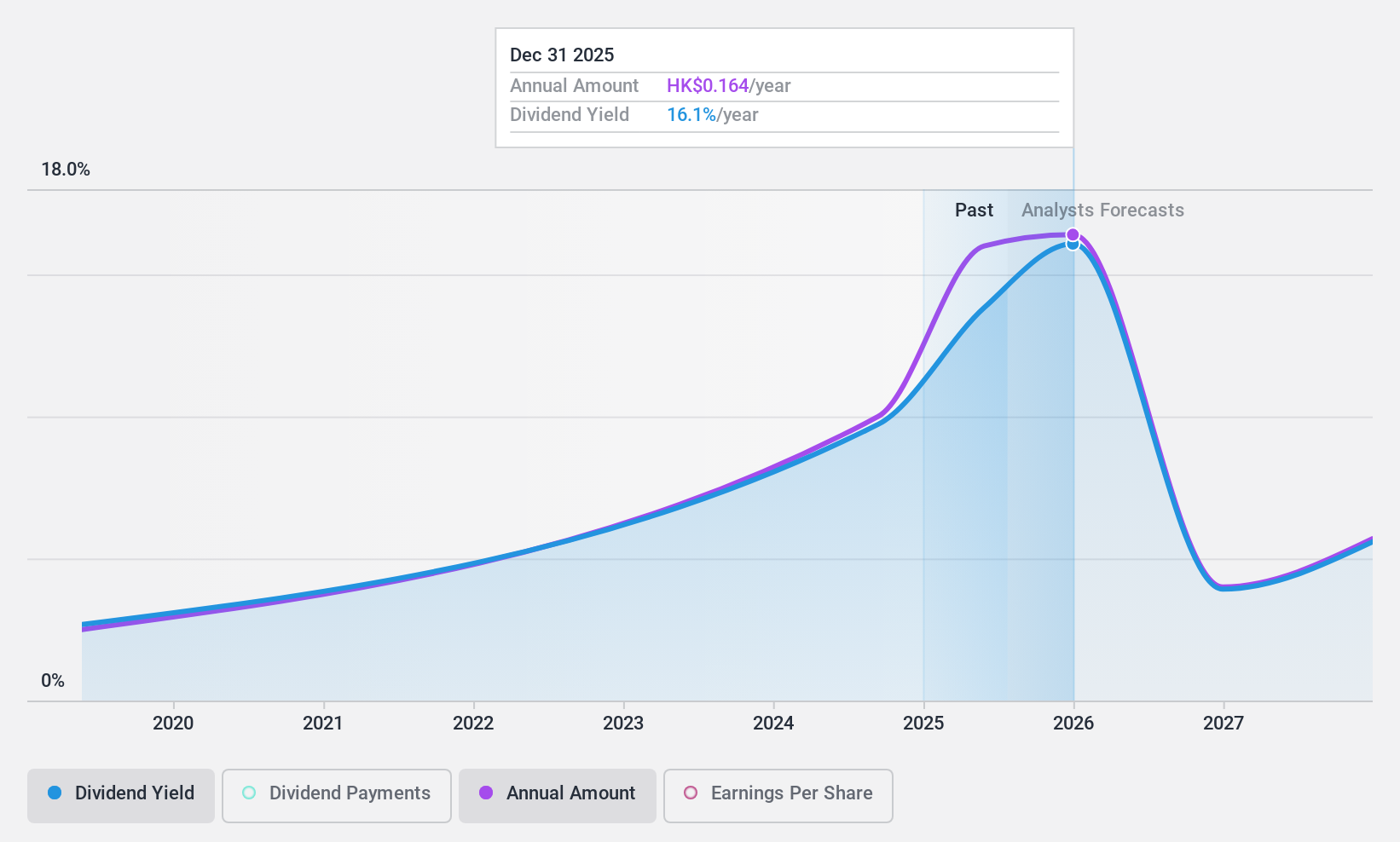

Dividend Yield: 9.8%

Paradise Entertainment's dividend yield ranks in the top 25% of Hong Kong market payers, with a payout ratio of 29% indicating strong earnings coverage. Despite this, its dividend history over the past decade has been volatile. Recent amendments to company bylaws aim to enhance shareholder engagement and flexibility in share repurchases. The company reported significant growth in sales and net income for H1 2024, supporting its interim dividend payment of HK$0.05 per share.

- Click here to discover the nuances of Paradise Entertainment with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Paradise Entertainment's share price might be too pessimistic.

Singapore Exchange (SGX:S68)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates as an integrated securities and derivatives exchange, along with related clearing houses and an electricity market in Singapore, with a market cap of SGD12.23 billion.

Operations: Singapore Exchange Limited generates revenue from various segments, including Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies, and Commodities (SGD322.50 million).

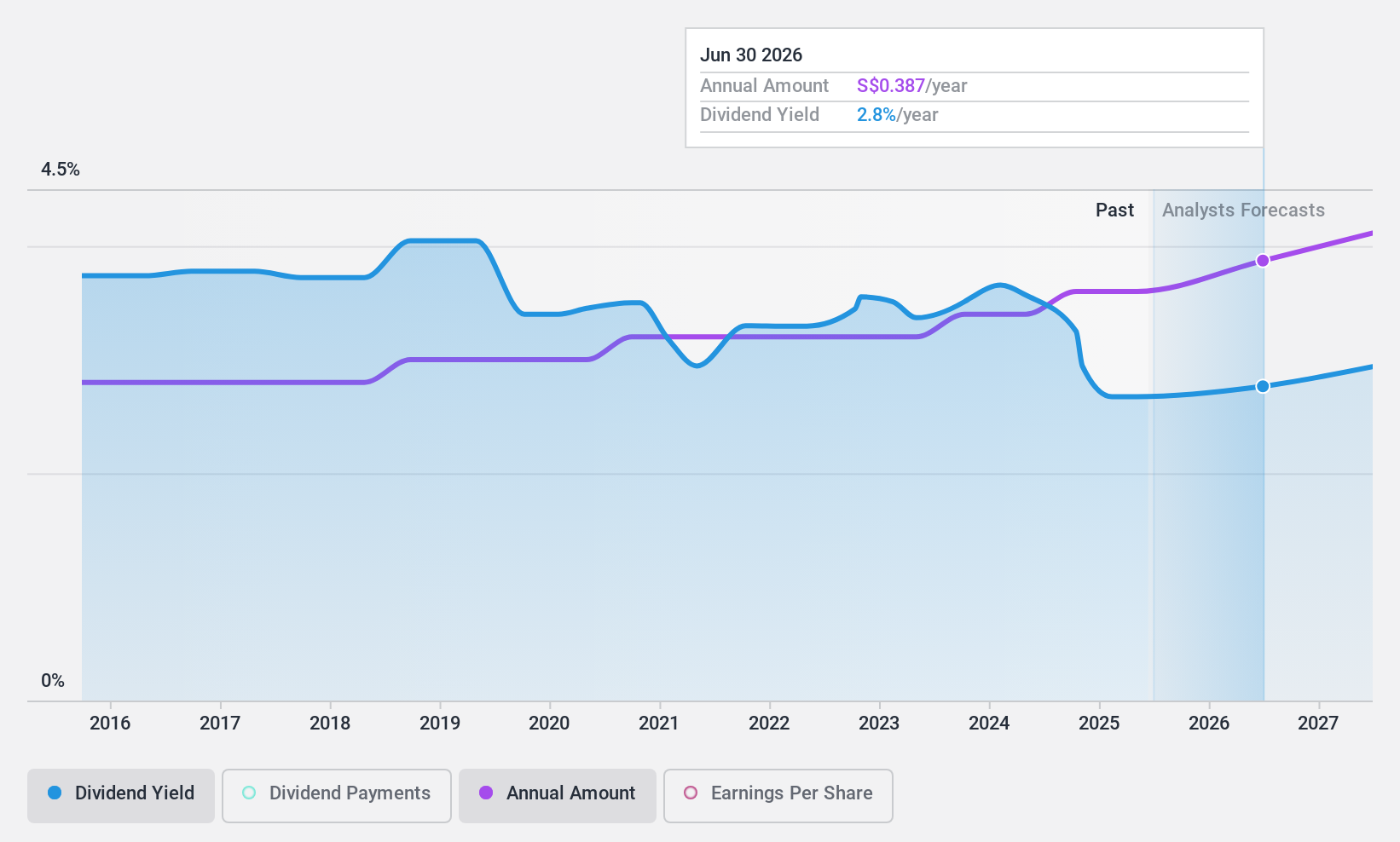

Dividend Yield: 3%

Singapore Exchange offers a stable dividend yield of 3.02%, lower than the top 25% in Singapore's market. The dividend is well-covered by earnings and cash flow, with payout ratios of 61.7% and 69.9%, respectively, and has shown consistent growth over the past decade. Recent executive changes include Daniel Koh's appointment as CFO, potentially bringing strategic enhancements to SGX's financial management amid ongoing earnings growth projections of 3.77% annually.

- Click here and access our complete dividend analysis report to understand the dynamics of Singapore Exchange.

- Our valuation report unveils the possibility Singapore Exchange's shares may be trading at a premium.

Nippon Beet Sugar ManufacturingLtd (TSE:2108)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Beet Sugar Manufacturing Co., Ltd. specializes in manufacturing and selling functional products in Japan, with a market cap of ¥29.58 billion.

Operations: Nippon Beet Sugar Manufacturing Co., Ltd. generates revenue from several segments, including Sugar at ¥44.58 billion, Feed at ¥12.72 billion, Agricultural Materials at ¥3.57 billion, Grocery at ¥2.68 billion, and Real Estate at ¥1.51 billion.

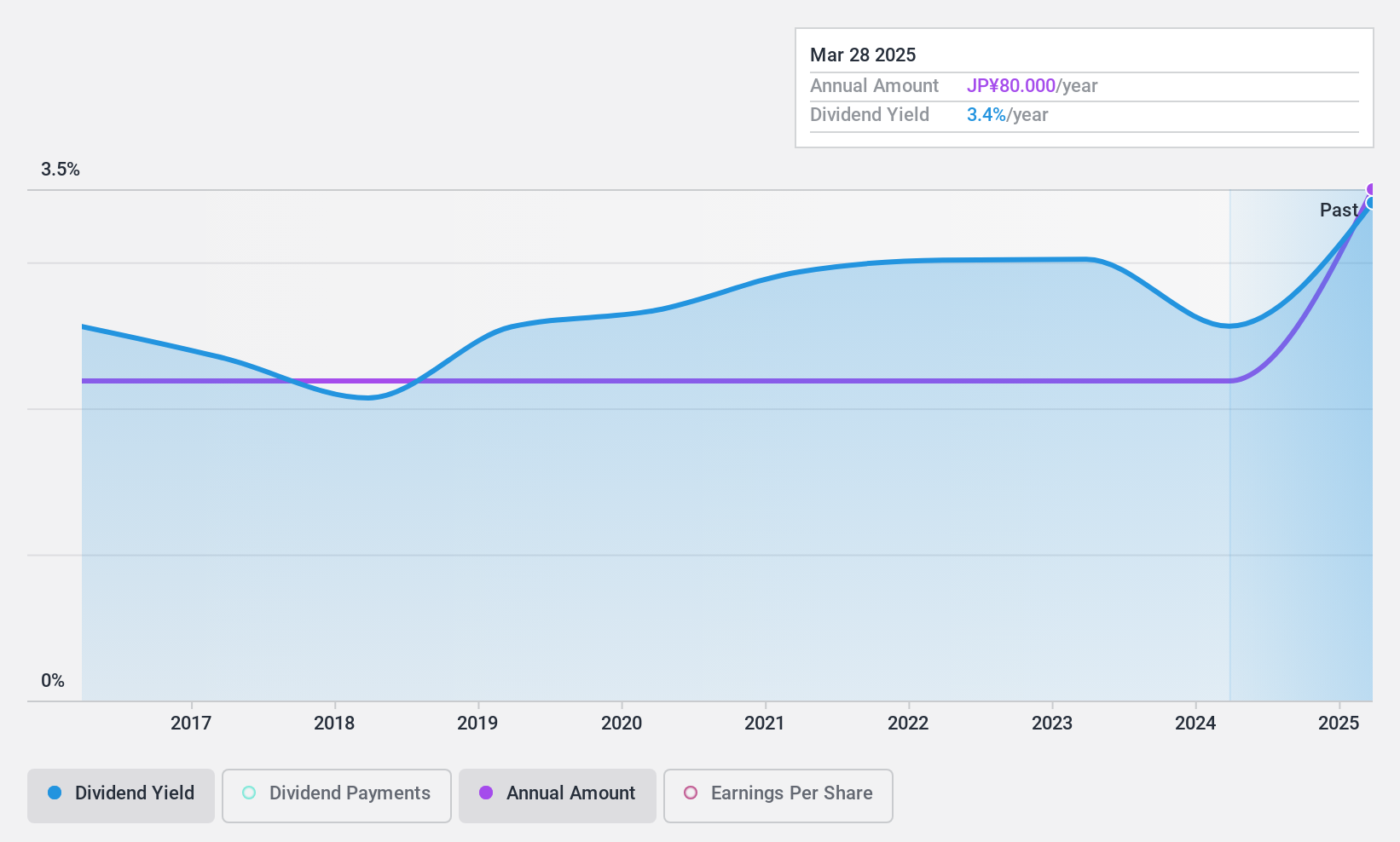

Dividend Yield: 3.3%

Nippon Beet Sugar Manufacturing Co., Ltd. offers a reliable dividend yield of 3.35%, though it is below the top 25% of Japanese dividend payers. The company's dividends are well-covered by earnings and cash flows, with low payout ratios of 10% and 33.4%, respectively, indicating sustainability. Despite recent one-off items affecting results, dividends have been stable and growing over the past decade, supported by significant earnings growth in the past year.

- Navigate through the intricacies of Nippon Beet Sugar ManufacturingLtd with our comprehensive dividend report here.

- Our valuation report here indicates Nippon Beet Sugar ManufacturingLtd may be undervalued.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1954 Top Dividend Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1180

Paradise Entertainment

An investment holding company, primarily provides casino management services in Macau, the People’s Republic of China, and the United States.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives